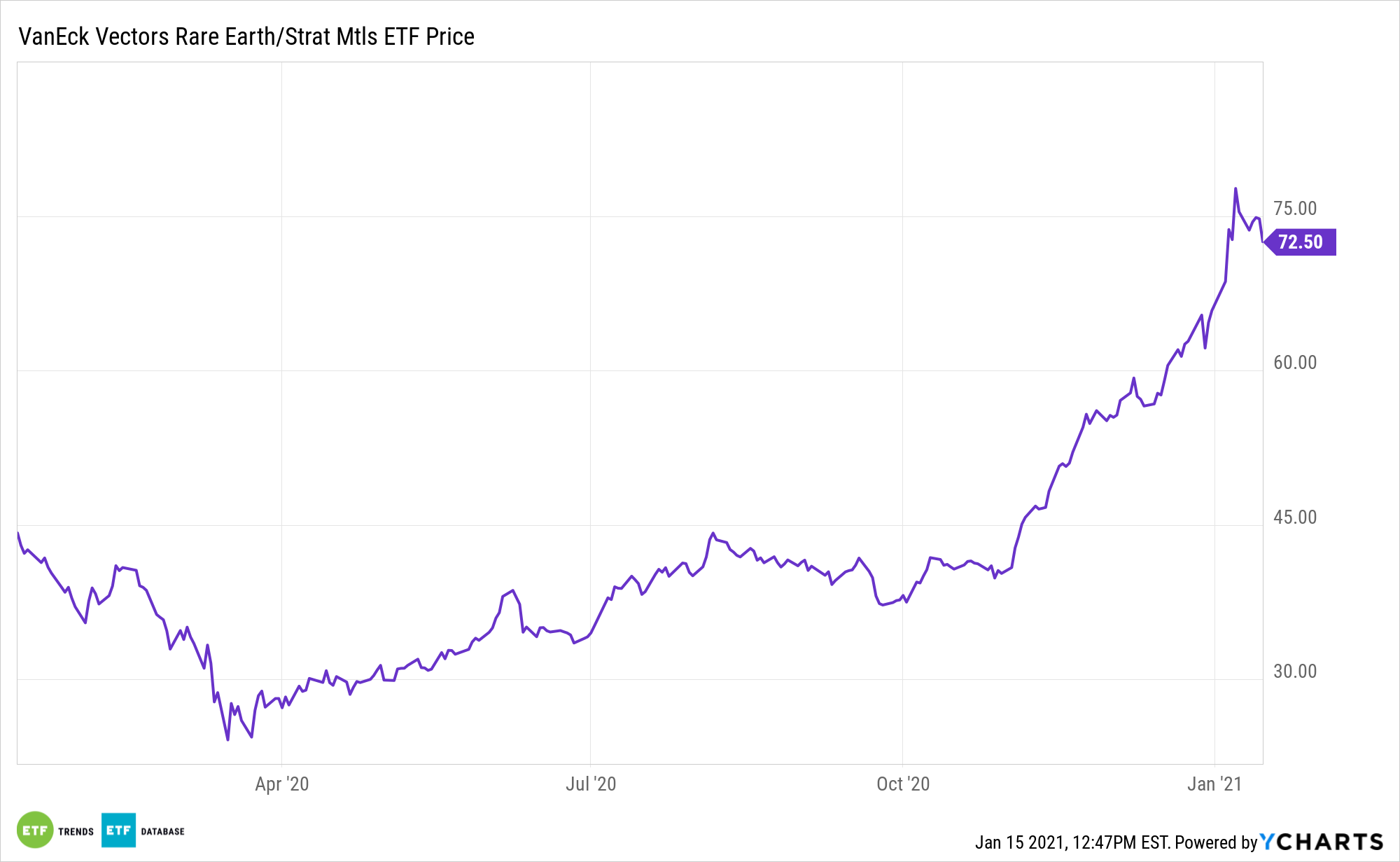

Both ESG investing and power have been prevailing tendencies getting a number of investor curiosity

Both ESG investing and power have been prevailing tendencies getting a number of investor curiosity to start out the brand new yr. ETF issuer VanEck is seeing curiosity in some extra locations forward-thinking traders might wish to contemplate.

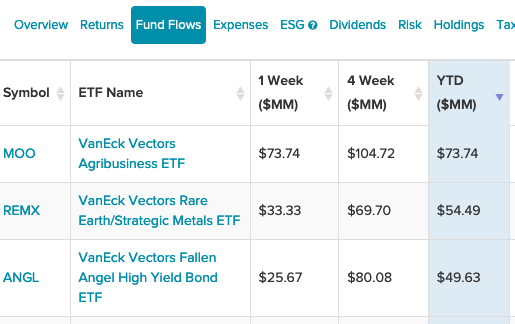

VanEck Vectors® Agribusiness ETF (MOO): seeks to copy as intently as attainable, earlier than charges and bills, the worth and yield efficiency of the MVIS® World Agribusiness Index (MVMOOTR), which is meant to trace the general efficiency of firms concerned in: agri-chemicals, animal well being and fertilizers, seeds and traits, from farm/irrigation gear and farm equipment, aquaculture and fishing, livestock, cultivation and plantations (together with grain, oil palms, sugar cane, tobacco leafs, grapevines, and many others.), and buying and selling of agricultural merchandise. MOO offers traders:

- A Place to Meet Rising Demand: World inhabitants progress is driving rising meals demand and the necessity for environment friendly agricultural options

- A Pure Play with World Scope: Corporations should derive at the very least 50% of whole revenues from agribusiness to be added to the Index

- Complete Publicity: Index targets firms throughout the agribusiness business from seeds and fertilizers to farming gear and meals processors

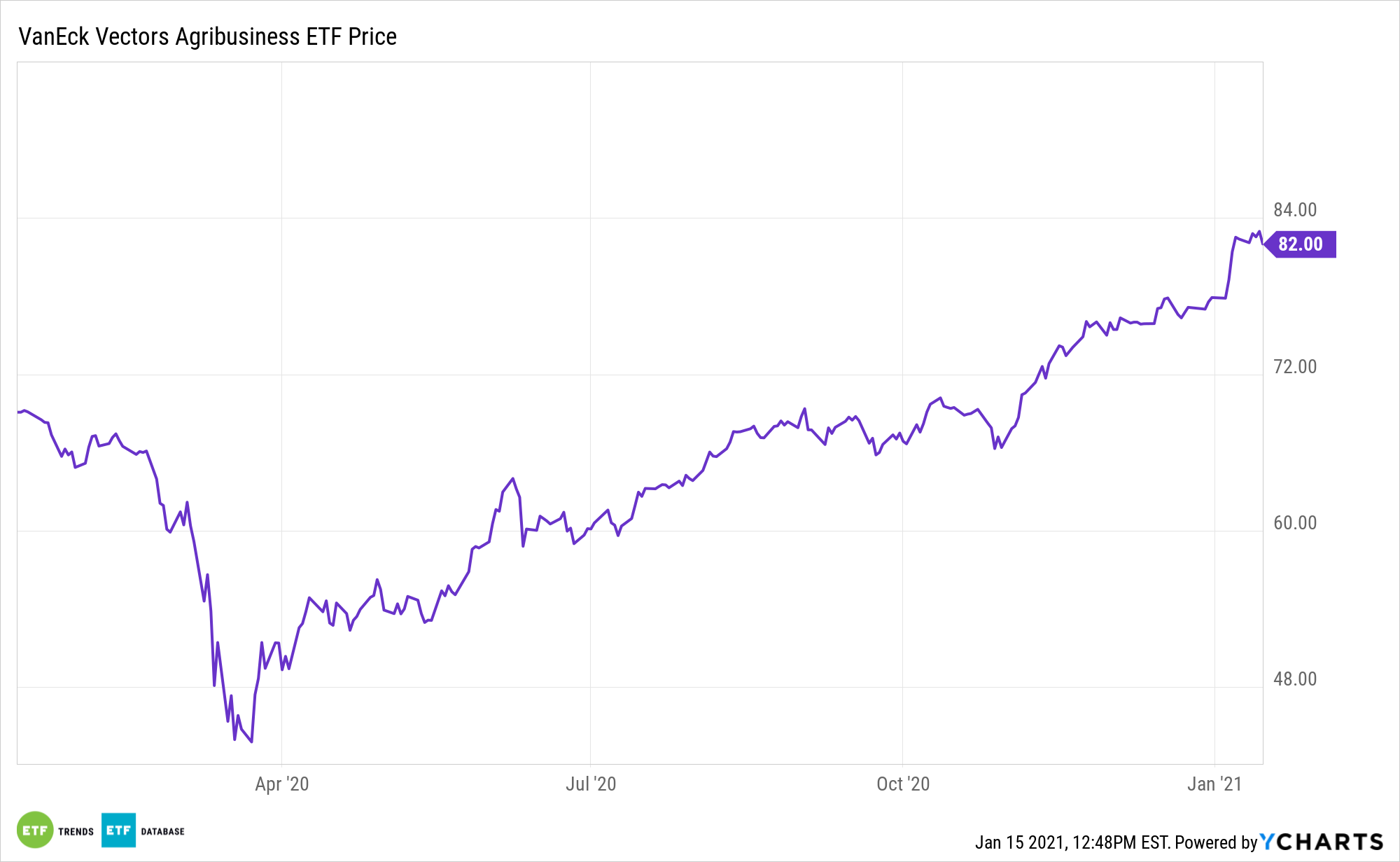

VanEck Vectors Fallen Angel Excessive Yield Bond ETF (BATS: ANGL): ANGL seeks to copy as intently as attainable the worth and yield efficiency of the ICE BofAML US Fallen Angel Excessive Yield Index, which is comprised of under funding grade company bonds denominated in U.S. {dollars} that had been rated funding grade on the time of issuance.

The fund focuses on debt that has fallen out of investment-grade favor and is now repurposed for top yield returns with the downgraded-to-junk standing. ANGL offers traders:

- Greater-High quality Excessive Yield: Fallen angels, excessive yield bonds initially issued as funding grade company bonds, have had traditionally larger common credit score high quality than the broad excessive yield bond universe

- Outperformance within the Broad Excessive Yield Bond Market: Fallen angels have outperformed the broad excessive yield bond market in 12 of the final 16 calendar years

- Greater Danger-Adjusted Returns: Fallen angels have traditionally provided a greater danger/reward commerce off than discovered with the broad excessive yield bond market

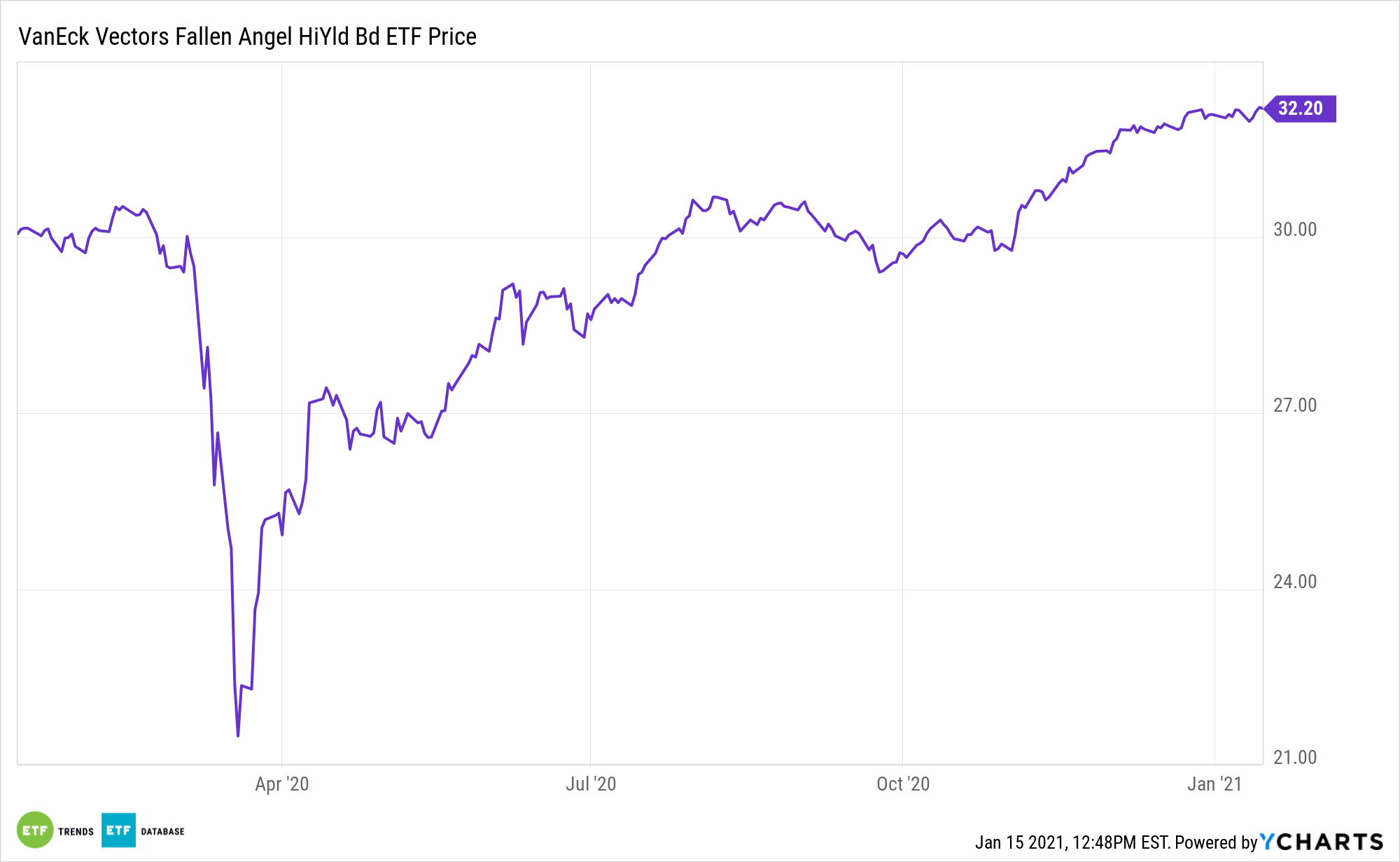

VanEck Vectors Uncommon Earth/Strategic Metals ETF (REMX): seeks to copy as intently as attainable, earlier than charges and bills, the worth and yield efficiency of the MVIS® World Uncommon Earth/Strategic Metals Index. The fund usually invests at the very least 80% of its whole property in securities that comprise the fund’s benchmark index.

The index consists of firms primarily engaged in a wide range of actions which might be associated to the manufacturing, refining, and recycling of uncommon earth and strategic metals and minerals. REMX offers traders:

- One-Commerce Entry to the Uncommon Earth/Strategic Metals Business: A extremely unstable business that provides key inputs to lots of the world’s most superior applied sciences

- Complete World Publicity: Corporations should derive at the very least 50% of whole revenues from the uncommon earth/strategic metals business to be added to the Index and will embody A-shares issued by Shanghai-listed firms buying and selling by way of Shanghai-Hong Kong Inventory Join

- An Business Recognized for Volatility: Quickly altering provide and demand dynamics, authorities protection implications, and heavy China involvement have pushed vital volatility within the business traditionally

For extra information and data, go to the Tactical Allocation Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.