By: BCM Funding Group

By: BCM Funding Group

Manufacturing stays sturdy within the U.S. and noticed extra beneficial properties in February—even within the frozen Lonestar state—however producer costs are additionally climbing with out accompanying beneficial properties in costs charged, and it might spell bother. Residence costs noticed their greatest annual achieve since 2006—11.2% year-over-year—in January and are considerably outpacing wages, however how will climbing rates of interest come into play? And the eviction moratorium has been prolonged via June, however what lies forward for the sector although when it lastly expires? Over within the fairness markets, valuations are at extremes, as is margin debt. If hedge funds are falling to leverage and margin, how susceptible is the ever-expanding inhabitants of novice retail traders? Massive Tech shares tumbled after the 10-year Treasury yield hit its highest stage in over a 12 months to shut out March, however general, correlation between equities and bonds is climbing. What lies forward although as an infection charges additionally climb throughout the nation?

[wce_code id=192]

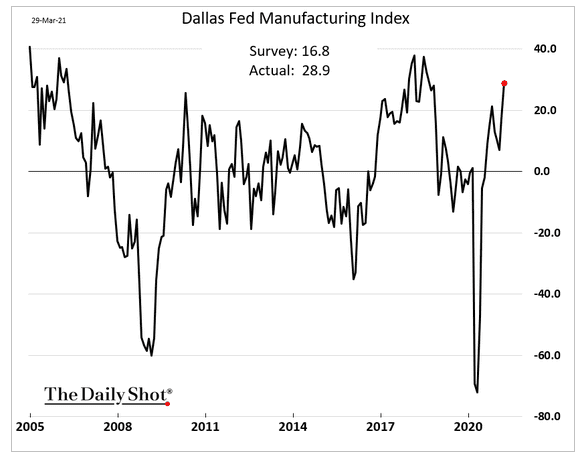

1. Regardless of the deep freeze, the Dallas FED’s manufacturing report was sturdy, much like the opposite regional surveys:

Supply: The Each day Shot, from 3/30/21

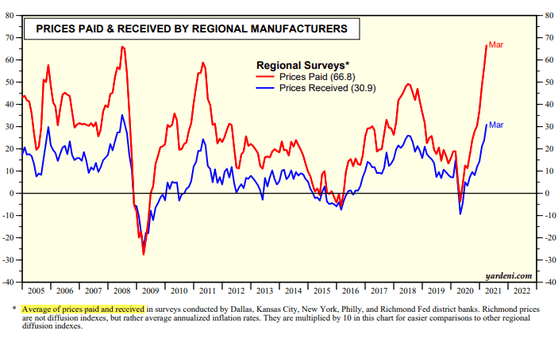

2. The combination of this month’s FED surveys signifies that the costs paid for the prices of products offered has far exceeded the costs acquired by producers; it will squeeze margins, trigger an inflationary improve in costs, or a few of each:

Supply: The Each day Shot, from 3/30/21

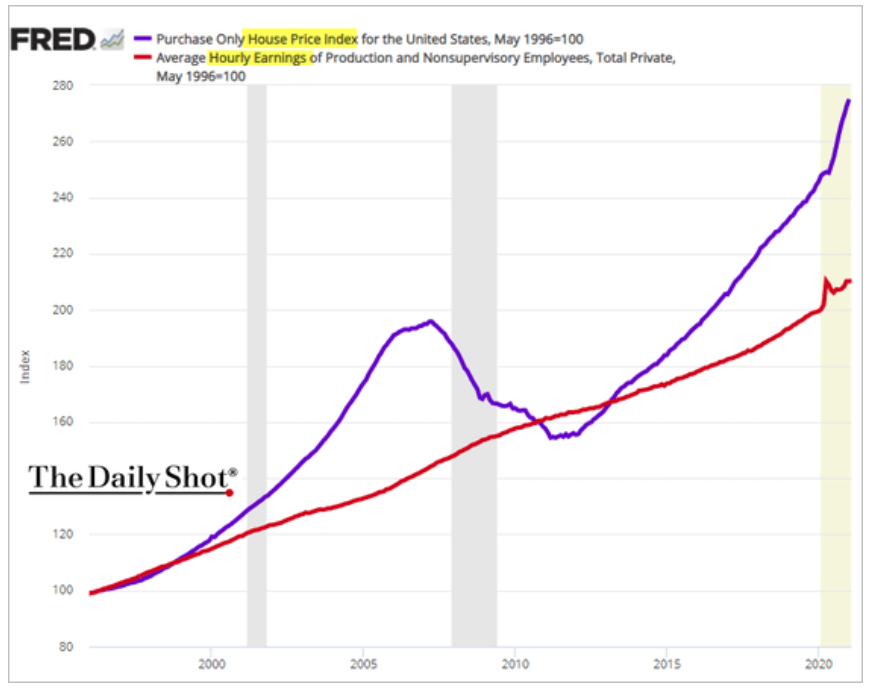

3. Housing worth will increase are simply outpacing revenue progress. With mortgage charges rising, will this vital progress section of the financial system get choked off?

Supply: The Each day Shot, from 3/31/21

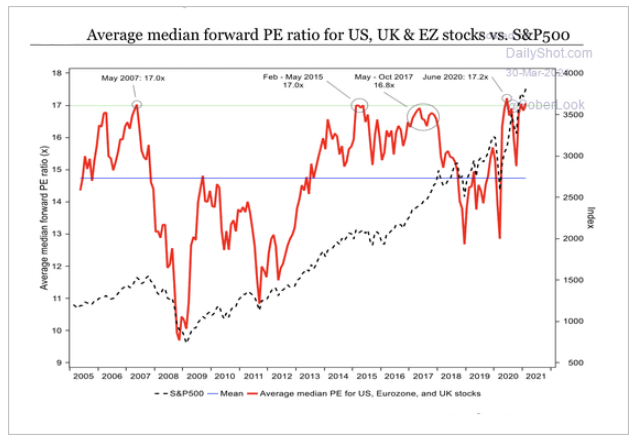

4. Whereas world fairness earnings have continued to enhance, the markets’ P/E ratios are additionally close to historic peaks:

Supply: The Each day Shot, from 3/30/21

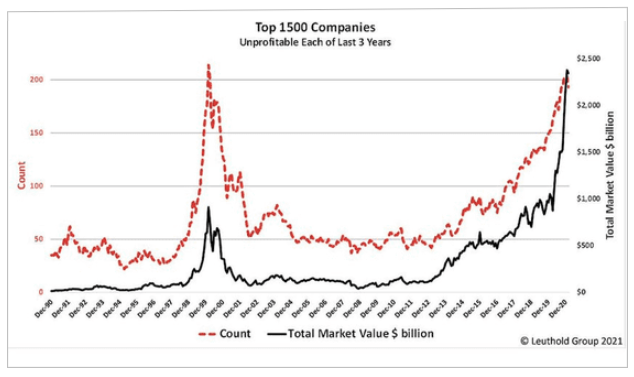

5. Traders are pouring extra capital into extra unprofitable corporations than through the earlier peak, the dot.com bubble within the late 1990s. When and the way will the air come out of this bubble?

Supply: The Each day Shot, from 3/30/21

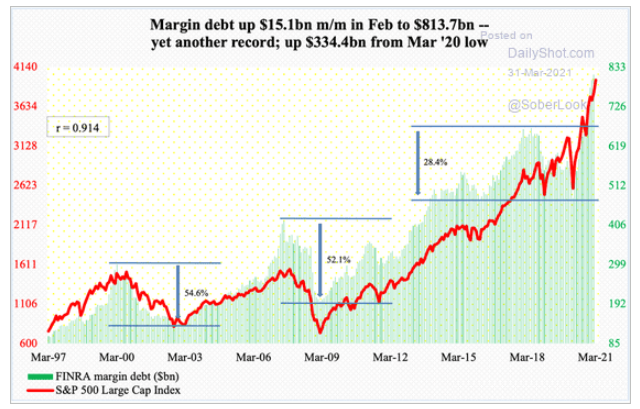

6. Do the brand new do-it-yourself traders perceive the dangers of margin? We’ll discover out!

Supply: The Each day Shot, from 3/31/21

7. The markets are breaking an previous maxim: “Don’t battle the FED”. In fact, the FED didn’t know concerning the upwards of $7.7 trillion ($1.9 + $0.9 + $1.9 and now probably +$Three trillion) in new federal spending…

Supply: The Each day Shot, from 3/31/21

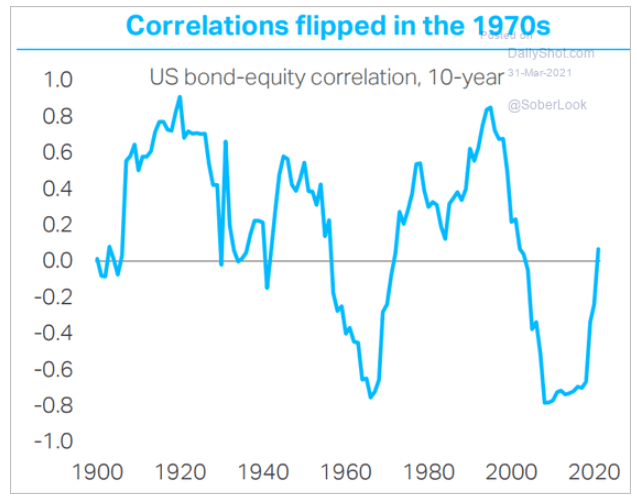

8. An amazing historic chart exhibiting fairness and bond correlations over time.

Supply: The Each day Shot, from 3/31/21

9. Inflation and rates of interest are, basically, rising throughout the globe. A lot of that is as a result of rise in oil costs:

Supply: The Each day Shot, from 3/31/21

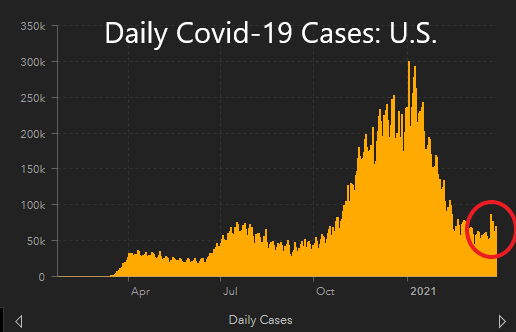

10. Listed below are the day by day variety of U.S. Covid instances. We have now circled what our CDC director spoke to and is anxious about:

Supply: JHU CSSE, from 3/30/21

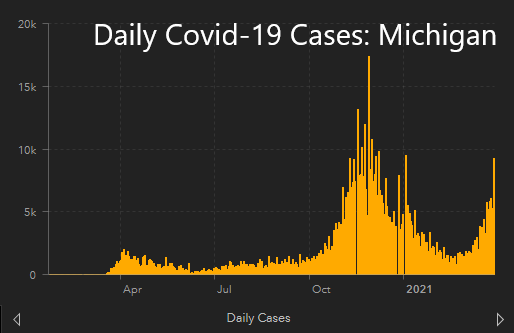

11. In some States, together with Michigan beneath, the third wave has already begun.

Supply: JHU CSSE, from 3/30/21

This text was contributed by Beaumont Capital Administration, a participant within the ETF Strategist Channel.

For extra insights like these, go to BCM’s weblog at weblog.investbcm.com.

Disclosure: The charts and info-graphics contained on this weblog are sometimes primarily based on knowledge obtained from third events and are believed to be correct. The commentary included is the opinion of the writer and topic to alter at any time. Any reference to particular securities or investments are for illustrative functions solely and usually are not meant as funding recommendation nor are they a suggestion to take any motion. Particular person securities talked about could also be held in consumer accounts. Previous efficiency is not any assure of future outcomes.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.