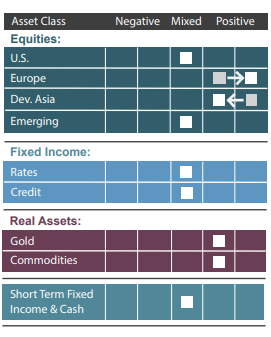

Equities:

▶ U.S. Equities: By our measures the U.S. fairness markets stay considerably overvalued as they proceed to hover round all-time highs which is indicative of decrease anticipated returns on common

over the longer-term. Whereas Fed Chair Powell indicated on the June FOMC assembly that the time

had come to start to contemplate tapering the Fed’s present $120 billion in month-to-month bond purchases

(a possible damaging for the markets), he additionally indicated that it was too early for the Fed to contemplate

elevating short-term rates of interest. Continued simple financial coverage could also be supportive of additional

positive factors in U.S. equities. Nevertheless, weaker than anticipated progress within the second half of the yr as a result of

persevering with provide chain disruptions, labor shortages and the current surge within the coronavirus Delta

variant might collectively show to be a internet drag on the financial rebound. Flattening yield curve

measures and a current widening of our excessive yield credit score unfold measures heightens the danger of an

fairness market correction within the close to time period.

▶ Japan Equities: Based mostly on our present valuation measures Japanese equities stay comparatively

engaging on a longer-term foundation. Nevertheless, a current deterioration in our excessive yield credit score unfold

measure alongside the potential for damaging investor psychology has indicated that Japanese

equities are at the moment considerably much less engaging.

[wce_code id=192]

▶ European Equities: The European fairness markets stay comparatively undervalued, significantly in

comparability to U.S. equities. Furthermore, financial and monetary insurance policies in Europe proceed to be extremely

accommodative serving to to bolster the area’s financial rebound making European equities considerably extra engaging.

▶ China Equities: Chinese language fairness markets have been shaken lately by the Chinese language authorities’s

crackdown on know-how firms and the massive non-public for-profit instructional tutoring sector.

Damaging investor psychology, current flattening of the yield curve, and widening of our excessive yield

credit score unfold measure are negatives for the Chinese language fairness market.

▶ India Equities: Our mannequin analysis continues to point that India fairness markets stay engaging on a projected risk-adjusted return foundation. The steepening yield curve and low rate of interest atmosphere in India are each constructive contributors. India can be making higher progress on vaccinating

their inhabitants though this can be a large job which can take time. As famous beforehand, upcoming

elections ought to encourage continued extremely accommodative financial and monetary insurance policies for an

prolonged interval and depart room for financial enchancment as soon as vaccinations ramp up. Two areas of concern in India are growing inflationary pressures and the potential for widening credit score

spreads which we proceed to watch.

Mounted Revenue:

▶ Bonds: Although the current decline in rates of interest has helped to considerably increase the outlook

for bonds, at present terribly low yields the danger/return trade-off for U.S. Treasury securities

shouldn’t be compelling. As well as, U.S. Treasuries proceed to keep up deeply damaging actual curiosity

charges, which means that yields are effectively under inflation expectations.

▶ Credit score: The outlook for credit score stays blended. Whereas there was some widening in excessive yield and

funding grade credit score spreads lately, traders’ seemingly insatiable seek for yield in in the present day’s

low-rate atmosphere may proceed to be supportive of company bond markets. Nevertheless, any

hassle within the credit score markets may result in a fast widening of credit score spreads which may show to

be a decidedly damaging occasion for company bond holders.

Actual Property:

▶ Gold: The current decline in actual yields (nominal yields much less inflation expectations) has improved

the relative attractiveness of gold. As well as, though present investor consensus is for inflationary pressures to be transitory, ought to inflation show to be extra persistent and as an alternative financial

progress maybe extra transitory, the U.S. economic system may face the prospect of stagflation, which

is characterised by slowing financial progress and rising costs (i.e., inflation). Gold represents an

asset class that might profit from potential stagflation.

▶ Commodities have loved robust year-to-date efficiency, however might face shorter-term headwinds as market members turn out to be extra involved about financial progress prospects significantly in China. As well as, the present consensus amongst traders that the specter of inflation might

have receded considerably has led to some revenue taking in commodities. Nevertheless, Commodities stay engaging within the medium-term as a result of their longstanding relative undervaluation versus equities

in addition to the continued prospect for a powerful international financial restoration within the second half of 2021.

Initially revealed by 3EDGE, August 2021

DISCLOSURES: This commentary and evaluation is meant for data functions solely and is as of August 7, 2021. This commentary doesn’t represent a suggestion to promote or solicitation of a suggestion to purchase any securities. The opinions expressed in View From the EDGE® are these of Mr. Folts and Mr. Biegeleisen and are topic to alter with out discover in response to shifting market situations. This commentary shouldn’t be supposed

to offer private funding recommendation and doesn’t have in mind the distinctive funding targets and monetary scenario of the reader. Buyers ought to solely search funding recommendation from their particular person monetary

adviser. These observations embody data from sources 3EDGE believes to be dependable, however the accuracy of such data can’t be assured. Investments together with frequent shares, mounted revenue, commodities, ETNs and ETFs contain the danger of loss that traders ought to be ready to bear. Funding within the 3EDGE funding methods entails substantial dangers and there might be no assurance that the methods’

funding targets can be achieved. Actual Property (Gold & Commodities) consists of treasured metals resembling gold in addition to investments that function and derive a lot of their income in actual belongings, e.g., MLPs,

metals and mining companies, and so forth. Intermediate-Time period Mounted Revenue consists of mounted revenue funds with a median period of higher than 2 years and fewer than 10 years. Brief-Time period Mounted Revenue and Money consists of

money, money equivalents, cash market funds, and stuck revenue funds with a median period of two years or much less. Previous efficiency shouldn’t be indicative of future outcomes.

Intermediate-Time period Mounted Revenue consists of mounted revenue funds with a median period of higher than 2 years and fewer than 10 years.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.