By Robert Ross Pricey Reader,

By Robert Ross

Pricey Reader,

One among my favourite reads to begin off a brand new yr is Byron Wien’s record of 10 surprises, which he is revealed for 36 years.

Whereas I may spend a whole article debating every level in his 2021 record, at the moment I need to deal with the final a part of No. 8:

“The fairness market broadens out. Shares past healthcare and know-how take part within the rise in costs…

“Massive cap tech… shares are laggards for the yr.”

Massive techs lagging the broad markets this yr would certainly be a shock. However I am making the alternative wager—that tech would be the yr’s top-performing sector.

Right this moment I am going to inform you which shares I imagine will lead the sector… and the markets… increased.

Massive Tech Is About to Get a Lot Larger

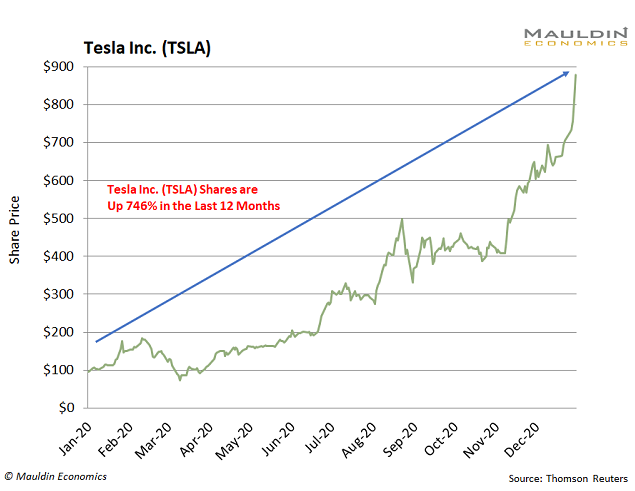

I can hear you now: “However Robert, know-how shares are so costly! Haven’t you seen Tesla (TSLA)?”

Sure, some know-how shares are overvalued. However should you evaluate at the moment’s tech inventory costs to their March 2000 peak, they’re truly moderately priced.

The 5 largest know-how shares are 20% cheaper than they have been in March 2000.

And that’s with the Federal Reserve’s best financial coverage in US historical past.

Fed to Hold Lending the Market a Serving to Hand

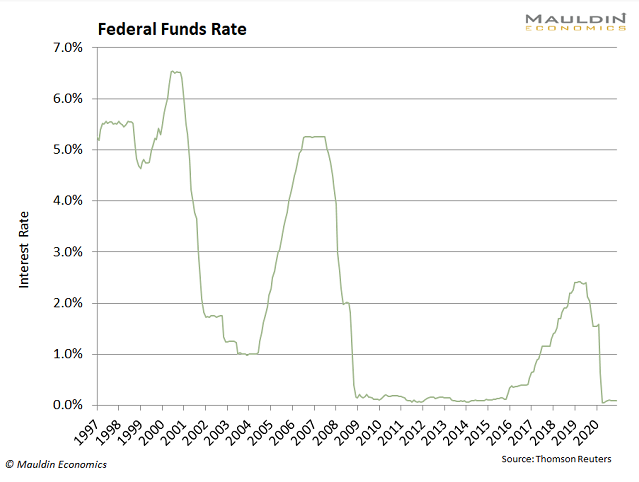

Keep in mind the nice previous days of incomes 5% on a financial institution financial savings account?

The Federal Reserve’s simple cash insurance policies that push folks out of “protected” investments (i.e., cash market funds and bonds) and into riskier belongings (i.e., shares) ended that.

Enjoyable truth: The Fed’s easy-money coverage was not practically this simple again within the Tech Bubble days.

That’s why—although tech inventory valuations are inching nearer to the highs we noticed in March 2000—the traditionally low Fed Funds price means valuations needs to be a lot increased than the Tech Bubble 1.0.

No Bubble Right here: Sensible Cash Expects Techs to Pop Larger

A latest Financial institution of America survey confirmed hedge fund managers have extra publicity to shares than at any interval within the final 18 months.

Analysts see extra upside, too. Probably much more.

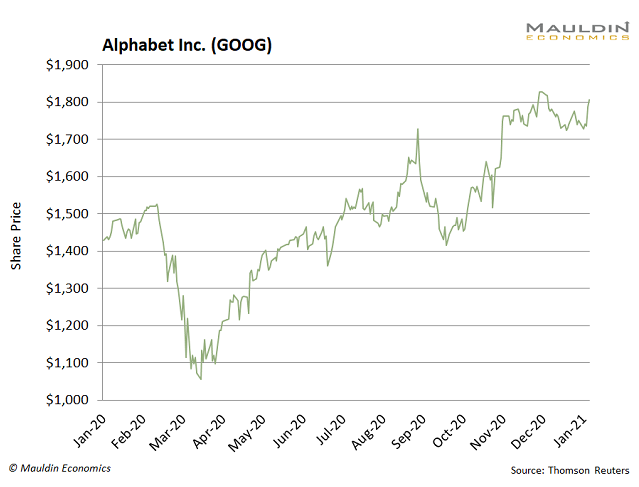

For instance, Goldman Sachs simply raised its worth goal on Alphabet (GOOG) to $2,250:

That is a pop of about 25% from its latest worth of $1,797.

There are many alternatives for dividend-paying tech shares as nicely. One such firm is Oracle (ORCL).

The IT large generates over 80% of its gross sales from cloud-related merchandise. Oracle additionally secured a bid to grow to be the “trusted know-how associate” of TikTok—the wildly widespread social media app that’s been everywhere in the information recently.

Oracle is a trusted title in one other key approach: It pays a strong 1.7% dividend yield. Plus, it earns an ideal 100/100 rating on my proprietary Dividend Sustainability Index (DSI), so you may relaxation assured this dividend is protected.

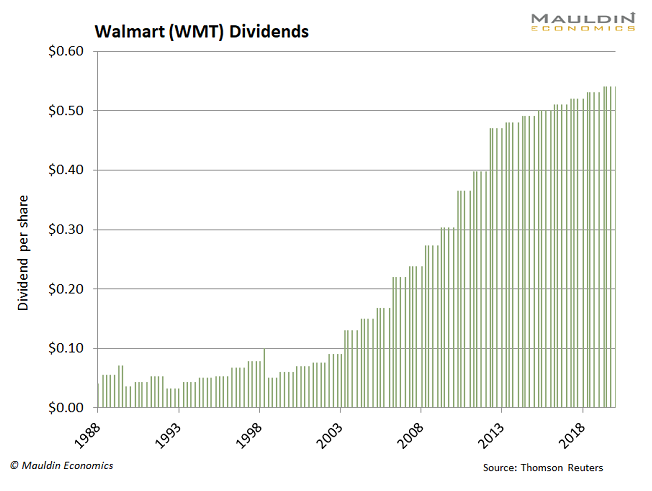

We will say the identical a few shock know-how inventory: Walmart (WMT).

Do not be a type of individuals who don’t take into account Walmart a tech firm. This Bentonville, Ark., retail empire boasts the second-largest e-commerce platform within the US.

Walmart grew its e-commerce gross sales a large 74% over the past yr. This bests even Amazon’s (AMZN) strong 48% progress.

And in relation to dividend payers, Walmart is hard to beat. This Dividend Aristocrat has raised its dividend for 31 years in a row:

The corporate pays a modest 1.7% dividend yield, which my DSI system tells me is protected AND set to develop over the long term.

Backside line: Whereas know-how shares are on an unbelievable run, I believe that is solely only the start.

So, sit up for the continued outperformance of a number of the world’s greatest tech corporations within the coming yr. To see how else I am investing, learn my prime three predictions for 2021 right here.

Robert Ross is a senior fairness analyst at Mauldin Economics. He’s the editor of the earnings investing-focused letter Yield Shark and the free ezine The Weekly Revenue.

Initially revealed by Mauldin Economics

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.