The tax submitting deadline was prolonged to mid-Could, that day continues to be approaching rapidly. Buyers who held the Invesco S&P 500 Equal Weight ETF (RSP) will incur zero capital beneficial properties in 2020.

RSP equally weights its holdings, so the ETF leans towards smaller firms with diminished focus danger when in comparison with the cap-weighted benchmark S&P 500 Index. The scale issue provides the potential higher-than-benchmark returns related to comparatively smaller shares throughout the universe being thought of.

Smaller capitalization firms are likely to have increased development potential, and are much less extensively researched. Moreover, they transfer nearer in lockstep to the broader economic system, however can exhibit extra volatility when markets are fluxing up and down.

The ETF wrapper holds a number of advantages for property like RSP.

“In contrast to mutual funds, ETFs usually don’t promote securities when buyers redeem their shares,” a CFRA “Funds in Focus” market analysis report famous, highlighting RSP as one of many funds that incurred no capital beneficial properties tax final 12 months. “Most buying and selling takes place within the secondary market, with promote orders being crossed with purchase orders by way of the alternate as they’re with shares.”

“One of many advantages buyers in ETFs have traditionally loved is robust tax effectivity,” the report added. “ETF-focused advisors and buyers in 2020 acquired fewer surprises at 12 months finish and we anticipate extra folks that blend ETFs and mutual funds collectively might be extra inclined to shift towards methods to keep away from paying increased capital beneficial properties taxes sooner or later. There are a number of robust tax-efficient actively managed and index-based ETFs to think about.”

Benefits of an Equal Weight Technique

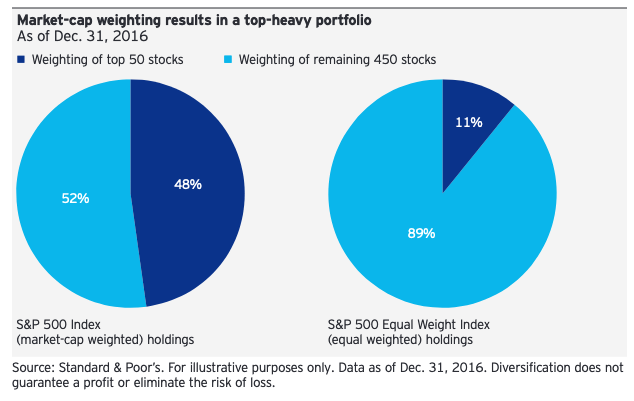

An Invesco “Technique Insights” report just lately highlighted the advantages of utilizing an equally-weighted funding method. A few these embody diversification potential and traditionally increased returns when evaluating the S&P 500 Index and S&P 500 Equal Weight Index (EWI).

“As a result of market-cap weighting, efficiency of the S&P 500 Index may be dominated by a small variety of shares,” the report stated. “The 50 largest securities within the index symbolize almost 50% of its weight, leaving the following 450 shares to account for the remaining 50%. The highest 50 shares within the S&P EWI, on the different hand, comprise simply 11% of that index.”

“Equal weighting means each inventory has the identical potential affect on the returns of the S&P EWI, whereas within the S&P 500 Index, a inventory with a weight of two% has 10 instances the affect of 1 with a weight of simply 0.2%,” the report famous.

For extra information and knowledge, go to the Revolutionary ETFs Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.