Oil costs can lastly put 2020 behind them because the commodity hit the damaging territory in a pan

Oil costs can lastly put 2020 behind them because the commodity hit the damaging territory in a pandemic-ridden yr. Nonetheless, oil is off to a stable begin in 2021, which could be seen in ETFs just like the VanEck Vectors Oil Service ETF (OIH) and the VanEck Vectors Unconventional Oil & Fuel ETF (FRAK).

OIH is up 13.54% to begin the brand new yr whereas FRAK is up 12.19%. We are able to see the current energy in oil by trying on the Bloomberg Fuel Oil Subindex Stage, which exhibits an increase of over 20% within the 3-month chart.

^BGOS knowledge by YCharts

In fact, an enormous mover for oil will likely be what OPEC members do at some point of 2021, however within the meantime, oil costs are feeding into energy for OIH and FRAK. Each funds give traders publicity to grease with the dynamic capability of an ETF wrapper.

OIH seeks to duplicate the value and yield efficiency of the MVIS® US Listed Oil Companies 25 Index. The fund usually invests at the least 80% of its whole property in securities that comprise the fund’s benchmark index.

The index consists of frequent shares and depositary receipts of U.S. exchange-listed corporations within the oil providers phase. Such corporations might embrace small- and medium-capitalization corporations and international corporations which can be listed on a U.S. trade.

OIH is up nearly 80% previously Three months.

OIH knowledge by YCharts

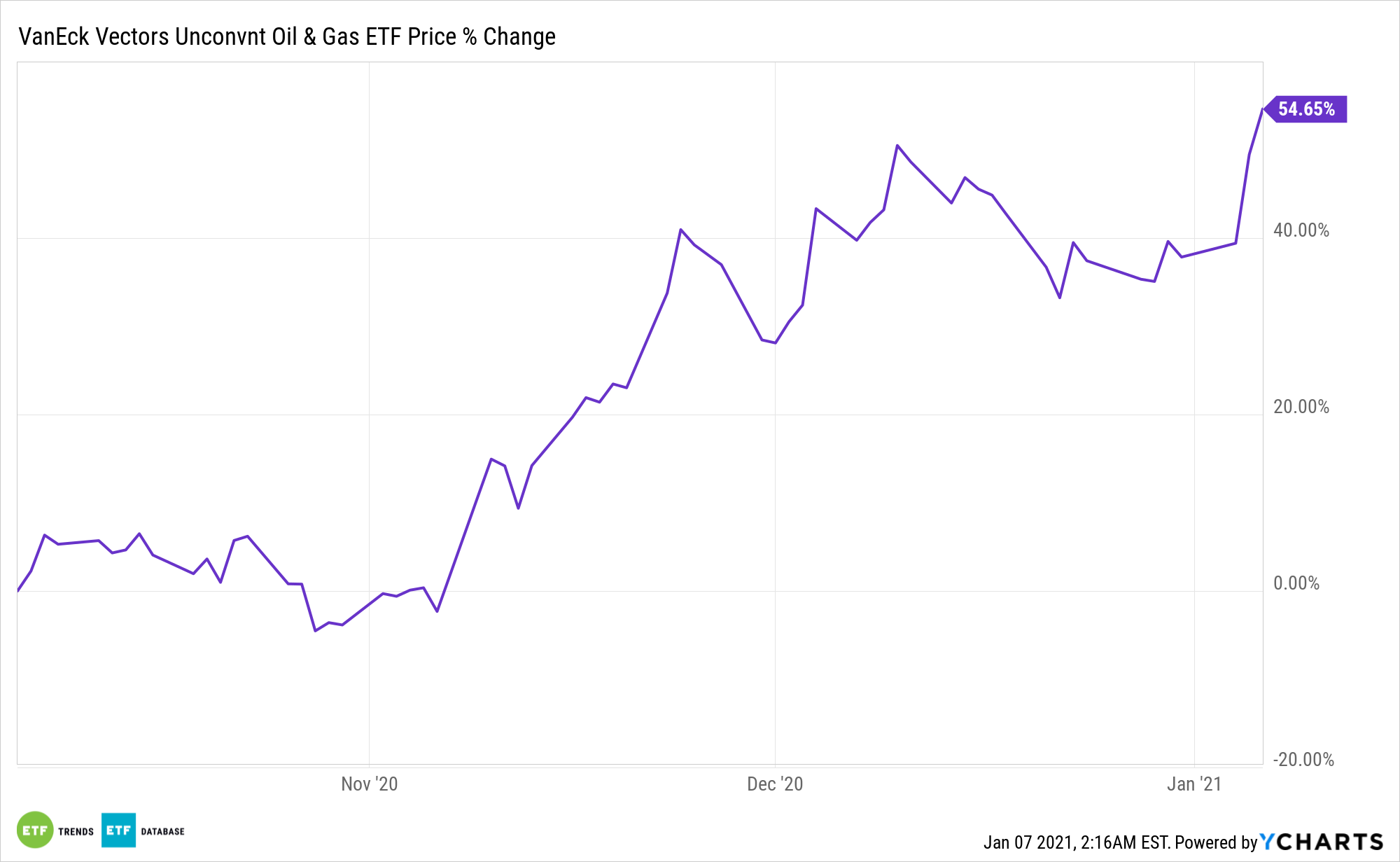

FRAK seeks to duplicate as intently as attainable, earlier than charges and bills, the value and yield efficiency of the MVIS International Unconventional Oil and Fuel Index, which is meant to trace the general efficiency of corporations concerned within the exploration, improvement, extraction, and/or manufacturing of unconventional oil and pure fuel. Up to now Three months, FRAK has gained over 50%.

FRAK knowledge by YCharts

Shock Manufacturing Minimize

As talked about, OPEC will all the time have a say wherein route oil costs will go. Nonetheless, it seems like they’re seeking to additionally put 2020 behind them with a current transfer from one in every of its greatest members.

Per a Markets Insider report, “Saudi Arabia introduced a shock oil manufacturing lower of an additional 1 million barrels per day all through February and March, Bloomberg reported. WTI Crude costs jumped to a 10-month excessive, above $50 per barrel, and oil-related shares like Marathon Oil and Occidental Petroleum jumped as a lot as 14% in Tuesday trades.”

“We do this with the aim of supporting our financial system, the economies of our colleagues in OPEC+ nations, to help the business,” Saudi Vitality Minister Prince Abdulaziz bin Salman instructed reporters on Tuesday, in line with Bloomberg.

For extra information and knowledge, go to the Tactical Allocation Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.