The Worldwide Power Company (IEA) was based in 1974 in response to grease embargos the earlier 12 months that induced the worldwide worth of oil to surge 300% from $three per barrel to $12 per barrel. From the beginning, the IEA’s mission has been to assist member nations take care of main oil provide disruptions.

Through the years, the group’s purview has broadened to incorporate extra than simply oil safety, and in its most up-to-date report, the IEA sounds the warning bell on the worldwide provide of key minerals—notably copper.

“In the present day’s provide and funding plans for a lot of vital minerals fall effectively quick of what’s wanted to help an accelerated deployment of photo voltaic panels, wind generators and electrical autos,” IEA Govt Directive Religion Birol writes.

Many of those minerals are produced by a really small variety of firms in a small variety of jurisdictions. Take uncommon earth metals, utilized in all the things from semiconductors to smartphone batteries. China controls between 80% and 95% of the world market, relying on the mineral.

Or have a look at copper. Chile and Peru are chargeable for a mixed 40% of world output. The biggest copper mine on the earth, Chile’s Escondida, is believed to have reached peak manufacturing. In the meantime, the Chilean authorities has threatened to close down the mine—57.5% of which is owned by BHP—for its water utilization. Oh, and did I point out there’s a strike at Escondida?

These are solely near-term dangers to world provide. Wanting extra long-term, the dangers enhance and may very well be extra extreme.

Copper Provide Constraints as Demand Surges

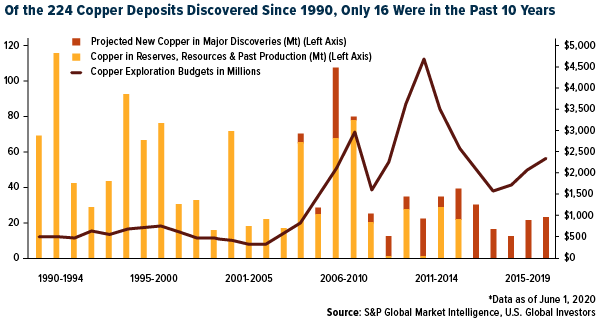

Like gold, fewer and fewer giant copper deposits are being found, and the time between discovery and manufacturing has lengthened over time as prices rise. S&P International Kevin Murphy referred to as final decade “dismal” when it comes to new discoveries. Of the 224 copper deposits that have been found between 1990 and 2019, solely 16 have been discovered prior to now 10 years. Though the earth’s floor nonetheless has an abundance of the crimson metallic, most new deposits are of low grade.

click on to enlarge

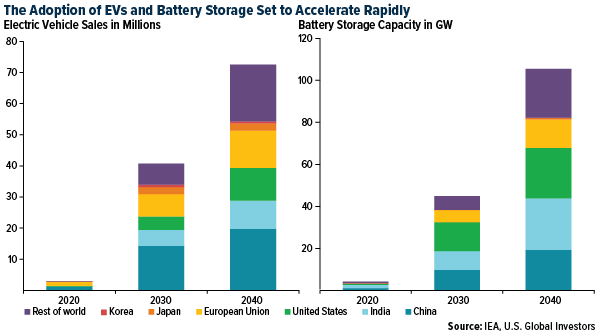

This may very well be an issue going ahead. As I’ve written about earlier than, the adoption of electrical autos (EVs) and battery storage expertise—each of which rely closely on copper—is ready to speed up quickly over the approaching a long time. Final 12 months, EV gross sales have been round three million. By 2040, they may very well be as excessive as 70 million.

click on to enlarge

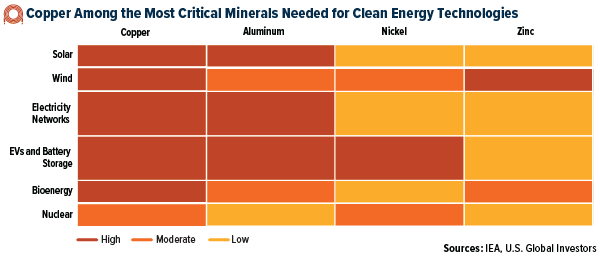

In line with the IEA, copper will stay probably the most extensively used metallic in renewable power applied sciences. In comparison with aluminum, nickel and zinc, its significance is rated excessive for many new energy-related tasks. That’s primarily as a result of its electrical conductivity is the second finest after silver and 60% larger than aluminum. Goldman Sachs predicts that by 2030, copper demand will develop practically 600% to five.four million tons.

click on to enlarge

Industrial Manufacturing Begins at Ivanhoe’s Kamoa-Kakula

Though giant copper discoveries have gotten fewer and farther between, there are notable exceptions. The IEA mentions Peru’s Quellaveco, majority-owned by Anglo American, and Ivanhoe’s Kamoa-Kakula within the Democratic Republic of the Congo (DRC).

I’ve written concerning the creating Kakula undertaking a number of occasions earlier than. Final week, Ivanhoe introduced that copper focus manufacturing formally started on the world-class discovery, a number of months forward of schedule.

“Discovering and delivering a copper province of this scale, grade and excellent ESG credentials, forward of schedule and on finances, is a unicorn within the copper mining enterprise,” commented Ivanhoe founder and co-chair Robert Friedland, who added that Kakula was found solely 5 years in the past. This represents “exceptional progress by the mining trade’s glacial requirements from first drill gap to a brand new main mining operation.”

Kakula, Robert says, is now on path to grow to be the world’s second largest copper mining advanced and even perhaps the largest. Additional, the undertaking is estimated to be the world’s highest grade main copper mine. Additional nonetheless, Ivanhoe pledges that Kakula will probably be a net-zero greenhouse gasoline generator, making the corporate a beautiful ESG play.

File Copper Value by Yr-Finish?

Final week, analysts at CIBC introduced that they adjusted their end-of-year copper worth forecast to $5.25 a pound, Kitco reviews. The estimates at the moment are 22% and 32% above 2021 and 2022 consensus estimates.

The supporting elements embody “constructive financial information, USD weak spot, continued Chinese language demand and tight world stock ranges,” CIBC wrote.

If true, this needs to be supportive of copper miners reminiscent of Ivanhoe going ahead.

Learn additional:

Initially revealed by US Funds, 6/1/21

All opinions expressed and information offered are topic to alter with out discover. A few of these opinions might not be applicable to each investor. By clicking the hyperlink(s) above, you can be directed to a third-party web site(s). U.S. International Buyers doesn’t endorse all data equipped by this/these web site(s) and isn’t chargeable for its/their content material. Beta is a measure of the volatility, or systematic danger, of a safety or portfolio compared to the market as an entire.

Holdings might change day by day. Holdings are reported as of the latest quarter-end. The next securities talked about within the article have been held by a number of accounts managed by U.S. International Buyers as of (03/31/2021): BHP Group Ltd., Anglo American Plc, Ivanhoe Mines Ltd.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.