By Larry Whistler, CFA, Preside

By Larry Whistler, CFA, President & Co-Chief Funding Officer, Nottingham Advisors

With all due respect to the great people at Merriam-Webster, we at Nottingham really feel that it’s the US Federal Reserve chair’s definition of the phrase transitory that carries probably the most weight as of late. Barely a reference to inflation goes by with out some Fed official utilizing the time period transitory within the subsequent breath. A LOT is using on the Fed’s definition of the adjective, particularly the long run size of this bull market, which has benefitted each bond and inventory traders. Given the rise within the stage of inflation that we’re at present seeing, the Fed of 20 years in the past (led by legendary Chair Alan Greenspan) would absolutely be elevating short-term rates of interest to counteract the pernicious impression of such an increase within the common worth stage.

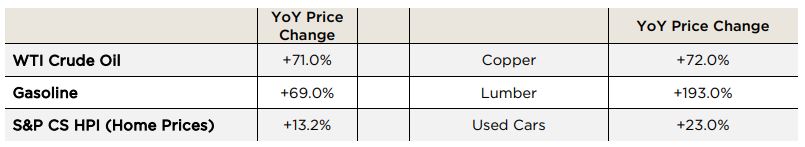

Immediately’s Fed, nevertheless, is sticking by Chair Powell’s notorious utterance of a 12 months in the past that the Fed was “not even fascinated about fascinated about elevating charges.” This, regardless of Might’s CPI studying displaying a 5.0% rise in 12 months over 12 months (YoY) costs (up from April’s +4.2% YoY surge). Even the Fed’s most well-liked measure of inflation, the PCE Core Index, rose +3.1% YoY in April. Anecdotal proof of worth will increase are in every single place, particularly pronounced in current Q2 earnings commentary from S&P 500 CEO’s & CFO’s. The temporary desk under highlights some modifications from early 2020.

[wce_code id=192]

Granted, 12 months over 12 months comparisons do considerably exaggerate the ramp up in costs given widespread financial closures throughout the interval a 12 months in the past; nevertheless, the info are that costs in every single place are surging. A few of the blame could be attributed to provide chain disruptions, exacerbated by intermittent lockdowns because of the pandemic. Many manufacturing corporations are solely simply coming again on-line, making an attempt to handle by a myriad of bottlenecks together with labor shortages. Family items akin to home equipment, leisure items like swimming pools and sizzling tubs, even automobiles, are all in brief provide relative to demand, and waits of 3-6 months for purchasers to obtain their items are usually not unusual.

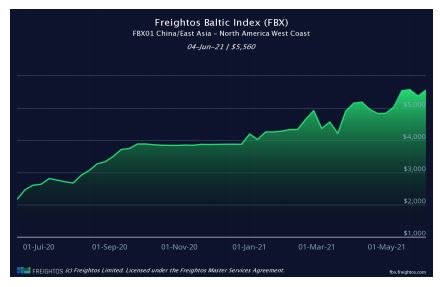

The fee to ship a 40-foot container from China to the US West Coast has surged by +156% over the previous 12 months, not too long ago hitting all-time highs. Many of those container ships return to China almost empty, with container prices averaging $970 per container for the US to Asia leg, or 20% of the Asia to US value! In fact, increased transport prices are often handed alongside to consumers/customers whatever the product being shipped.

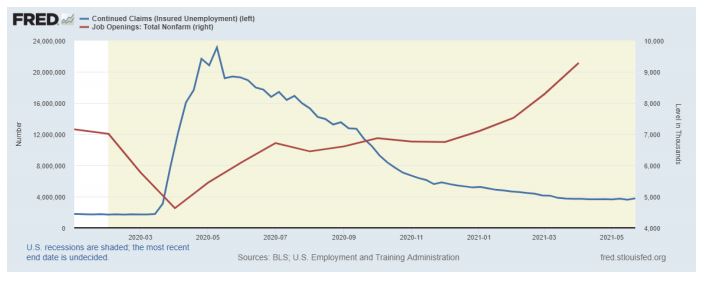

Now we have but to say probably the most impactful and probably probably the most sturdy of worth will increase, wage worth inflation. The large dislocation to labor triggered by the pandemic, adopted by the much more huge Federal response to the disaster, has led to a profound shift within the ongoing labor/administration compensation battle, with labor gaining an higher hand for now (and the wage will increase to show it!). From a pre-pandemic low of three.5%, the U.S. Unemployment Price surged to 14.8% in April of 2020, earlier than regularly trending again right down to Might’s 5.8% studying. Common Hourly Earnings rose +0.5% MoM in Might and proceed to development increased. Fed Chair Powell has said repeatedly that the Fed is concentrated on employment and the return to pre-pandemic ranges, which occurred to have been the bottom previously 50 years.

The chart above clearly illustrates the push/pull dynamic going down between Persevering with Jobless Claims (Blue) and Job Openings (Pink). It’s admittedly a bit difficult to reconcile a 5.8% Unemployment Price with over 9 million Job Openings at present, besides when one considers the prolonged jobless advantages at present being provided by the federal authorities and plenty of states. In accordance with the Unemployment Profit Calculator on Forbes.com, a New York State resident would obtain $653 per week in mixed state and federal advantages for as much as 24 weeks. Primarily based on a 40-hour week, this may be the equal of $16.32 per hour. With the primary $10,000 exempt from federal tax, this profit might be value greater than $20 per hour.

Whereas we at Nottingham subscribe to the College of Non-Judgment, enhanced advantages can provide a believable rationalization for each the excessive Job Openings quantity (would you’re employed for lower than $20 per hour in the event you had been paid extra to remain residence?), in addition to the rising Common Hourly Earnings quantity. Anecdotally, nearly each enterprise owner-client we have now is looking desperately for labor assist, expert or non. Additional to that, I’ve three teenage sons, plying their rising but doubtful skills within the restaurant commerce this summer time (numerous levels of dish-washing, sandwich-making and bar-backing), all incomes almost $15 per hour (for decidedly low-skilled labor! To not fear, they don’t learn my letters, nor, to my chagrin, a lot else).

Larger wages, as soon as locked in, could be considerably sticky. After a lot debate and argument for the next minimal wage, it could look like right here. A pronounced labor scarcity, particularly within the eating and leisure area, has triggered 26 states (largely red-leaning) to decide out of the extra $300 per week federal UI profit program, with some states even providing again to work bonuses of as much as $2,000 to get folks again on payrolls. The Fed estimates unemployment will attain 4.5% by year-end, and it definitely seems as if there may be sufficient demand for labor at present to get us there.

The implications for increased inflation are profound on many ranges, however maybe most relevantly to our shoppers is the impression increased charges might have on asset costs. We don’t assume it’s any secret that this lengthy bull run in shares, bonds, gold, actual property and collectibles (okay, almost each asset we will consider!) has the fingerprints of the Federal Reserve (and to be honest the ECB, Financial institution of Japan, Financial institution of Canada, Financial institution of England….) throughout it. Low rates of interest, be they artificially induced or in any other case, can prop up asset costs far past intrinsic worth and for longer than many anticipate.

And but, regardless of all of the hoopla, and the foregoing survey of rising costs, we have now a Federal Reserve that continues to be satisfied that immediately’s worth climbs are of restricted period and {that a} 12 months or two therefore we must always see a resumption of sub 2% inflation. Definitely, todays 1.46% yield on the 10-year Treasury would recommend the broader market agrees. However, perhaps that 1.46% yield is because of Fed’s $120 BILLION per 30 days of Treasury and mortgage-backed safety purchases.

Regardless, the Fed appears certain sufficient of their place that it continues to increase its stability sheet (Blue/RHS) – now approaching $7.5 TRILLION, whereas coincidentally the US Cash Provide (Pink/LHS) has grown by 50% over the previous 5 years alone. The problem for the investor of immediately is deciding on whom or what to imagine, and what to do about it. Nottingham’s common place is that inflationary pressures are actual, they’re prone to persist for a while, and bond yields, absent central financial institution intervention might be measurably increased. That mentioned, I additionally assume my youngsters spend an excessive amount of time on their cell telephones and numerous good that does me! The purpose is, till the Fed pivots, inflation’s true impression on rates of interest will stay muted. The previous maxim, “Don’t Battle The Fed”, nonetheless has benefit.

In some unspecified time in the future, nevertheless, the Fed will sign, hopefully loudly and clearly, that it has modified its stance, it should start tapering bond market purchases, and it’ll regularly – ever so regularly, return the rate of interest pricing mechanism again to open markets. If they can stick the proverbial touchdown (consider touchdown a 747 on an plane service throughout a hurricane), changes to fairness costs might show tolerable. Asset costs of all stripes will seemingly contract within the quick run, as new info is disseminated into {the marketplace}. Mortgage charges will seemingly rise, crimping affordability, borrowing prices will seemingly enhance, resulting in much less debt and decrease revenue margins, and money flows will get discounted by the next rate of interest, resulting in decrease current values. That’s Finance 101.

As a lot as we love a very good bull market, the additional asset costs disassociate with intrinsic worth, the extra painful the last word correction. Immediately’s low rates of interest have resulted in lots of areas of over-valuation within the US inventory market, and throughout many different threat property. There are nonetheless pockets of worth, nevertheless, and Nottingham is working time beyond regulation to determine and acquire publicity to areas of the market we really feel provide our shoppers an honest likelihood for optimistic returns over the months and years forward. We expect diversification has been underpriced and underappreciated the previous couple years, but we really feel it’s as essential as ever proper now. Now we have another considerations round altering fiscal coverage which will lead to a drag on company earnings within the years forward, however we’ll sort out that in an upcoming letter.

For now, we take heed to the Fed, and take them at their phrase that they are going to be affected person with inflation. It’s lastly warming up right here within the northeast and with more and more optimistic information on the Covid-front, we hope you might be all capable of regain some semblance of normalcy in your lives, take good lengthy mask-less walks and be a part of your neighbors for dinner at your favourite restaurant. It’s time.

Right here’s to a very good summer time.

Nottingham Advisors provides each institutional and particular person shoppers expertise, sophistication, and professionalism when serving to them obtain their objectives. With over 40 years of serving Western New York and shoppers in additional than 30 states, Nottingham tailors every answer to suit the particular wants of every shopper.

For extra details about Nottingham’s choices, go to www.nottinghamadvisors.com or name 716-633-3800.

Nottingham Advisors, LLC (“Nottingham”) is an SEC registered funding adviser situated in Amherst, New York. Registration doesn’t indicate a sure stage of talent or coaching. Nottingham and its representatives are in compliance with the present registration and spot submitting necessities imposed upon SEC registered funding advisers by these states wherein Nottingham maintains shoppers. Nottingham might solely transact enterprise in these states wherein it’s registered, discover filed, or qualifies for an exemption or exclusion from registration or discover submitting necessities. For info pertaining to the registration standing of Nottingham, please contact Nottingham or discuss with the Funding Advisor Public Disclosure Web site (www.adviserinfo.sec.gov). Any subsequent, direct communication by Nottingham with a potential shopper shall be carried out by a consultant that’s both registered or qualifies for an exemption or exclusion from registration within the state the place the potential shopper resides.

This article is proscribed to the dissemination of common info pertaining to Nottingham’s funding advisory companies. As such nothing herein needs to be construed as the supply of personalised funding recommendation. The data contained herein relies upon sure assumptions, theories and rules that don’t utterly or precisely replicate your particular circumstances. Data offered herein is topic to vary with out discover and shouldn’t be thought-about as a solicitation to purchase or promote any safety. Adhering to the assumptions, theories and rules serving the premise for the data contained herein shouldn’t be interpreted to offer a assure of future efficiency or a assure of attaining total monetary targets. As funding returns, inflation, taxes and different financial situations range, your precise outcomes might range considerably. Moreover, this text incorporates sure forward-looking statements that point out future potentialities. Attributable to recognized and unknown dangers, different uncertainties and elements, precise outcomes might differ materially from the expectations portrayed in such forward-looking statements. Readers are cautioned to not place undue reliance on forward-looking statements, which communicate solely as of their dates. As such, there is no such thing as a assure that the views and opinions expressed on this article will come to cross. This article shouldn’t be construed to restrict or in any other case limit Nottingham’s funding selections.

This article incorporates info derived from third celebration sources. Though we imagine these third celebration sources to be dependable, we make no representations as to the accuracy or completeness of any info ready by any unaffiliated third celebration included herein, and take no accountability due to this fact. Some parts of this text embrace the usage of charts or graphs. These are meant as visible aids solely, and on no account ought to any shopper or potential shopper interpret these visible aids as a technique by which funding selections needs to be made. Now we have offered efficiency outcomes of sure market indices for illustrative functions solely as it isn’t attainable to straight spend money on an index. Indices are unmanaged, hypothetical automobiles that function market indicators and don’t account for the deduction of administration charges or transaction prices usually related to investable merchandise, which in any other case have the impact of decreasing the efficiency of an precise funding portfolio. It shouldn’t be assumed that your account efficiency or the volatility of any securities held in your account will correspond on to any benchmark index. An outline of every index is on the market from us upon request.

Investing within the inventory market includes beneficial properties and losses and might not be appropriate for all traders. Previous efficiency isn’t any assure of future outcomes.

For extra details about Nottingham, together with charges and companies, ship for our Disclosure Brochure, Half 2A or Wrap Brochure, Half 2A Appendix 1 of our Type ADV utilizing the contact info herein.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.