Amid hypothesis that the yield curve is flattening, small cap shares encountered headwinds final week with the Russell 2000 Index sliding 4.2%.

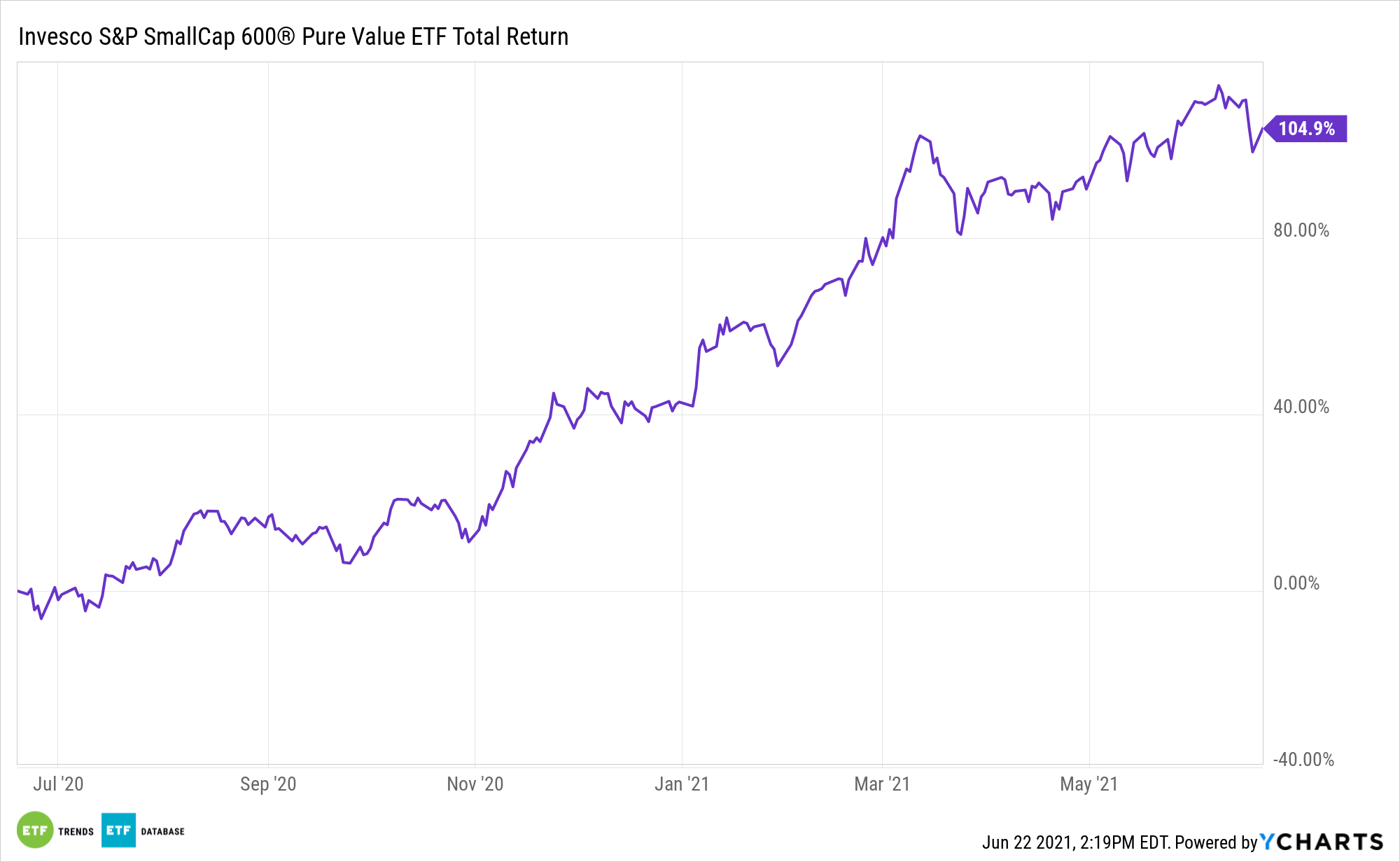

Issues had been worse for the Invesco S&P SmallCap 600 Pure Worth ETF (RZV). The beforehand sizzling alternate traded fund shed nearly 6% as some market members took the flattening yield curve as an indication that financial progress is slowing, which means progress shares might overtake cyclical names as soon as extra.

Whereas loads of market members are anticipating progress shares to return again into focus, buyers should not be hasty in dismissing RZV and its closely cyclical lineup. In reality, some analysts see extra upside forward for cyclical equities.

“The backdrop for Small, Cyclicals, Worth continues to get higher; estimates heading up, valuations enticing, forecast for financial progress a bit rosier,” stated Jefferies small-cap analyst Steven DeSanctis in a current word, stories Maggie Fitzgerald for CNBC.

Substances Are There for Extra RZV Upside

Over the course of the present cyclical worth renaissance, some market observers questioned the veracity of the rally, speculating that the upside was being generated by financially flimsy, low high quality cyclical shares.

These are related considerations, significantly with smaller shares, a few of which can be struggling to succeed in profitability. Nevertheless, issues are trying up for small cap worth names as a result of earnings progress estimates within the house are trending greater and, as CNBC stories, “earnings and gross sales revision ratios hit new all-time highs.”

On this vein, Wall Avenue is anticipating that some small cap cyclicals will knock the quilt off the ball when the second quarter earnings seasons begins in earnest subsequent month. Concerning RZV, expectations of enhancing earnings are cheap as a result of the allocates nearly 38% of its mixed weight to monetary providers and client discretionary shares.

Small cap financials are among the many greatest beneficiaries of the current surge in 10-year Treasury yields, which boosts internet curiosity margins for banks. Likewise, RZV client cyclical holdings are benefiting from the reopening commerce and customers desirous to spend once more.

Lastly, “a few of the shares which were hit have really seen earnings and income estimates transfer greater and now these shares are low-cost,” added DeSanctis.

For extra information, data, and technique, go to the ETF Training Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.