By Rob Williams, Director of Analysis, Sage Advisory Earlie

By Rob Williams, Director of Analysis, Sage Advisory

Earlier this yr many buyers panicked and fled to money when information of Covid-19 brought on a pointy downturn within the first quarter. Whereas market downturns are widespread, there was no playbook for a world pandemic. Nevertheless, as a result of historic financial coverage and monetary stimulus response, the correction proved to be short-lived. It was extra like an intra-cycle correction that occurs quick however rebounds simply as shortly. Ultimately, like in different corrections, these buyers who stayed invested available in the market had been higher served than those that fled to money.

Throughout the newest 4 market corrections, on common roughly two-thirds of an investor’s draw back was recovered in two weeks.

Put one other method, for the 2020 correction, an investor who misplaced $10,000 by going to money when the market hit backside, would miss out on recouping ~$6,200 if s/he had been nonetheless invested in money two weeks later.

| Yr of Correction | % of draw back recovered in first week |

% of draw back recovered in first two weeks |

| 2015 | 48% | 64% |

| 2016 | 43% | 78% |

| 2018 | 43% | 52% |

| 2020 | 27% | 62% |

| Common | 40% | 64% |

Market Timing vs. Time within the Market

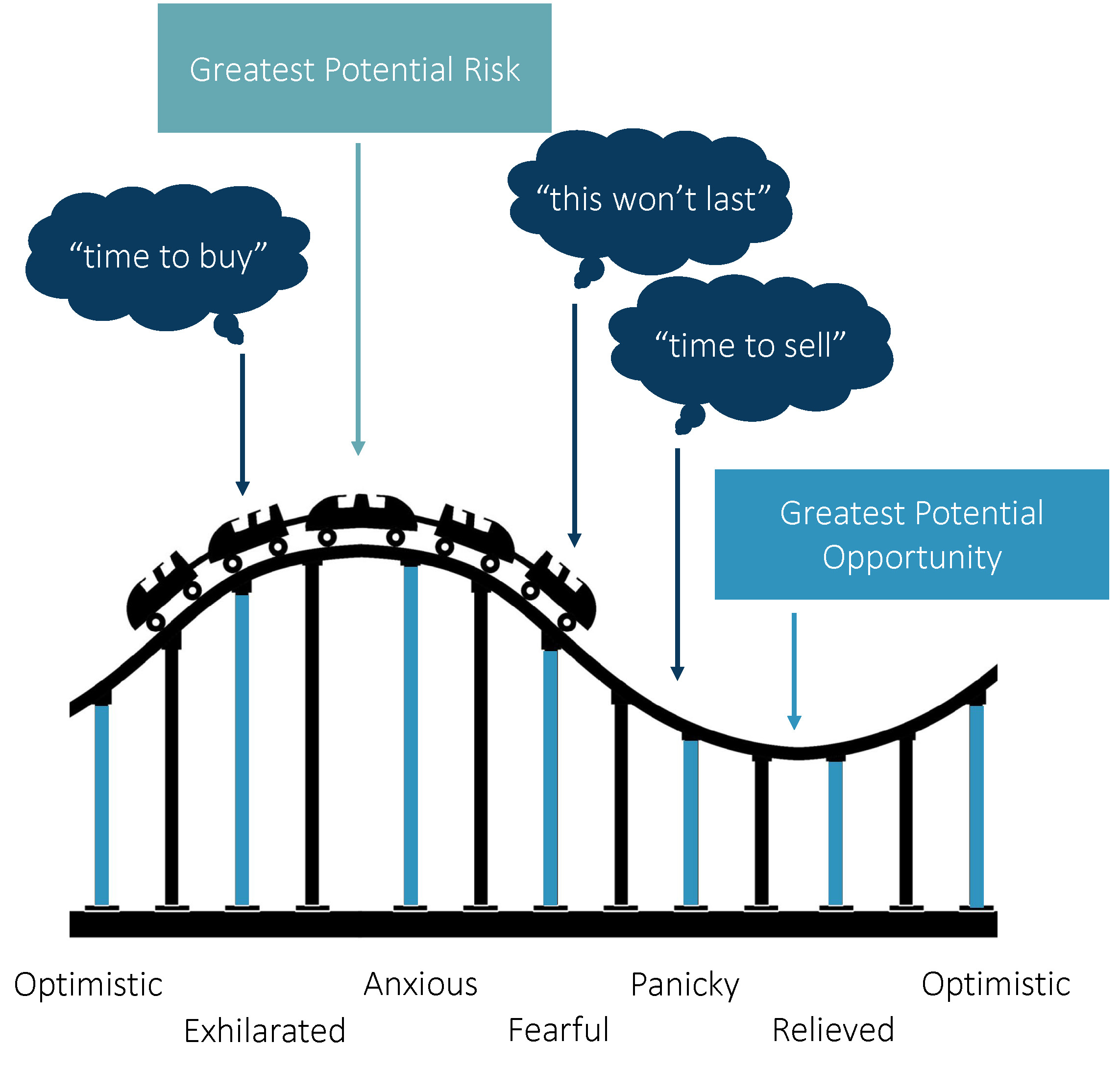

Market timing is a technique that depends on predicting market actions – and it’s practically not possible to perform even by probably the most expert portfolio managers. Ideally, buyers wish to purchase shares when costs are low and promote them when costs hit highs. Nevertheless, this not often happens. As a substitute what typically occurs when markets dip down is buyers 1) panic and promote their shares to carry money, and a couple of) don’t reinvest their money again into the market quick sufficient to trip the market again up.

Time available in the market refers to a “buy-and-hold” method, whereby buyers make investments after they can as typically as they’ll, they usually keep invested by means of market cycles. Over the long-term, buyers’ returns are prone to be greater than they’d have been if that they had tried and failed at timing the market (which is nearly all the time the case!).

Protecting Shoppers Invested

At Sage, we want time available in the market. And as tactical managers, we take this a step additional by 1) creating the smoothest trip doable in order that monetary advisors have a neater time holding purchasers invested, and a couple of) holding quick to our perception that there’s all the time a greater market section to be in than money. Our tactical method to investing consumer portfolios contains shifting out and in of shares, bonds, and many others., because the market modifications. As a substitute of going to money and exiting the market completely, we want to deal with rotating into market segments which are prone to carry out higher than others given the present market surroundings.

[wce_code id=192]

As a substitute of deciding when to exit the market and reenter, which is extraordinarily troublesome to time, we ask what segments of the market are prone to outperform? What’s inflicting the correction? And, what asset lessons are prone to have probably the most upside because the markets recuperate?

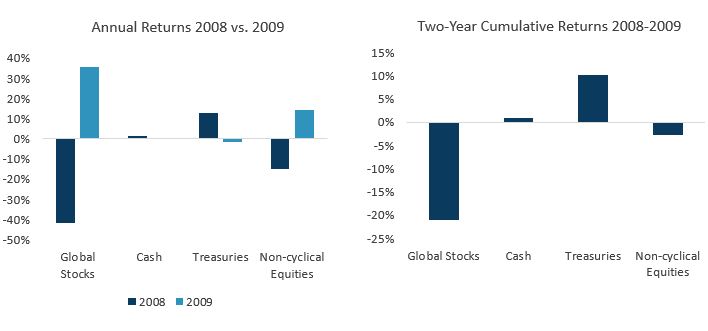

Even throughout giant, longer-lasting corrections, money is commonly not one of the best protection over time. For tactical methods, particularly balanced ones, the 2008-2009 interval supplies an ideal instance. The technique of accelerating Treasuries within the bond allocation, whereas utilizing defensive shares as an alternative of money on the fairness aspect, offered buyers with a smoother trip (much less swings up/down) and comparable draw back safety than money with out the dangers that end result from making an attempt to time when to get out and again into the market.

Given the political and macro uncertainties dealing with fairness buyers and the difficult yield surroundings dealing with earnings buyers, it has by no means been extra vital to use an energetic method to investing. It’s also vital to remain invested available in the market and never be pushed by worry and market timing. As we’ve discovered from earlier market downturns, money is commonly not one of the best protection.

Disclosures: That is for informational functions solely and isn’t meant as funding recommendation or a proposal or solicitation with respect to the acquisition or sale of any safety, technique or funding product. Though the statements of reality, info, charts, evaluation and information on this report have been obtained from, and are based mostly upon, sources Sage believes to be dependable, we don’t assure their accuracy, and the underlying info, information, figures and publicly accessible info has not been verified or audited for accuracy or completeness by Sage. Moreover, we don’t signify that the knowledge, information, evaluation and charts are correct or full, and as such shouldn’t be relied upon as such. All outcomes included on this report represent Sage’s opinions as of the date of this report and are topic to vary with out discover as a consequence of numerous components, comparable to market situations. Traders ought to make their very own choices on funding methods based mostly on their particular funding goals and monetary circumstances. All investments include threat and will lose worth. Previous efficiency isn’t a assure of future outcomes.

Sage Advisory Companies, Ltd. Co. is a registered funding adviser that gives funding administration companies for a wide range of establishments and excessive internet price people. For added info on Sage and its funding administration companies, please view our site at www.sageadvisory.com, or check with our Type ADV, which is offered upon request by calling 512.327.5530.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.