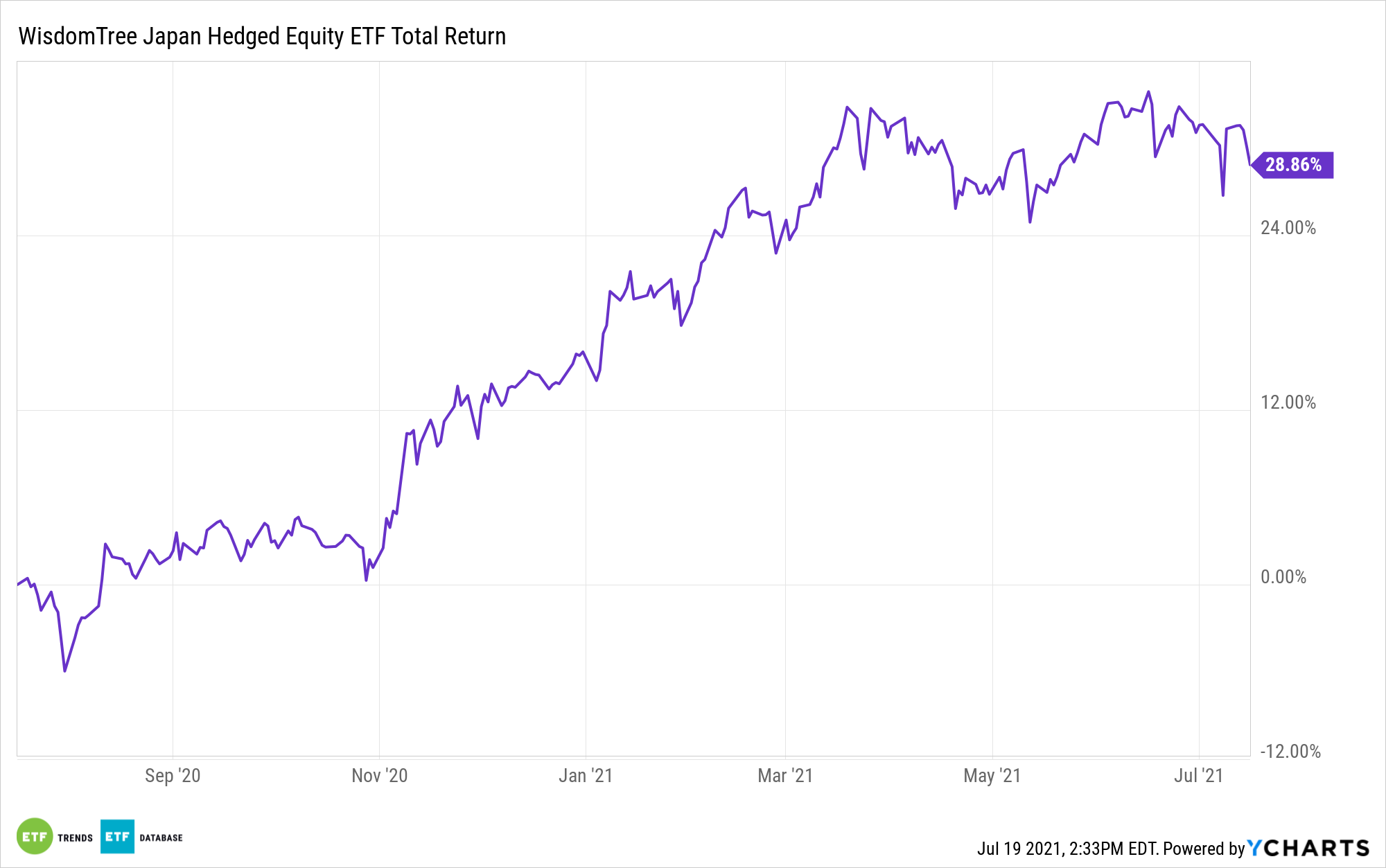

The WisdomTree Japan Hedged Fairness Fund (NYSEArca: DXJ) is greater by 11.08% year-to-date, an admirable displaying amongst developed market single-country change traded funds.

Extra upside may very well be on the best way for Japanese equities and DXJ as activist traders more and more augur for change at firms on the earth’s third-largest financial system. Whereas Japan does not have a deep historical past of being dwelling to activist targets, that state of affairs is altering.

“Ten activist campaigns had been launched there within the first half of the yr, accounting for 26% of non-U.S. campaigns, in response to information launched by Lazard. The nation has quickly turn into a hotbed for activism. In 2015, solely 6% of non-U.S. campaigns had been in Japan,” reviews Carelton English for Barron’s.

Activists eyeing Japanese firms could also be emboldened by the outcomes Effissimo Capital Administration and Farallon Capital Administration bought at Toshiba, which led to the resignation of the chief government officer earlier this yr. Toshiba is a smaller member of DXJ’s roster.

Seven & I Holdings Co., the father or mother firm of the 7-11 comfort retailer chain and one other DXJ holding, can be the goal of activist motion.

“ValueAct Capital initiated a stake in 7-Eleven-parent Seven & i Holdings, saying that its sum-of-the elements valuation was steeper than the corporate’s present market cap. Final month, Seven & i mentioned that it will decrease its stake within the father or mother of retail chain Francfranc,” in response to Barron’s.

One cause activists could also be concentrating on Japanese firms is that firms within the Land of the Rising Solar have sturdy steadiness sheets and are flush with money. Solely not too long ago, prior to now few years, have they began rewarding traders with buybacks and dividends.

Activists typically pursue change at cash-rich firms below the auspices of the corporate not doing proper by shareholders and never producing ample return on that capital.

Thus far, these activists aren’t displaying sector-level preferences for Japanese companies, but it surely would not be shocking to see industrial, client discretionary, and expertise firms, which mix for almost 62% of DXJ’s weight, draw extra activist consideration in Japan. No matter sector, the local weather appears to be like proper for activists within the nation.

“Challenges at Japanese firms had been as soon as unthinkable. However the nation has turn into extra shareholder-friendly following modifications made below former Prime Minister Shinzo Abe,” in response to Barron’s. “Now, activist wins might turn into the norm.”

For extra on implement mannequin portfolios, go to our Mannequin Portfolio Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.