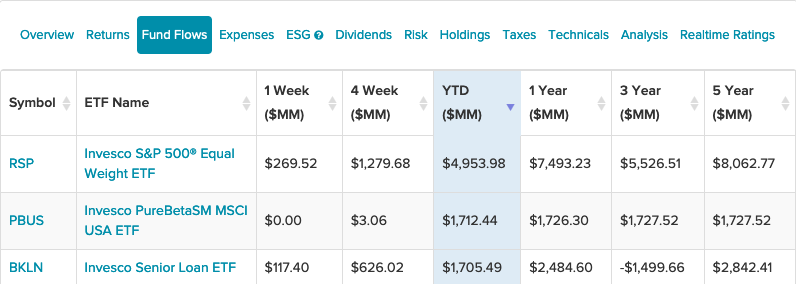

An equal weight technique, pure beta play, and senior mortgage possibility are sitting atop Invesco’s year-to-date inflows leaderboard.

On the high of the heap is the Invesco S&P 500 Equal Weight ETF (RSP), which makes use of a technique to diversify holdings with the intention to get rid of focus danger. RSP equally weights its holdings, so the ETF leans towards smaller firms with diminished focus danger when in comparison with the cap-weighted benchmark S&P 500 Index.

The dimensions issue provides the potential higher-than-benchmark returns related to comparatively smaller shares throughout the universe being thought-about. Moreover, traders can get this equal weight technique from RSP at a low 0.20% expense ratio.

“This ETF is linked to the S&P 500 Index, nevertheless its distinctive weighting methodology will make it helpful for some, whereas impractical for lively merchants,” an ETF Database evaluation stated. “Like many Rydex merchandise, RSP is linked to an equal-weighted index, which means that part firms obtain roughly equal allocations.”

Pure Beta Publicity

The second highest fund flows go to the Invesco PureBeta MSCI USA ETF (PBUS), which provides ETF traders a heavy emphasis on giant cap equities and the power to carefully mirror the actions of the market. PBUS boasts the bottom expense ratio of the three ETFs at 0.04%.

Total, PBUS seeks to trace the funding outcomes of the MSCI USA Index. The fund usually will make investments a minimum of 90% of its complete property within the securities that comprise the underlying index.

The index is designed to measure the efficiency of the large- and mid-capitalization segments of the U.S. fairness market. Prime holdings characteristic acquainted large tech names like Apple, Microsoft, Amazon, Fb, and Google.

Senior Mortgage Publicity

Investing in debt will at all times imply the opportunity of a default. On this vein, senior mortgage investing can look particularly engaging with ETFs just like the Invesco Senior Mortgage ETF (BKLN).

BKLN seeks to trace the funding outcomes of the S&P/LSTA U.S. Leveraged Mortgage 100 Index. The Adviser and the fund’s sub-adviser outline senior loans to incorporate loans known as leveraged loans, financial institution loans, and/or floating fee loans.

Banks and different lending establishments usually concern senior loans to firms, partnerships, or different entities. Senior loans are sometimes used for enterprise recapitalizations, acquisitions, leveraged buyouts, and re-financings. BKLN’s mortgage portfolio will embody the acquisition of loans from banks or different monetary establishments by way of assignments or participations.

For extra information and knowledge, go to the Modern ETFs Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.