The nice information on the success of the primary COVID vaccine trials is a giant step in the dire

The nice information on the success of the primary COVID vaccine trials is a giant step in the direction of getting again to a extra regular setting. Responses from the federal government and personal sector to the current outbreaks lead us to imagine that the virus and its impacts will probably be with us for months to return. Nonetheless, markets are inclined to low cost future outcomes.

For instance, the fairness market tends to backside three to 4 months previous to the tip of a recession as we noticed this previous spring. With that in thoughts, the fairness market rally that started in late March makes excellent sense contemplating the financial restoration that started over the summer time.

We predict that the U.S. fairness market has begun to low cost expectations of the financial system reopening and our lives getting again to a extra regular setting someday subsequent yr. Because of this, we’ve got shifted our tactical allocations primarily based on an optimistic outlook for the subsequent 6-18 months. We’ve centered our tactical fairness allocations on cyclical areas, akin to financials and transportation, balanced with extra defensive sectors, akin to well being care and client staples.

As well as, whereas we don’t anticipate long-term rates of interest to succeed in the degrees that we noticed over the past enterprise cycle, we do anticipate long-term rates of interest to push considerably larger. Because of this, we’ve got positioned our fastened revenue allocations to offer a cushion in opposition to fairness market volatility, generate present revenue, and supply safety in opposition to rising long-term rates of interest.

[wce_code id=192]

We view the blended election outcomes as a constructive total. Traditionally, the U.S. fairness market has carried out fairly properly with a blended authorities. With no sweeping authorities coverage adjustments anticipated, we predict that companies and households can concentrate on the sturdy financial fundamentals that the U.S. enjoys.

For instance, the October Markit U.S. Composite PMI survey reached its highest degree since Could 2018. Encouragingly, expectations for employment, funding, output, and earnings all strengthened within the newest survey. After the U.S. financial system noticed gorgeous a 33.1% GDP development throughout the third quarter, we anticipate the tempo of development to gradual however be persistent by way of the approaching yr.

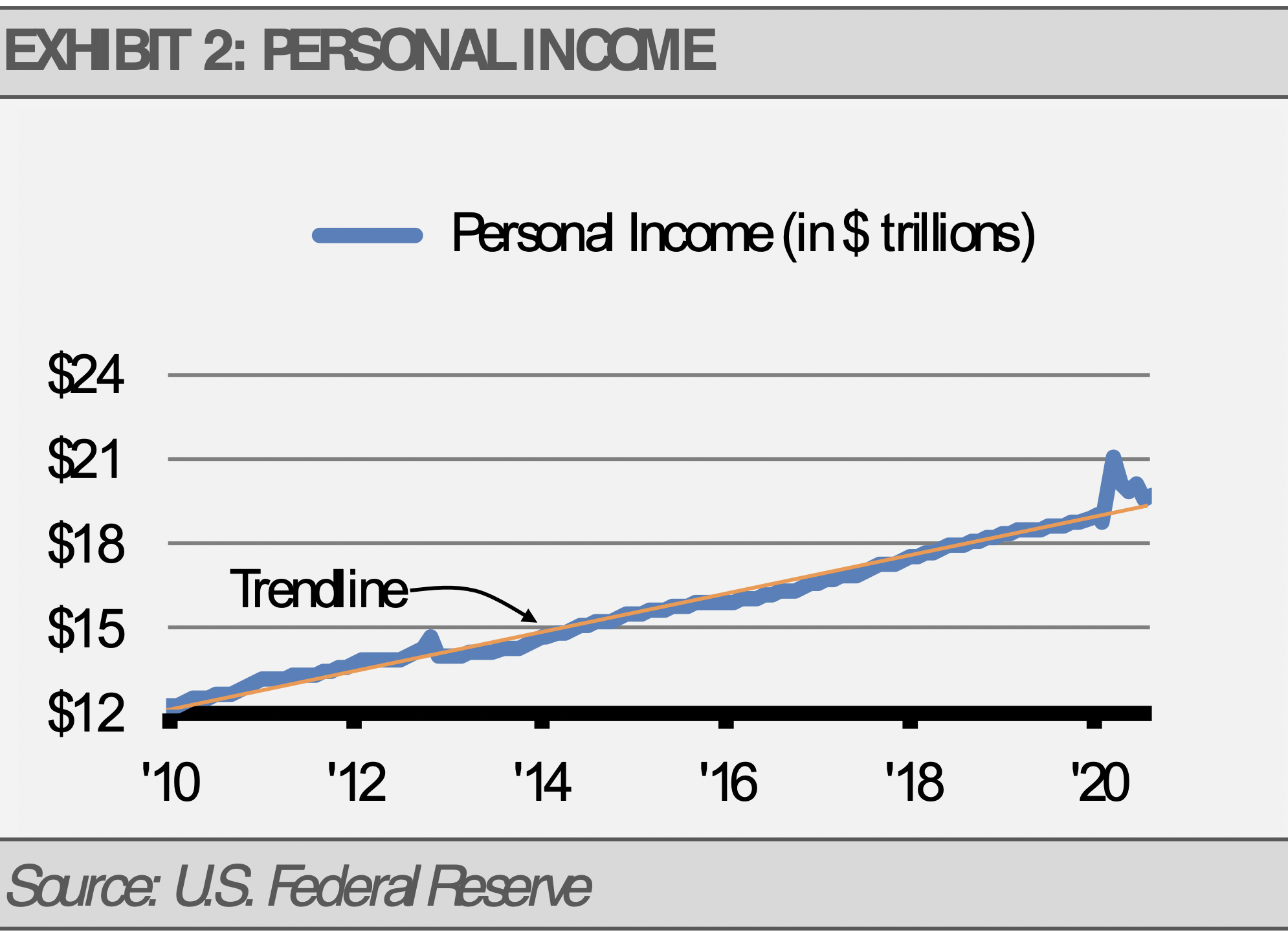

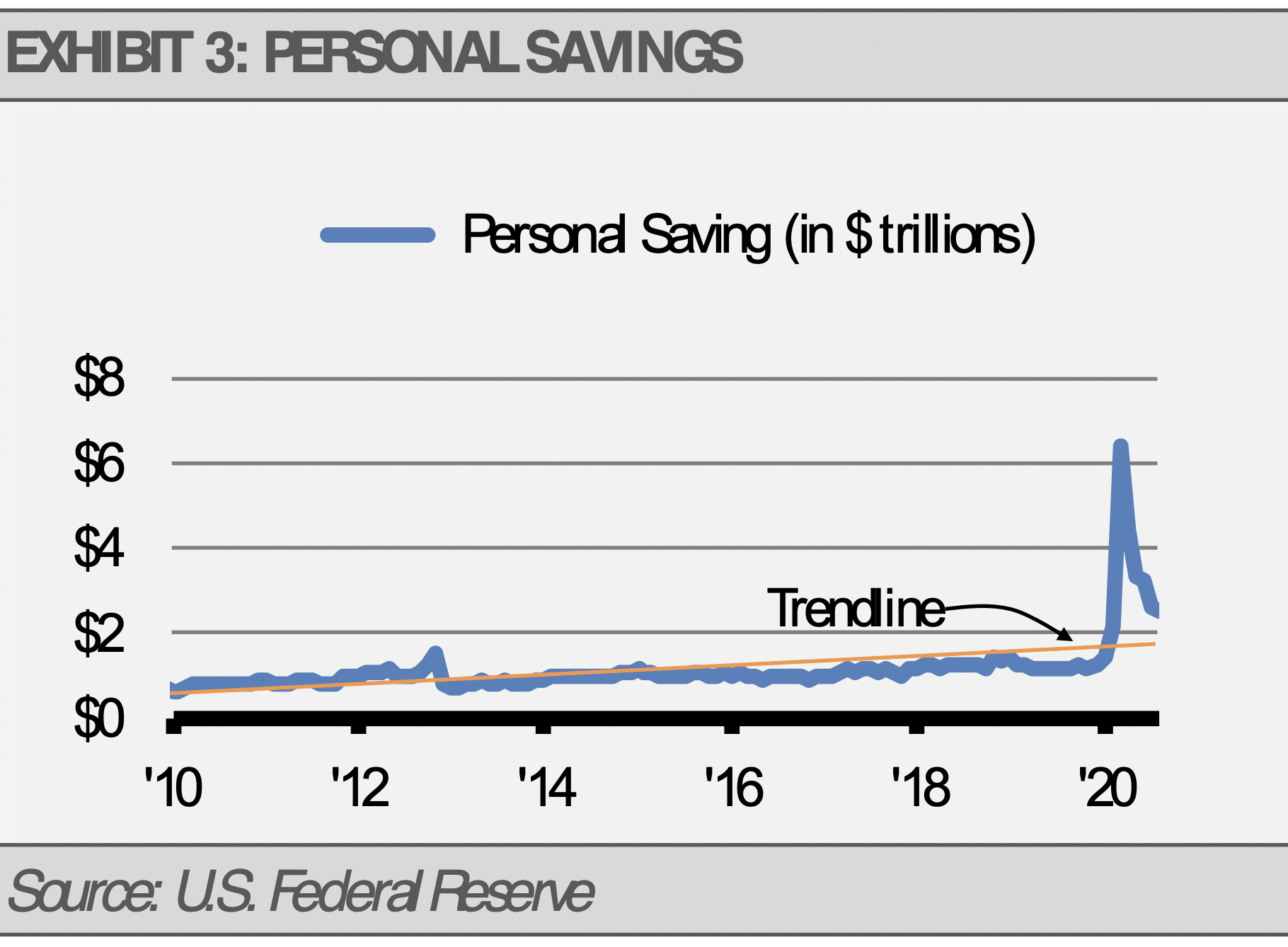

We additionally anticipate to see a stimulus invoice early subsequent yr with a worth of about $1 trillion. Whereas this quantity is lower than some would hope, we predict that it must be greater than satisfactory to help additional financial restoration. Because of the huge fiscal help from the federal authorities and the advance within the labor market with joblessness falling rapidly, private revenue has recovered to its historic trendline whereas private financial savings stays properly above its trendline. These datapoints ought to bode properly for client spending within the months forward.

In the meantime, persevering with jobless claims stay in a declining pattern. This weekly information is timelier than the month-to-month jobless claims report and probably extra helpful on this fast-changing setting. The present degree’s downward pattern in continued claims suggests enchancment within the labor market with capability for nonetheless extra enchancment to return.

In the meantime, persevering with jobless claims stay in a declining pattern. This weekly information is timelier than the month-to-month jobless claims report and probably extra helpful on this fast-changing setting. The present degree’s downward pattern in continued claims suggests enchancment within the labor market with capability for nonetheless extra enchancment to return.

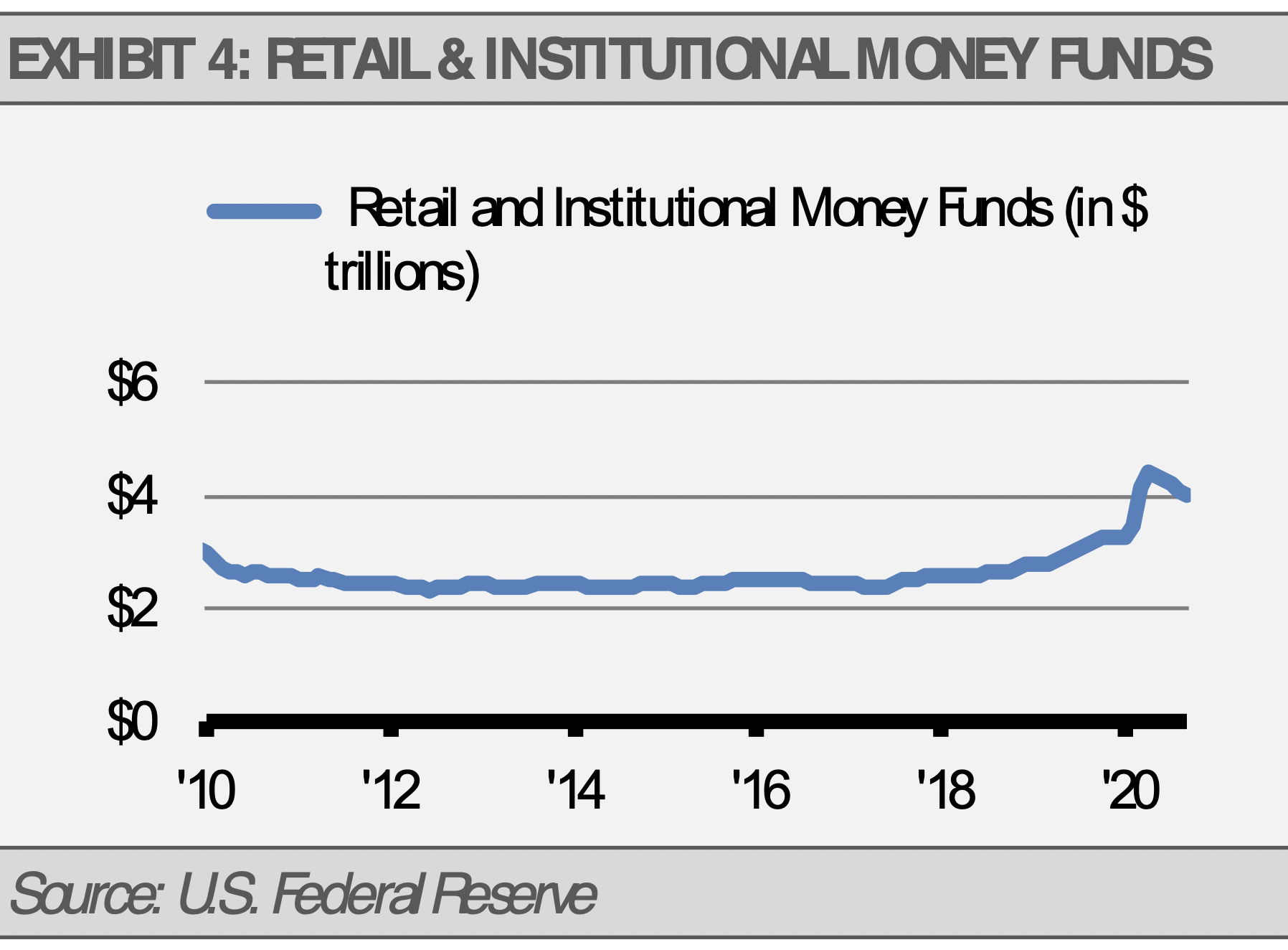

Lastly, with saving charges excessive and a lot liquidity pumped into the system by the U.S. Federal Reserve, each retail and institutional cash market belongings stay close to file highs with nearly $four trillion in mixed belongings. With this enormous amount of money incomes close to 0% curiosity, not less than a few of it might transfer into the fairness markets as buyers search extra return on their capital. A transfer from cash markets into the fairness markets might propel the inventory market but larger.

In abstract, sturdy U.S. fundamentals for personal sector companies and households, plus the potential for added fiscal stimulus and a supportive U.S. Federal Reserve, leads us to anticipate stable financial development throughout the months forward and a robust U.S. inventory market into 2021.

THE CASH INDICATOR

The Money Indicator (CI) stays properly inside its regular vary. After being very useful in illustrating market stresses this previous spring, the CI confirms our elementary work that means the markets are in good condition regardless of the noise we proceed to see within the headlines. Because of this, we might use fairness market declines as a shopping for alternative.

DISCLOSURES

Any forecasts, figures, opinions or funding strategies and methods defined are Stringer Asset Administration, LLC’s as of the date of publication. They’re thought-about to be correct on the time of writing, however no guarantee of accuracy is given and no legal responsibility in respect to error or omission is accepted. They’re topic to alter with out reference or notification. The views contained herein are to not be taken as recommendation or a suggestion to purchase or promote any funding and the fabric shouldn’t be relied upon as containing enough data to help an funding resolution. It must be famous that the worth of investments and the revenue from them might fluctuate in accordance with market situations and taxation agreements and buyers might not get again the total quantity invested.

Previous efficiency and yield is probably not a dependable information to future efficiency. Present efficiency could also be larger or decrease than the efficiency quoted.

The securities recognized and described might not characterize all the securities bought, offered or beneficial for shopper accounts. The reader shouldn’t assume that an funding within the securities recognized was or will probably be worthwhile.

Knowledge is supplied by varied sources and ready by Stringer Asset Administration, LLC and has not been verified or audited by an impartial accountant.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.