If oil costs have been a curler coaster, 2020 would make even the bravest stomachs a bit queasy. No

If oil costs have been a curler coaster, 2020 would make even the bravest stomachs a bit queasy. Nonetheless, the tide may very well be turning for the commodity and ETFs just like the Direxion Each day S&P Oil & Fuel Exp. & Prod. Bull 2X Shares (GUSH), which has rallied in December.

GUSH seeks each day funding outcomes equal to 200% of the each day efficiency of the S&P Oil & Fuel Exploration & Manufacturing Choose Trade Index. The fund, underneath regular circumstances, invests at the very least 80% of its internet property (plus borrowing for funding functions) in monetary devices and securities of the index, ETFs that monitor the index and different monetary devices that present each day leveraged publicity to the index or ETFs that monitor the index.

The index is designed to measure the efficiency of a sub-industry or group of sub-industries decided based mostly on the World Trade Classification Requirements. Its 3-month trailing returns have been over 60% per Morningstar numbers.

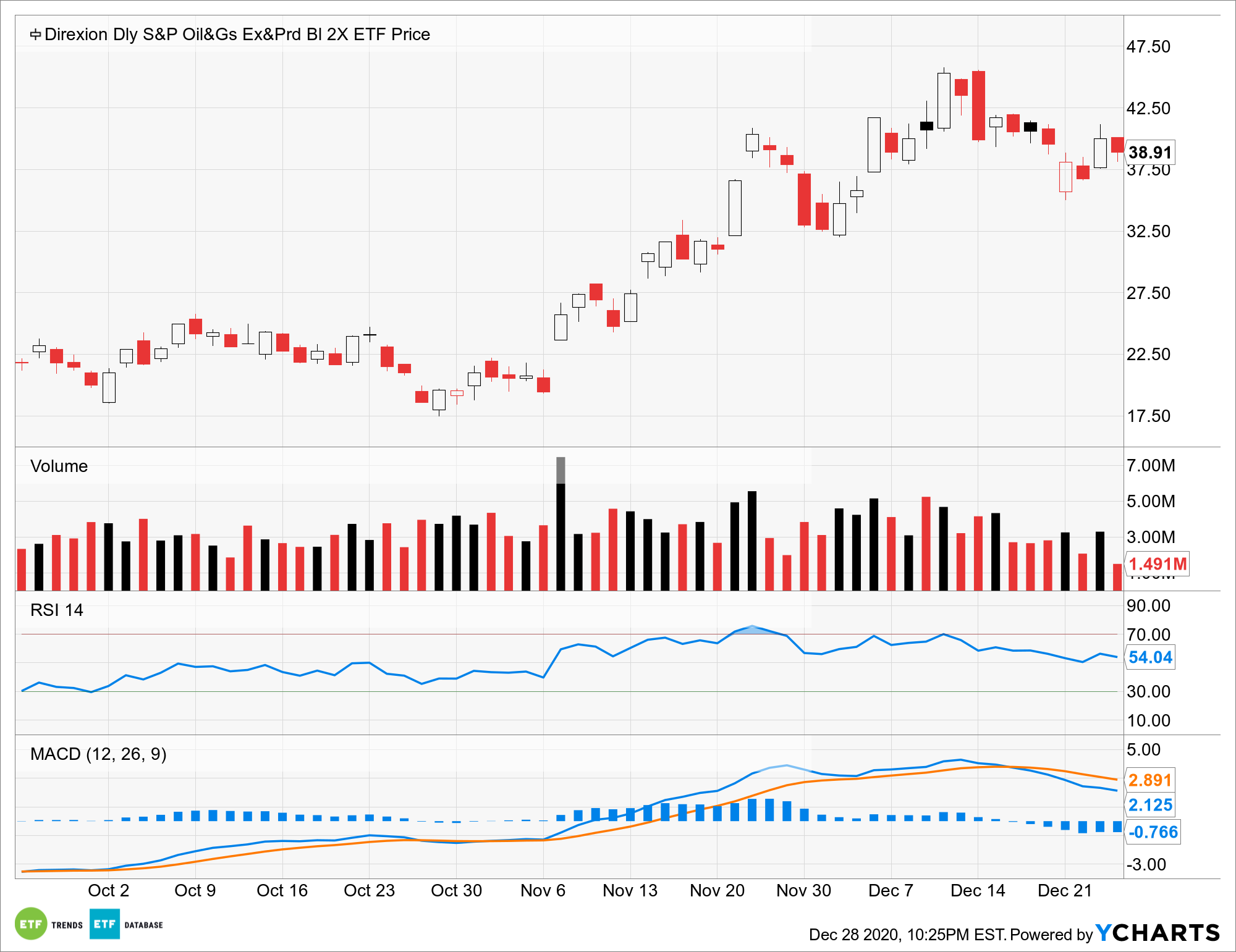

GUSH is buying and selling beneath overbought ranges. A relative energy indicator (RSI) and shifting common convergence divergence (MACD) filter, present the exponential shifting common line dipping beneath the sign line, which might imply GUSH might head decrease. It may very well be a wait and see second for GUSH to see if that December rally nonetheless has legs heading into 2021. If that’s the case, merchants could have a shopping for alternative forward for a New 12 months’s bounce.

A December in a 12 months No person Desires to Keep in mind

2021 has been a December to recollect. Per a Direxion Investments weblog put up, “the Direxion Each day S&P Oil & Fuel Exp. & Prod. Bull 2X Shares (GUSH) has staged a convincing 35% rally because the begin of December, with main constituents like Devon Vitality Company and Diamondback Vitality climbing to six-month highs.”

“The rise may be chalked as much as a equally spectacular and surprising surge in oil costs,” the article assist. “Since November, spot costs for Brent and WTI Crude oil have charted an upward trajectory of roughly 25% that has now put the commodities at ranges they haven’t seen since March.”

For extra information and data, go to the Leveraged & Inverse Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.