By Cristopher Anguiano, Analyst, World Analysis & Design, S&P Dow Jones Indices

By Cristopher Anguiano, Analyst, World Analysis & Design, S&P Dow Jones Indices

The seek for methods that establish dangers and progress alternatives with a motivation in sustainable investing has by no means been greater for rising markets. Environmental, social, and governance (ESG) investing offers a method for traders to go above and past conventional monetary issues by specializing in a wide range of impactful matters related to companies. These matters embody how corporations work together with their workers, the communities they function in, their dedication to the atmosphere, and the way they encourage change and innovation, to call just a few.

The fast progress and relevance of sustainable investing over the previous years has made it a cornerstone within the funding choice course of, so the presence of a broad ESG benchmark for the biggest market in Latin America was vital. Aimed towards ESG-oriented traders, S&P Dow Jones Indices launched on Aug. 31, 2020, the S&P/B3 Brazil ESG Index, an ESG-weighted index following a straight algorithm appropriate for the Brazilian market, with a concentrate on sustainability and ESG ideas just like these of the S&P 500® ESG Index.

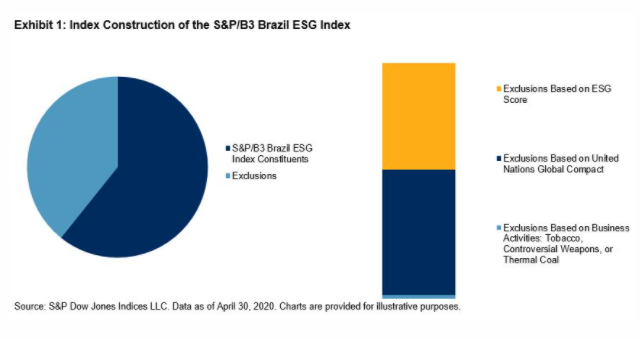

Utilizing the S&P Brazil BMI as its underlying index, corporations are excluded primarily based on the next standards:

- Enterprise actions associated to tobacco, controversial weapons, and thermal coal;

- United Nations World Compact (UNGC) non-compliance;1

- S&P DJI ESG Rating; and

- Media and stakeholder evaluation controversies.

In the newest rebalance on April 30, 2020, the ensuing universe consisted of 96 constituents.

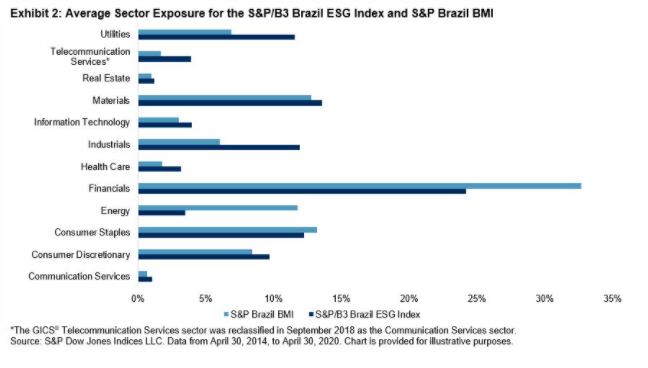

Firms are weighted by ESG rating, which is topic to a liquidity cap aimed to enhance liquidity. Throughout the April 2020 rebalance, analyzing 25% of the previous six months’ median worth traded reveals {that a} BRL one billion ticket may be traded on common in lower than sooner or later. As well as, common sector publicity decreased for Shopper Staples, Vitality, and Financials. In distinction, all different sectors’ publicity elevated.

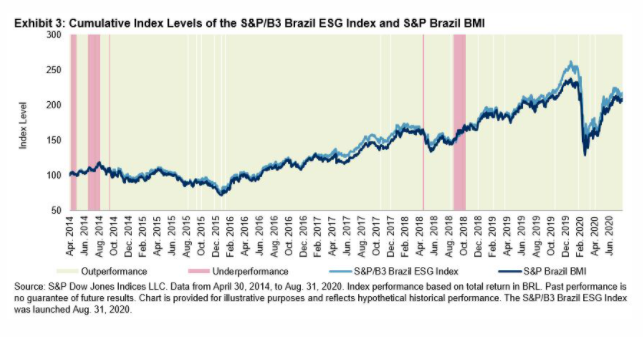

The index strikes just like its benchmark and reveals a mean annualized beta of 0.9 and annualized monitoring error that oscillates round 6%. In March 2020, the S&P/B3 Brazil ESG Index skilled a rise in beta and monitoring error, displaying a beta near 1 and a 6.5% monitoring error as a result of COVID-19 pandemic, when world markets suffered giant losses. We are able to see this motion within the cumulative stage chart in Exhibit three on the finish of Q1 2020. It’s related to spotlight that the technique not solely achieved a danger/return profile just like that of the S&P Brazil BMI, it additionally outperformed in additional than 90% of the historic observations.

From an ESG perspective, the S&P/B3 Brazil ESG Index was in a position to enhance its ESG rating relative to that of the S&P Brazil BMI. Throughout its most up-to-date rebalance, the general ESG rating of the S&P/B3 Brazil ESG Index elevated from 47.9 to 57.7, an enchancment of 9.eight factors; contemplating that the utmost attainable ESG rating of any technique utilizing the S&P Brazil BMI is 95.9, the ESG realized potential was 20.4%.

General, the S&P/B3 Brazil ESG Index is designed to be an alternate for traders which might be in search of publicity to the broad Brazilian equities market whereas sustaining a concentrate on accountable investing, with out shedding the advantages of efficiency and liquidity.

Initially revealed by Indexology Weblog, 9/30/20

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.