By Rod Smyth, Chairman of the Board of Administrators

SUMMARY

- We imagine low rates of interest assist inventory and actual property valuations…

- … however create a problem for ‘maintain’ and ‘distribute’ buyers.

- We predict tactical asset allocation and danger administration will help overcome this problem.

TINA stands for ‘There Is No Different’ (on this case, to shares) and is an acronym now we have heard more and more this yr. It was made well-known as Margaret Thatcher’s marketing campaign slogan within the 1980s stating there was no different to free market capitalism. Widespread acronyms like this one can typically seize the temper of a second in time and this one is borne out by the information. Now, 15 months from the pandemic’s outset, the willingness to take danger is again, as seen by the outsized value positive aspects in each shares and home costs in each absolute and actual phrases (internet of inflation). The reason being clear to us – on the time of this writing, yields on cash markets are successfully zero, the yield on a 30-year mortgage is round 3%, the 10-year Treasury bond is round 1.3% and the yield on an index of the riskiest company bonds is beneath 4% for the primary time ever. So long as charges stay considerably beneath the speed of inflation, we must always anticipate the worth of shares and residential costs to be nicely above common.

[wce_code id=192]

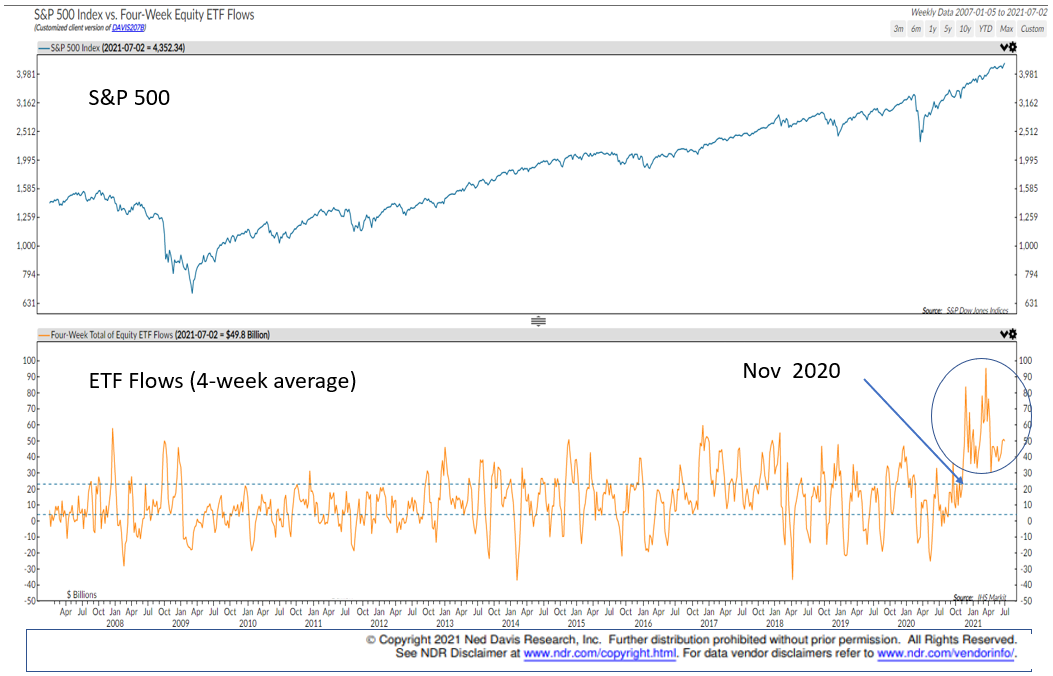

Elevated danger taking can be seen within the final six months of inflows into Fairness Trade Traded Funds (ETFs). In our chart beneath, courtesy of Ned Davis Analysis, you may see that since November 2020, inflows are coming in at ranges which might be unprecedented since 2008. We predict this can be a attributable to a mix of optimism associated to the inventory market’s resilience through the pandemic, and the dearth of engaging options.

Copyright 2021 Ned Davis Analysis, Inc. Additional distribution prohibited with out prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For knowledge vendor disclaimers check with www.ndr.com/vendorinfo/.

Previous efficiency is not any assure of future outcomes. Proven for illustrative functions. Not indicative

We imagine low rates of interest assist inventory valuations.

With the foremost US inventory indexes hitting all-time highs, we wish to put the latest ranges into context. A technique to do that is to have a look at shares relative to their very own historic pattern. In line with our historic research of inventory costs since 1926, the inflation-adjusted pattern return of huge cap shares is 6.4% (together with reinvested dividends). As of the newest knowledge now we have, giant caps are 46% above this pattern (Might 2021), which we view as excessive however not excessive – in 1999/2000 this index was 100% above pattern. In line with our analysis, the 10-year return outcomes from present ranges are extra typically constructive than unfavorable. Whereas we expect long-term (7 to 10-year) returns might be decrease than common (assuming some imply reversion) we don’t suppose now could be the time to decrease inventory weightings as low charges counsel shares ought to stay above pattern in our view. So as soon as once more, rates of interest are key to the outlook for shares and whereas we anticipate them to rise considerably, we expect they may stay low sufficient to permit the bull market in shares to proceed.

There’s a complement to shares for risk-averse buyers.

Bond yields could also be low however as we noticed final yr, they’ll go decrease in a disaster inflicting bond costs to rise quickly thereby offsetting a portion of fairness losses and decreasing a portfolio’s volatility and drawdown. Traders who owned balanced portfolios within the first quarter of 2020 had been most likely very glad they owned some bonds. Thus, the function of bonds and money in a portfolio have modified as charges have fallen. Their major function immediately is to offer a buffer in market corrections and provides buyers who’re withdrawing cash to fund retirement, a cushion to satisfy speedy spending wants. We’ve revealed three 21st Century Retirement items masking the Accumulate, Maintain, and Distribute phases. The realities of ‘TINA’ means we suggest a larger publicity to dangerous belongings resembling shares for these near retirement (maintain buyers) and people in retirement (distribute buyers). Nevertheless, we imagine there’s a function for bonds as described above, and likewise for tactical adjustments to asset allocation which we incorporate into our balanced portfolios.

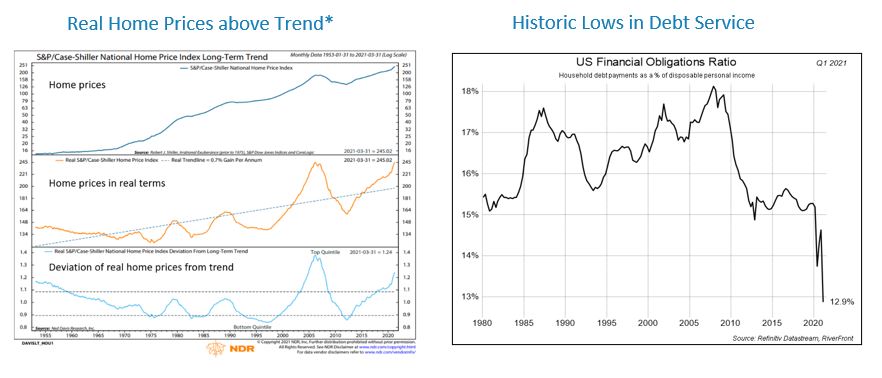

A increase however not a ‘bubble’ in actual property, in our view.

As with shares, with rates of interest beneath the extent of inflation, residence costs are additionally rising fairly quickly. In line with an index of present residence costs created by economists Karl Case, Robert Shiller and Customary & Poor’s, present residence costs have risen very persistently since 1955 with the one extended decline occurring throughout the actual property disaster of 2008. When inflation is included, the image is sort of totally different as proven within the center clip of the chart beneath, additionally courtesy of Ned Davis Analysis. There have been a number of cycles in actual residence values, essentially the most dramatic being the house value bubble which led to 2008. A brand new bull market in residence costs started in 2012, however as you may see it has accelerated dramatically in the previous couple of months.

* This chart is an index of residence costs primarily based on present properties and doesn’t embody the rental earnings an investor would obtain so just isn’t akin to shares. Copyright 2021 Ned Davis Analysis, Inc. Additional distribution prohibited with out prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For knowledge vendor disclaimers check with www.ndr.com/vendorinfo/.

Previous efficiency is not any assure of future outcomes. Proven for illustrative functions. Not indicative of RiverFront portfolio efficiency. Index definitions can be found within the disclosures.

Evaluating immediately’s stage with that of 2007-2008 requires us to additionally evaluate rates of interest. At present the 10-year treasury bond yields 1.3% whereas from 2004- 2007 it was 2-Four occasions larger starting from 3.5 to five.5%. We imagine residence patrons care extra in regards to the month-to-month fee they need to make and the choice value of renting than absolutely the value of the house. We imagine immediately’s residence value ranges are comprehensible within the context of the present stage of rents and the extraordinarily low stage of mortgage rates of interest. Thus, the US monetary obligations ratio (which measures the price of curiosity funds) is at file lows (see chart above, proper). For that reason, we see a increase however not but a bubble in residence costs.

How TINA impacts totally different investor sorts and our suggestions for portfolio construction:

The Accumulate Investor:

For buyers within the Accumulate section of their investing journey, our recommendation is constant. We imagine the investor saving month-to-month ought to make investments as a lot as attainable in shares and see bear markets as a possibility to build up shares at decrease costs. For individuals who personal their very own properties, we encourage you to lock within the lowest mortgage fee and refinance if it makes monetary sense. For these trying to purchase, the previous adage in regards to the significance of location applies. Housing markets are native not nationwide. If shopping for means a mortgage fee that’s just like or decrease than the price of renting, then residence costs should not overvalued in our view.

The Maintain Investor:

Whereas we can not know what the correct amount of danger belongings is for any particular particular person, within the years main as much as retirement we imagine some stability between progress of capital and capital preservation is the target. With the return on safer investments so low, it’s doubtless that the investor should allocate a bigger portion to riskier, extra unstable ones. Since we imagine extra unstable belongings like shares will do higher in 5 and 10-year timeframes, the first problem for buyers is prone to be an emotional one: are you able to climate a bear market with out shedding your nerve, and are you prepared to rebalance by including to danger belongings after a decline to maintain your required asset combine? That is the place we imagine a Monetary Advisor can each provide help to formulate the correct mix and provide help to navigate the journey emotionally. In case you have some flexibility concerning retirement age, this will help the plan significantly.

The Distribute Investor:

The Distribute investor is, by definition, essentially the most risk-adverse of our three investor sorts. Nevertheless, Distribute buyers immediately ought to acknowledge that bond market yields are at present beneath the speed of inflation, suggesting a portfolio comprised strictly of bonds is poised to lose buying energy over time. Subsequently, in our view, a Distribute investor ought to solely have the vast majority of their portfolio allotted to bonds if: 1. They’ve greater than sufficient saved that they’ll afford to lose buying energy and nonetheless preserve lifestyle or 2. They’re snug decreasing their lifestyle over time commensurate with their declining portfolio buying energy.

Our recommendation for the Distribute investor is just like that of the maintain investor concerning the potential want for extra dangerous belongings to attain a return aim. Additionally, by using a ‘money bucket’ a Distribute investor can have larger flexibility to cut back the necessity for trimming shares throughout market drawdowns. We imagine an energetic portfolio danger administration technique is essential for Distribute buyers, given the necessity for principal safety in quite a lot of unsure environments.

RiverFront’s Function:

We focus on providing each longer-range Accumulate investments and extra balanced investments for the Maintain and Distribute phases. Via tactical navigation in our balanced portfolios and fixed clear communication we imagine we will actually assist buyers navigate tougher markets and shoulder the emotional rebalancing determination, so buyers preserve an applicable asset combine.

Necessary Disclosure Data

The feedback above refer typically to monetary markets and never RiverFront portfolios or any associated efficiency. Opinions expressed are present as of the date proven and are topic to vary. Previous efficiency just isn’t indicative of future outcomes and diversification doesn’t guarantee a revenue or shield in opposition to loss. All investments carry some stage of danger, together with lack of principal. An funding can’t be made immediately in an index.

Chartered Monetary Analyst is knowledgeable designation given by the CFA Institute (previously AIMR) that measures the competence and integrity of economic analysts. Candidates are required to cross three ranges of exams masking areas resembling accounting, economics, ethics, cash administration and safety evaluation. 4 years of funding/monetary profession expertise are required earlier than one can turn into a CFA charterholder. Enrollees in this system should maintain a bachelor’s diploma.

Data or knowledge proven or used on this materials was obtained from sources believed to be dependable, however accuracy just isn’t assured.

This report doesn’t present recipients with info or recommendation that’s enough on which to base an funding determination. This report doesn’t take into consideration the particular funding targets, monetary scenario or want of any specific consumer and might not be appropriate for every type of buyers. Recipients ought to contemplate the contents of this report as a single think about investing determination. Extra elementary and different analyses can be required to make an funding determination about any particular person safety recognized on this report.

In a rising rate of interest setting, the worth of fixed-income securities typically declines.

Shares characterize partial possession of an organization. If the company does nicely, its worth will increase, and buyers share within the appreciation. Nevertheless, if it goes bankrupt, or performs poorly, buyers can lose their complete preliminary funding (i.e., the inventory value can go to zero). Bonds characterize a mortgage made by an investor to an organization or authorities. As such, the investor will get a assured rate of interest for a selected time frame and expects to get their unique funding again on the finish of that point interval, together with the curiosity earned. Funding danger is compensation of the principal (quantity invested). Within the occasion of a chapter or different company disruption, bonds are senior to shares. Traders ought to concentrate on these variations previous to investing.

Trade-traded funds (ETFs) are bought by prospectus. Please contemplate the funding targets, danger, costs and bills fastidiously earlier than investing. The prospectus and abstract prospectus, which incorporates this and different info, could be obtained by calling your monetary advisor. Learn it fastidiously earlier than you make investments. As a portfolio supervisor and a fiduciary for our purchasers, RiverFront will contemplate the funding targets, dangers, costs and bills of a fund fastidiously earlier than investing our purchasers’ belongings.

Pattern, in line with Worth Issues® is the slope of an exponential progress perform that intently tracks an actual (inflation-adjusted) long run Index for that Asset Class. Distance from Pattern is the space of the pattern line relative to the present index stage expressed as a share.

Index Definitions:

The S&P CoreLogic Case-Shiller U.S. Nationwide Residence Worth NSA Index is a composite of single-family residence value indices for the 9 U.S. Census divisions and is calculated month-to-month. It’s included within the S&P CoreLogic Case-Shiller Residence Worth Index Sequence which seeks to measure adjustments within the whole worth of all present single-family housing inventory.

Customary & Poor’s (S&P) 500 Index TR USD (Giant Cap) measures the efficiency of 500 giant cap shares, which collectively characterize about 80% of the entire US equities market.

ICE BofA Merrill Lynch Excessive Yield Index TR USD (Excessive Yield) which tracks the efficiency of US greenback denominated beneath funding grade rated company debt publicly issued within the US home market. Index constituents are capitalization-weighted primarily based on their present quantity excellent occasions the market value plus accrued curiosity.

RiverFront Funding Group, LLC (“RiverFront”), is a registered funding adviser with the Securities and Trade Fee. Registration as an funding adviser doesn’t indicate any stage of talent or experience. Any dialogue of particular securities is supplied for informational functions solely and shouldn’t be deemed as funding recommendation or a advice to purchase or promote any particular person safety talked about. RiverFront is affiliated with Robert W. Baird & Co. Included (“Baird”), member FINRA/SIPC, from its minority possession curiosity in RiverFront. RiverFront is owned primarily by its workers via RiverFront Funding Holding Group, LLC, the holding firm for RiverFront. Baird Monetary Company (BFC) is a minority proprietor of RiverFront Funding Holding Group, LLC and subsequently an oblique proprietor of RiverFront. BFC is the mother or father firm of Robert W. Baird & Co. Included, a registered dealer/seller and funding adviser.

To assessment different dangers and extra details about RiverFront, please go to the web site at www.riverfrontig.com and the Kind ADV, Half 2A. Copyright ©2021 RiverFront Funding Group. All Rights Reserved. ID 1718136

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.