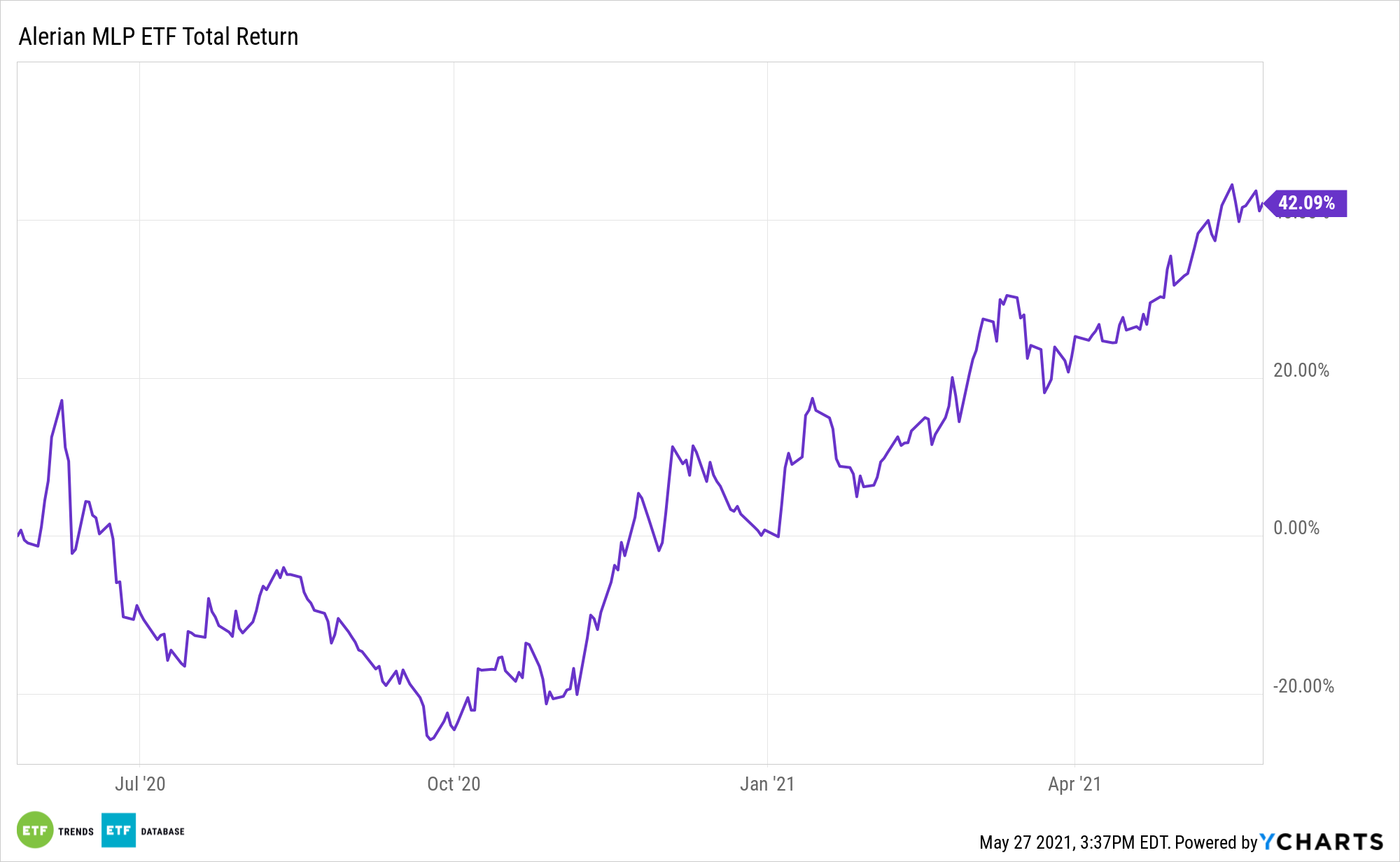

The ALPS Alerian MLP ETF (NYSEArca: AMLP), the king amongst alternate traded funds monitoring grasp restricted partnerships (MLPs), is greater by 35% year-to-date.

That is affirmation that the power sector is on the mend and that traders nonetheless love massive yields (AMLP yields 10.14%). Nevertheless, traders could not wish to get hung up on what lifted AMLP final week or final month as a result of the winds of change are blowing for midstream power firms.

On the Vitality Infrastructure Council (EIC) Investor Convention in Las Vegas, Alerian analyst Mauricio Samaniego documented the dialog about midstream’s evolving position within the booming renewable power realm.

“Among the many discussions, panelists emphasised the difficulties of the power transition and the myriad of challenges for renewable power, alluding that carbon seize and hydrogen may present options to decarbonize that would additionally assist guarantee power safety all through the power transition,” notes Samaniego.

AMLP’s Greener Future

There was a time when the first causes to embrace MLPs have been greater ranges of earnings and decrease correlations to grease and pure gasoline costs. Owing to firmer steadiness sheets and just lately robust earnings, many MLP elements are at the least sustaining, if not rising, distributions and share buyback plans are within the works.

Nevertheless, loads of AMLP member corporations seeing seismic shifts creating within the power area, and getting clever to the truth that they should evolve with the instances. Which means embracing renewables or danger being left behind.

On the EIC convention, “panelists emphasised the rising stress to decarbonize and alluded to carbon seize and hydrogen leveraging current power infrastructure to offer viable options, significantly for hard-to-abate sectors important to the financial system,” added Samaniego.

In contrast to their built-in oil counterparts, midstream names can extra nimbly transition to a low carbon future as a result of they already management the infrastructure property which might be important to making sure hydrogen, photo voltaic, and wind change into cost-efficient, reliable energy sources.

“Midstream firms present the spine to facilitate using cleaner power and are prone to profit from brief and long-term clear power alternatives as progress is made round renewable fuels, carbon seize, and hydrogen,” concluded Alerian’s Samaniego.

Different funds with publicity to income-generating power property embody the VanEck Vectors Vitality Revenue ETF (EINC) and the International X MLP ETF (NYSEArca: MLPA).

For extra on cornerstone methods, go to our ETF Constructing Blocks Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.