By Robert Ross Buyers may need thought they'd seen all of i

By Robert Ross

Buyers may need thought they’d seen all of it in 2020. However the inventory market motion was merely a preview of what is to come back in 2021.

Simply to take a fast look again, the market gave everybody a scare in 2020 when it bottomed in March. However then the S&P 500 surged 67% between March 23 and year-end.

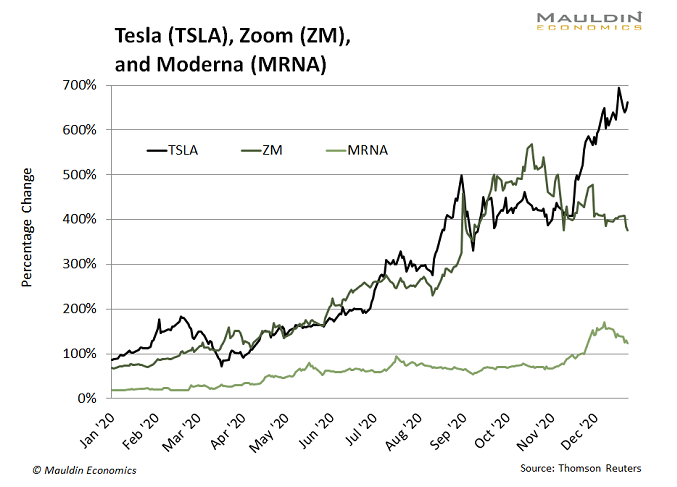

Sure shares like Tesla (TSLA), Zoom (ZM) and Moderna (MRNA) carried out even higher, hovering by triple-digits.

And now, we’re going from one “yr like no different” to a different.

Here is what I count on the brand new yr will convey for traders…

Prediction No. 1: The Bull Will Nonetheless Run in 2021

As 2020 has proven us, issues outdoors your management—like a world pandemic—can render any prediction nugatory.

However I’ve a number of confidence in—and some huge cash driving on—this concept.

Why? Three causes…

- We have now each cause to count on the Federal Reserve will hold cash flowing into shares.

Their simple cash insurance policies assist push folks out of “protected” investments (i.e., cash market funds and bonds) and into riskier property (i.e., shares). With the Fed pledging to maintain rates of interest low till 2023, bulls can stay up for a multiyear enhance.

Here is one thing else traders can stay up for…

- Congressional gridlock is not going wherever.

With political management cut up practically down the center in Washington, D.C., we’re in for a minimum of two years of political gridlock. Gridlock is traditionally nice for shares… particularly Walmart (WMT), Hewlett-Packard (HPE), and IBM (IBM).

As is that this…

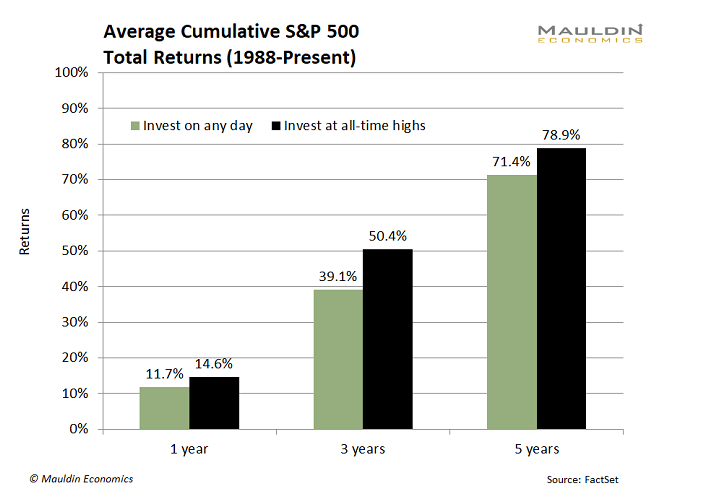

- Markets are at all-time highs… which generally result in extra all-time highs!

Since 1988, the S&P 500 returns have been considerably larger on one-, three-, and five-year time horizons when the index was at all-time highs:

However whereas I count on the bulls to maintain charging, some sectors are wanting even higher than others.

Prediction No. 2: Tech Will Be 2021’s Prime-Performing Sector

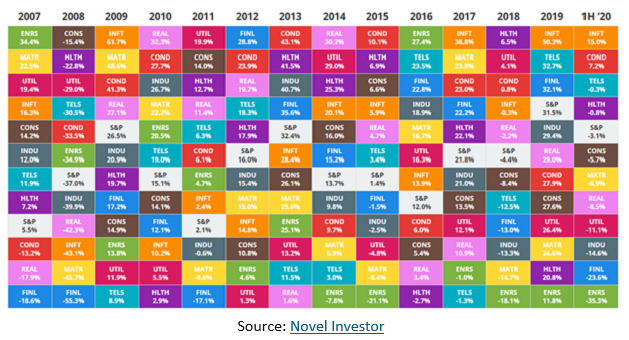

Know-how shares have been on an unbelievable run over the past 5 years. The truth is, it has been the best-performing sector in three of the final 4 years.

Overlook these nattering nabobs of negativity who say the tech run is nearly executed. Get able to see extra outperformance in 2021.

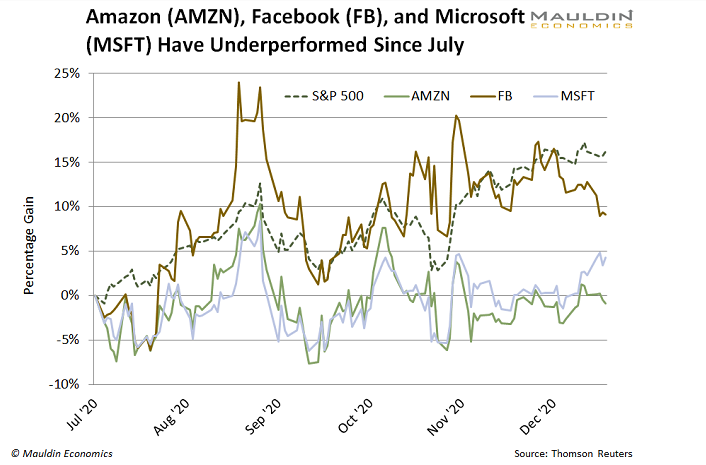

For one, whereas some tech names have had an unbelievable run in 2020, others have struggled… significantly within the second half of the yr.

Family names like Amazon (AMZN), Fb (FB), and Microsoft (MSFT) have nicely underperformed each the S&P 500 and Nasdaq since July. And good traders will see this chance to purchase nice firms at a reduction to their friends.

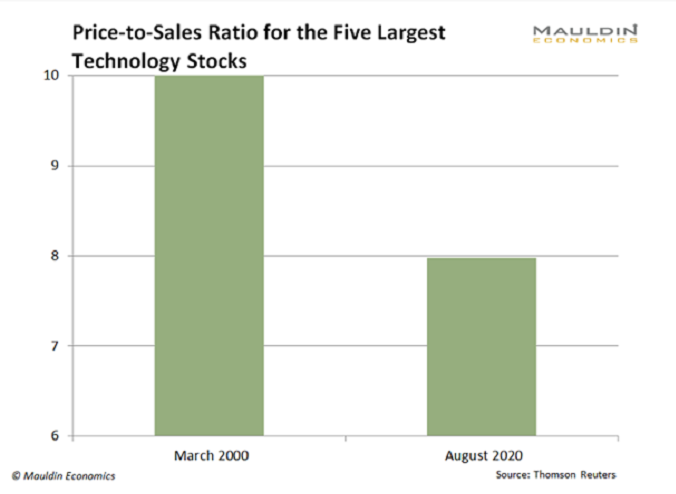

The opposite kicker is expertise shares should not costly.

In comparison with the dot-com bubble (when rates of interest have been 5X larger) the 5 largest US expertise firms are comparatively low-cost:

Know-how firms allowed many people to maintain working from dwelling, and biotechnology firms will assist us return to regular.

Meaning we’ll see one other large yr from the businesses that made—and can proceed to make—this potential.

The worst of the COVID-19 pandemic will quickly be behind us. The coronavirus vaccine will take impact, each bodily and psychologically, and the worldwide economic system will discover its footing once more.

Some firms are already taking that facet of the guess…

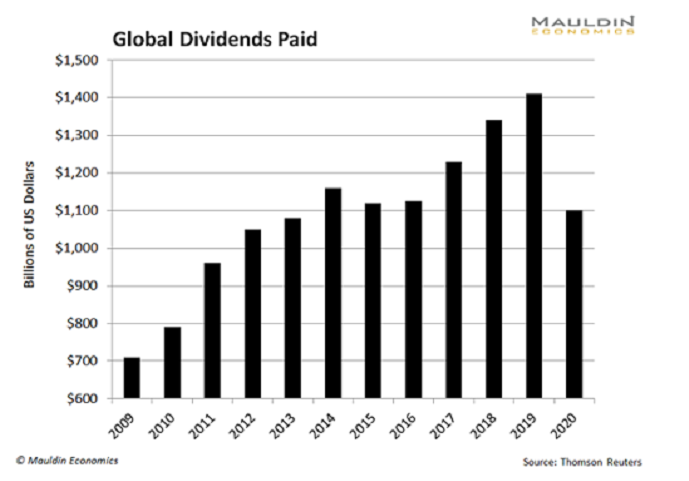

Prediction No. 3: 2021 Will Be the Greatest 12 months in a Decade for Dividend Hikes

2020 was the worst yr in a decade for dividend traders. In whole, international firms minimize their dividends by 22%.

Meaning 27% of all publicly traded firms slashed their dividends this yr.

We stayed on high of those dividend cuts all through the disaster. From cruise ships to casinos, we steered away from firms whose payouts my Dividend Sustainability Index (DSI) recognized as being in peril.

However what goes down… should come up. At the very least relating to dividends.

We have now already seen a couple of dividends return from the lifeless. Kohl’s (KSS), TJX Corporations (TJX), Marathon Oil (MRO), and Darden Eating places (DRI) are among the many first to reopen their purse strings.

Search for extra the place that got here from… even amongst those who maintained and/or raised their payouts in 2020.

Why? We are able to use historical past as our information.

Within the two years after the 2008 monetary disaster, we noticed international dividend payouts enhance 39%.

With the Fed holding the simple cash flowing… techs and biotechs preparing for one more unbelievable yr… and dividend revenue able to be unleashed, there’s by no means been a greater time to be an investor.

The Sin Inventory Anomaly: Acquire Huge, Protected Income with These Three Hated Shares

My brand-new particular report tells you every little thing about cashing in on “sin shares” (playing, tobacco, and alcohol). These shares are a lot safer and do twice in addition to different shares just because most traders attempt to keep away from them. Declare your free copy.

Initially printed by Mauldin Economics

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.