Power has been one of many top-performing sectors to date in 2021. But fairly than getting a run-of

Power has been one of many top-performing sectors to date in 2021. But fairly than getting a run-of-the-mill power fund with a handful of heavy allocations in direction of massive oil, buyers can go for an alternate play through the International X MLP & Power Infrastructure ETF (MLPX).

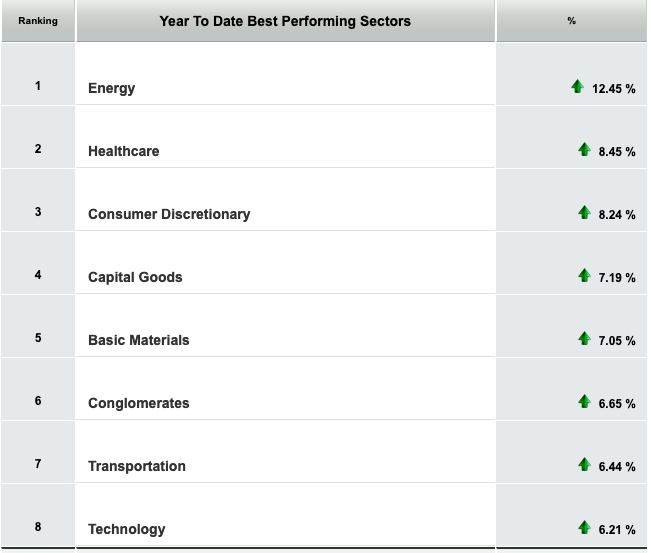

In response to information from CSIMarket.com, power leads the pack of sectors for year-to-date good points at about 12%.

At a 0.45% expense ratio, MLPX seeks to supply funding outcomes that correspond usually to the worth and yield efficiency, earlier than charges and bills, of the Solactive MLP & Power Infrastructure Index. The fund invests no less than 80% of its complete belongings within the securities of the index. It additionally invests no less than 80% of its complete belongings in securities of grasp restricted partnerships and power infrastructure firms.

The fund’s 80% funding insurance policies are non-fundamental and require 60 days prior written discover to shareholders earlier than they are often modified. The index tracks the efficiency of midstream power infrastructure MLPs and firms.

MLPs have change into very fashionable lately for primarily two causes: (1) required quarterly distributions present a gentle stream of present earnings, and (2) as a result of they’re partnerships, MLPs keep away from company earnings taxes at each the federal and state degree because the the tax legal responsibility is handed by way of to the person companions.

Total, MLPX offers buyers the next advantages:

- Tax Effectivity: Not like conventional MLP funds, MLPX avoids fund degree taxes by limiting direct MLP publicity and investing in related entities, such because the Basic Companions of MLPs and different power infrastructure firms.

- Midstream Publicity: MLPX invests in midstream infrastructure entities corresponding to pipelines and storage services which have much less sensitivity to power costs.

- Excessive Revenue Potential: The fund invests in MLPs and different power infrastructure corporations, which can end in above-average yields.

Outperforming Different Power Indexes

MLPX is up over 30% inside the previous few months, which underscores the energy of the power sector as of late. Recovering oil costs have a hand within the latest rally on the hopes {that a} Covid-19 vaccine will assist revive the economic system once more, which ought to as soon as once more spur extra transportation and thus, a requirement for oil.

When stacked up towards different power indexes the final six months, MLPX has additionally been an outperformer. Throughout the final six months, the fund is up virtually 22%, outpacing the S&P 500 Power Sector index’s 18.34% and the MSCI ACWI Power Sector index’s 17.15%.

For extra information and data, go to the Thematic Investing Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.