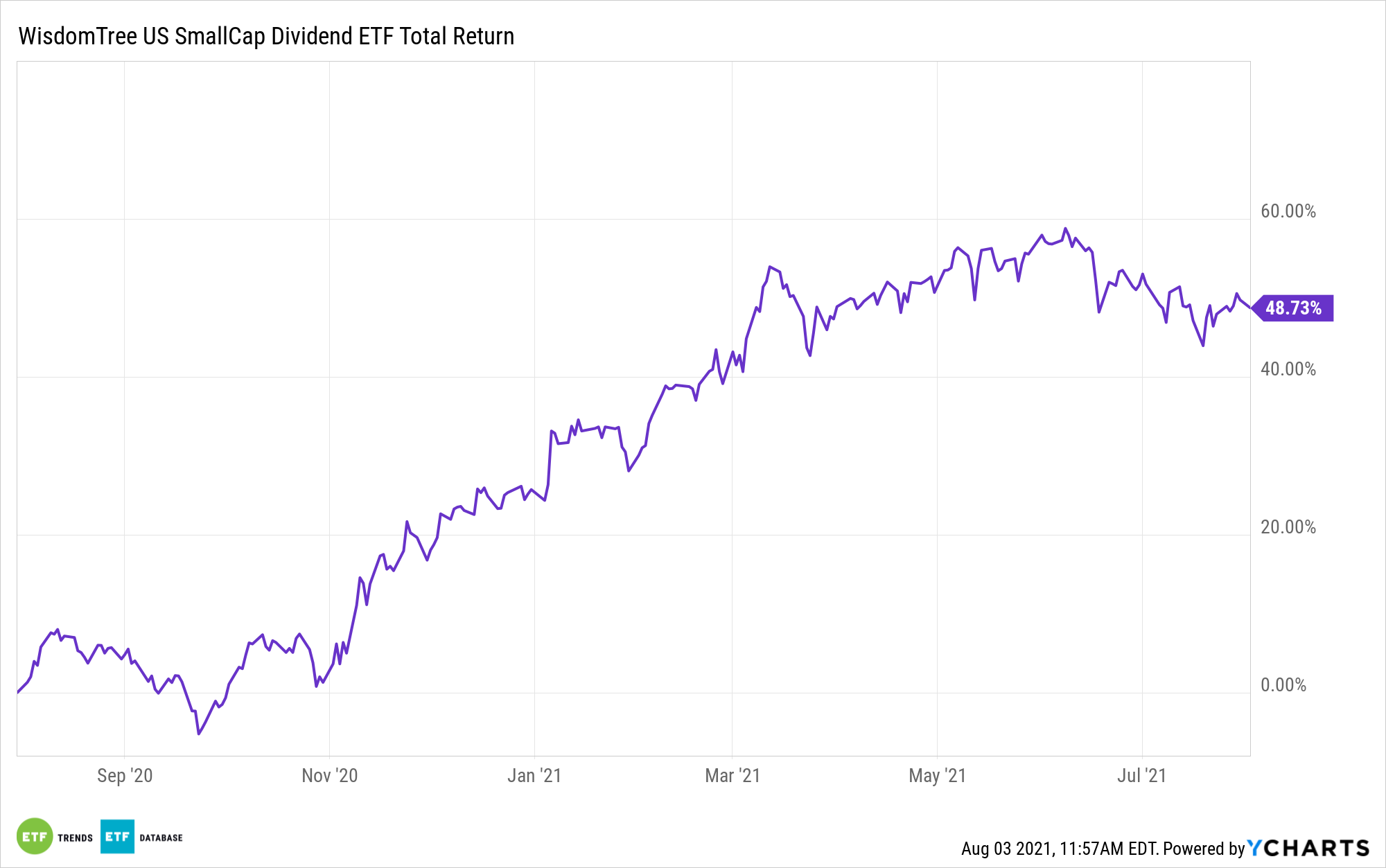

Small cap shares and change traded funds, particularly these with the worth designation, have been the celebrities of early 2021 – a theme that benefited the WisdomTree U.S. SmallCap Dividend Fund (NYSEArca: DES).

DES follows the WisdomTree U.S. SmallCap Dividend Index. That WisdomTree benchmark is essentially weighted. Particularly, it is “dividend weighted yearly to replicate the proportionate share of the combination money dividends every part firm is projected to pay within the coming yr,” in keeping with the issuer.

Though it is a devoted dividend fund with worth leanings, there are occasions when DES, like some other small cap fund, will look expensive relative to massive cap shares. Nevertheless, that is not the case in the present day, as buyers could possibly latch onto an excellent take care of this fund.

“Particularly, the ahead P/E of the S&P 500 relative to that of the S&P SmallCap 600 is measuring at ranges final seen on the finish of the 2001. Related relative valuations briefly spiked on the onset of the COVID-19 pandemic in March 2020 however corrected rapidly,” writes WisdomTree analyst Brian Manby. “The latest run-up can be much less regarding if the gauge was lower than 1. Traditionally, massive caps usually commanded a decrease valuation than small caps, for the reason that latter have been perceived to be riskier (therefore, decrease earnings within the ratio’s denominator). The previous, with greater earnings and perceived relative security, had their valuations saved in examine.”

Drilling Down on DES

Placing the above into context, home massive caps at the moment are as costly as they have been in opposition to small caps at any level since 2001.

In different phrases, buyers can seize DES and its 2.08% dividend yield, which is roughly 80 foundation factors above the S&P 500, on a budget. The $1.83 billion fund can be ideally positioned to profit from one other rise in 10-year Treasury yields, assuming that state of affairs involves move, as a result of DES devotes 25.51% of its weight to monetary companies shares.

Including to the DES valuation case is that its dividend-weighted methodology introduces a component of high quality, and high quality shares are really cheap in the present day. By some metrics, they’re even cheaper than worth shares. All that whereas massive caps are trying considerably bloated of their valuations.

“It’s laborious to disregard the chance that this creates for small caps, and solely reinforces our optimism on the ‘reopening’ commerce: bullish on cyclical sectors, worth and small caps. Whereas fears over the surging COVID-19 delta variant have given buyers pause, we predict that this may occasionally simply delay the financial restoration, moderately than derail it,” provides Manby.

For extra on learn how to implement mannequin portfolios, go to our Mannequin Portfolio Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.