By US Funds The in

By US Funds

The information cycle has been altering at a speedy clip these previous few months, so that you’re excused for those who missed an vital improvement involving President Donald Trump final week. And no, I’m not speaking about that improvement.

Final Wednesday, the president signed an government order addressing the menace posed by america’ overreliance on “important minerals” from “international adversaries.”

To be extra particular, “important minerals” right here means “uncommon earth metals,” and “international adversaries” means “China.”

I’ve written about uncommon earths earlier than. Though not as uncommon as gold, the group of 17 metals are used within the manufacture of superior applied sciences, together with electrical automobiles, wind generators and missile steerage techniques. Your iPhone accommodates various them. Every F-35 fighter jet has about half a ton of those strategic parts.

The issue is that the U.S. now not produces barite (utilized in fracking), gallium (semiconductors, 5G telecommunications), graphite (smartphone batteries) and various different supplies. “For 31 of the 35 important minerals, america imports greater than half of its annual consumption,” in accordance with the press launch.

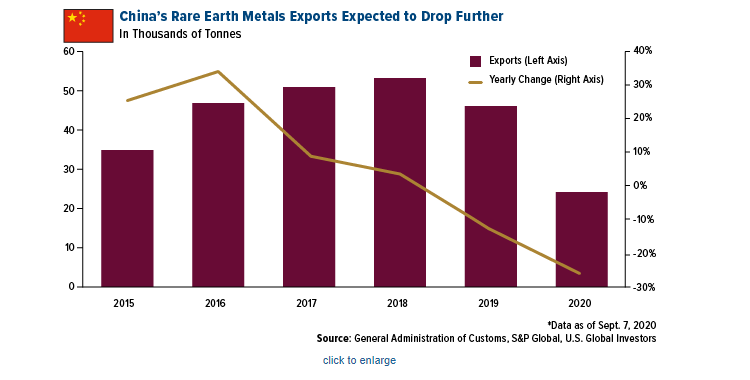

At this time, China controls some 80 % to 95 % of the world market, relying on the mineral. Clearly it is a concern, particularly provided that the nation’s exports of uncommon earths have fallen greater than 25 % year-over-year from January to August as a result of pandemic.

President Trump has rightfully declared this a nationwide emergency and asks that the usdevelop a “commercially viable” mineral provide chain that doesn’t rely on imports from China or elsewhere.

The query is: How will we get there?

Meet MP Supplies, Set to Go Public Later this Yr

The reply could lie with MP Supplies, an as-yet privately funded mining firm headquartered in Las Vegas. Based in 2004, MP Supplies purchased the storied Mountain Cross uncommon earth mission in 2017 for $20.5 million when its former operator, Molycorp, went bankrupt.

In case the identify is new to you, Mountain Cross—situated in San Bernardino County, California—is the one uncommon earth mining and processing plant within the U.S. Up till the 1980s, it was additionally the world’s main provider of obscure but vital metals starting from cerium to lanthanum to europium.

The pandemic however, MP Supplies has had an eventful yr. In July, the Pentagon introduced that it might be funding the corporate in addition to Australia’s Lynas to develop uncommon earth separation amenities in California and Texas that may rival China’s.

That very same month, MP Supplies mentioned it might listing on the New York Inventory Trade (NYSE) later this yr underneath the ticker MP after merging with a blank-check firm, Fortress Worth Acquisition. In a press launch, the corporate acknowledged it was “poised to develop into the Western champion of uncommon earth magnetics, onshoring a important sector that may energy a sustainable future.”

One among MP’s board of administrators, former Chairman of the Joint Chiefs of Workers Common Richard Myers, highlighted the urgency of increasing the corporate’s operations: “As international industries electrify within the coming a long time, the dearth of a sustainable, dependable provide of uncommon earths in North America would symbolize a single level of failure for nationwide and financial safety.”

The merger between MP and Fortress, anticipated to shut this quarter, will lead to an organization with an estimated valuation of $1.5 billion. A New York itemizing is scheduled to occur quickly after, so hold your eyes open.

Uncommon Earth Producers to Profit from Explosion in Electrical Car Demand

I don’t learn about you, however I scent cash. We could have already crossed a tipping level relating to renewable vitality, and the electrical automobile (EV) growth is simply starting. Such applied sciences rely on strategic minerals similar to those MP Supplies produce.

We get publicity to renewable vitality by corporations like Vestas Wind Programs and Canadian Photo voltaic, which manufacture and set up wind and photo voltaic initiatives, and we proceed to love Tesla. However it would develop into more and more extra worthwhile to spend money on their suppliers.

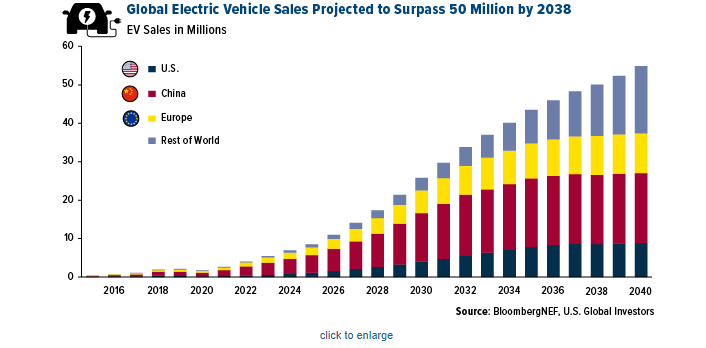

Client demand for renewable vitality and EVs is surging, however the actual drivers are international policymakers, that are legislating the shift away from fossil fuels. Numerous international locations—from the UK to France, from China to India—have outlined complete plans to section out inner combustion engine automobiles within the coming years and a long time.

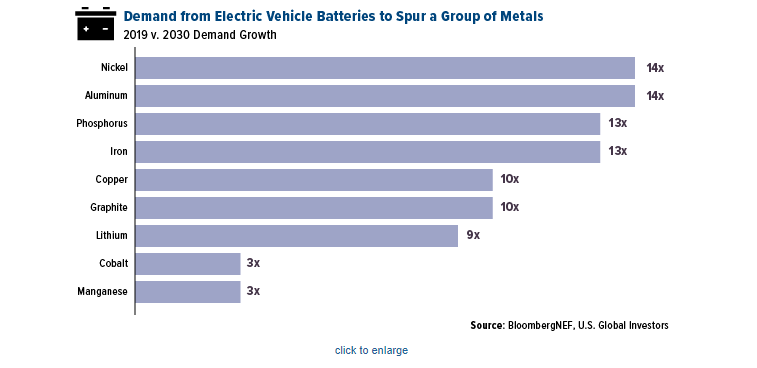

Check out how this shift is projected to have an effect on demand for not simply uncommon earths but in addition plain previous metals with family names. Demand for nickel and aluminum is estimated to develop an unbelievable 14 instances between 2019 and 2030. Phosphorus and iron may multiply 13 instances, copper and graphite 10 instances.

Renewable Vitality and EVs Are Mineral Hogs

Many customers and lawmakers favor renewable vitality and EVs as a result of they’re “clear,” however the fact is that they require way more metals and different supplies than their predecessors.

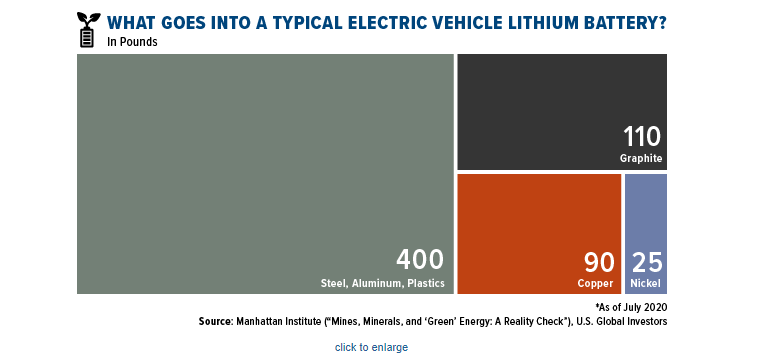

That’s in accordance with estimates made by the Manhattan Institute’s Mark Mills, who writes in a July report that wind generators, photo voltaic panels and EV batteries require greater than 10 instances the amount of uncooked supplies that go into constructing custom fossil fuel-burning crops and automobiles, and but they ship the identical quantity of vitality.

To get much more particular, a typical 1,000-pound lithium EV battery accommodates about 25 kilos of nickel, 90 kilos of copper, 110 kilos of graphite and 400 kilos of metal, aluminum and varied plastics. As a lot as 45,000 tons of ore should be mined in an effort to make simply certainly one of these batteries, Mills says.

A single EV, in the meantime, accommodates extra cobalt than 1,000 smartphones.

Such figures appear to undermine the mission assertion of the “inexperienced agenda,” however so what? As buyers, we should observe the cash.

Working example: Tesla just lately signed a five-year provide settlement with Australia’s Piedmont Lithium, which operates in North Carolina. The EV-maker is now in talks with BHP Group on a nickel deal.

That is pure hypothesis, however a take care of MP Supplies wouldn’t be out of the realm of risk.

To study what else may very well be pushing steel costs larger proper now, watch my two-minute video on the buying supervisor’s index (PMI) by clicking right here!

Initially revealed by US Funds, 10/7/20

All opinions expressed and information supplied are topic to vary with out discover. A few of these opinions might not be acceptable to each investor. By clicking the hyperlink(s) above, you’ll be directed to a third-party web site(s). U.S. International Traders doesn’t endorse all data equipped by this/these web site(s) and isn’t answerable for its/their content material.

The Buying Managers Index (PMI) is a measure of the prevailing route of financial traits in manufacturing. The PMI relies on a month-to-month survey of provide chain managers throughout 19 industries, overlaying each upstream and downstream exercise.

Holdings could change every day. Holdings are reported as of the latest quarter-end. The next securities talked about within the article had been held by a number of accounts managed by U.S. International Traders as of 9/30/2020: Vestas Wind Programs A/S, Canadian Photo voltaic Inc., Tesla Inc., BHP Group Ltd.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.