On Behind the Markets, a podcast delivered to you by Jeremy Schwartz, WisdomTree International Head of Analysis, we speak to market strategists, enterprise executives and monetary advisors about necessary tendencies underpinning the monetary markets.

On this episode, Jeremy talks to Sailesh Radha, co-founder and chief funding strategist of Borealis International Advisory, and Drew Edwards, head of GMO’s Usonian Japan Fairness workforce.

Within the first half of the podcast, we spoke with Sailesh Radha. We lined the next vary of subjects:

- Radha’s use of a “Good CAPE” (cyclically adjusted price-to-earnings ratio) and actual alternate price mannequin to rank and rotate fairness investments among the many most tasty international locations.

- How his actual adjusted alternate price mannequin can assist valuations, with international locations turning into extra aggressive by way of exports and stronger earnings development.

- Why Radha’s mannequin at present favors Japan, Singapore, Korea and quite a lot of European and Scandinavian international locations whereas avoiding the UK, Taiwan and New Zealand.

- Why Radha likes Japan for each parts in his mannequin. He sees a robust decade forward of elevated productiveness, larger earnings development and valuations being actually low relative to historical past.

Within the second half of the present, we discover Japan in additional element with Edwards.

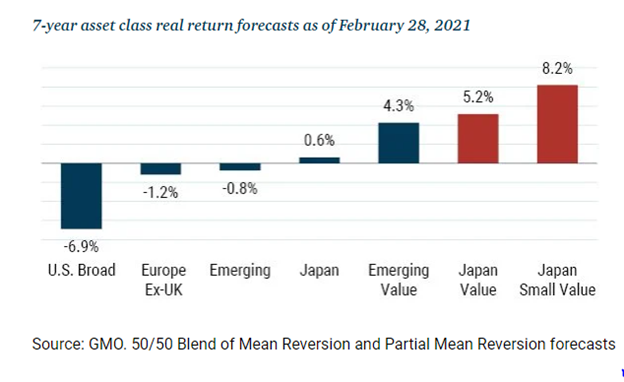

- GMO and Edwards’s workforce mannequin international alternatives utilizing a top-down and bottom-up course of. GMO notably believes the U.S. market faces a troublesome seven-year stretch forward, however Japanese belongings, and specifically Japan worth and small-cap worth, characterize an “island of potential in a sea of costly belongings.”[1]

- Edwards arrived in Japan as a school pupil and skilled the hangover from the bubble and celebration that occurred in 1980s. However now he sees the advantages of a few years of onerous work to restructure the economic system. He acknowledges many optimistic potential catalysts, from company governance reforms and enhancing returns on capital to broader cultural shifts.

- Traditionally, return on capital within the U.S. averaged 6% and Japan solely averaged 3%. However these charges have converged, and the GMO workforce thinks we at the moment are in a brand new regime of upper returns on capital in Japan.

- Edwards says the lowest-hanging fruit for Japanese corporations is to deploy their extra money, and there are just a few locations they’re doing this: rising buybacks, dividends and consolidation of industries. With excessive extra capital remaining, there are alternatives for higher returns.

- Edwards’s workforce likes most of the Japanese small-cap industrial corporations for management in area of interest components of the worth chain, but additionally as a result of they’re cyclically tied to an acceleration of world development because the economic system continues to reopen.

- We additionally talked about macro points starting from demographics and inflation as to whether the Financial institution of Japan will ever finish their coverage of buying ETFs.

Please take heed to the complete dialog beneath.

Initially revealed by WisdomTree, 5/4/21

1 Supply: https://www.gmo.com/americas/research-library/japan-value_an-island-of-potential-in-a-sea-of-expensive-assets/

U.S. traders solely: Click on right here to acquire a WisdomTree ETF prospectus which accommodates funding goals, dangers, prices, bills, and different info; learn and contemplate fastidiously earlier than investing.

There are dangers concerned with investing, together with attainable lack of principal. Overseas investing includes forex, political and financial danger. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller corporations could expertise larger value volatility. Investments in rising markets, forex, fastened revenue and different investments embody further dangers. Please see prospectus for dialogue of dangers.

Previous efficiency will not be indicative of future outcomes. This materials accommodates the opinions of the creator, that are topic to vary, and will to not be thought-about or interpreted as a suggestion to take part in any specific buying and selling technique, or deemed to be a suggestion or sale of any funding product and it shouldn’t be relied on as such. There isn’t any assure that any methods mentioned will work below all market situations. This materials represents an evaluation of the market surroundings at a particular time and isn’t meant to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation concerning any safety specifically. The person of this info assumes your complete danger of any use product of the data supplied herein. Neither WisdomTree nor its associates, nor Foreside Fund Companies, LLC, or its associates present tax or authorized recommendation. Traders in search of tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Except expressly said in any other case the opinions, interpretations or findings expressed herein don’t essentially characterize the views of WisdomTree or any of its associates.

The MSCI info could solely be used to your inner use, will not be reproduced or re-disseminated in any type and will not be used as a foundation for or part of any monetary devices or merchandise or indexes. Not one of the MSCI info is meant to represent funding recommendation or a suggestion to make (or chorus from making) any sort of funding choice and will not be relied on as such. Historic knowledge and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI info is supplied on an “as is” foundation and the person of this info assumes your complete danger of any use product of this info. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI info (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this info, in no occasion shall any MSCI Social gathering have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss income) or some other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Companies, LLC.

WisdomTree Funds are distributed by Foreside Fund Companies, LLC, within the U.S. solely.

You can not make investments instantly in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.