By CIBC, the index supplier on the ALPS Clear Vitality ETF

By CIBC, the index supplier on the ALPS Clear Vitality ETF (ACES)

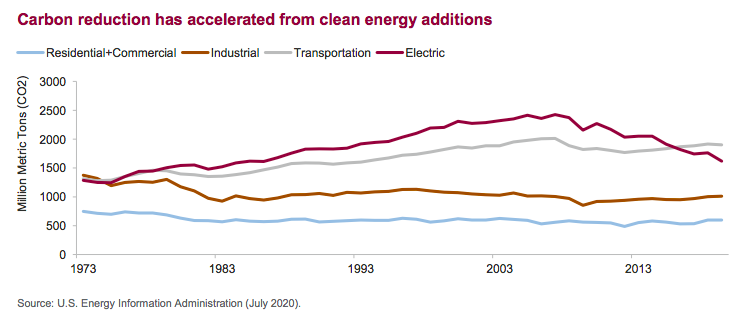

As soon as relegated to the sidelines of buyers’ consideration attributable to broad overreliance on subsidies and an absence of financial edge vs. conventional power, clear power and clear know-how are within the midst of a brand new period of progress and competitiveness. Though wind and photo voltaic capability have been increasing quickly for over a decade, utilities have solely lately wholeheartedly embraced each renewable sources as key technology applied sciences to improve energy plant fleets, which has dramatically accelerated the large-scale shutdown of coal.

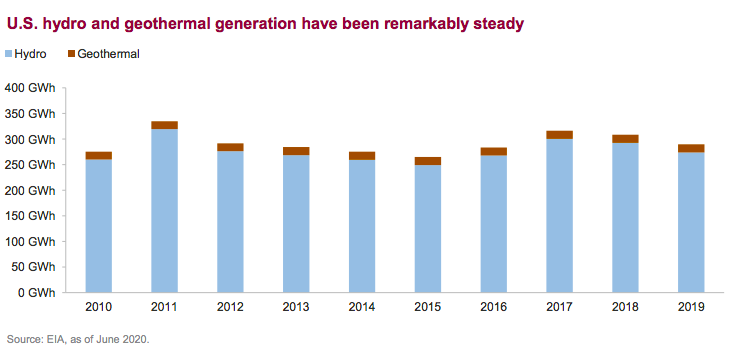

In the meantime, the soundness of hydropower and geothermal energy has been steadily producing baseload power for many years. When combining all renewable sources, 2019 marked the primary yr within the trendy electrical period that renewable power surpassed coal within the U.S. power provide combine. In truth, countrywide annual power consumption from coal has reached its lowest degree since 1964 within the U.S. [1]

“2019 coal use was the bottom since 1964, and clear power surpassed coal within the U.S.”

Along with the continued pattern of renewable power additions, clear know-how will play a key position in attaining larger power effectivity to assist us each preserve power and decrease greenhouse fuel emissions, whereas additionally supporting continued financial progress. Advances in applied sciences are enabling a sensible grid able to integrating extra distributed sources of power whereas on the identical time being extra resilient. Different applied sciences are permitting us extra management over the power we use so as to eat much less or use it in completely new methods.

Nowhere is that this know-how disruption extra evident than within the electrification of transportation. Because the know-how has superior, all varieties of automobiles are being electrified—from passenger vehicles to giant business vehicles—enhancing the outlook for electrical automobiles and gas cell applied sciences. Given the significant discount in emissions from the electrical sector over the previous decade, transportation is now the most important supply of greenhouse fuel emissions within the U.S., accounting for roughly 28% of the entire.[2]

Biofuels and biomass type another choice for different fuels and renewable electrical energy technology. Subsequent-generation biofuels and trendy biomass are serving to to safe our power provide and cut back greenhouse fuel emissions.

Quite a few coverage help initiatives are being proposed around the globe, additional bolstered by stimulus spending broadly, as momentum builds to deal with local weather change. Nonetheless, what is obvious is that governments are accelerating efforts to transition to a clear power future via additional incentives, extra stringent mandates and probably a extra prevalent worth on carbon. As well as, as know-how continues to drive down prices, extra corporations are rushing up their very own transition plans with significant commitments to reducing internet carbon emissions.

Dozens of U.S. utilities and different giant firms have dedicated to net-zero emissions within the coming a long time.[3] All of this culminates in a sexy funding atmosphere for the businesses delivering on the promise of unpolluted power immediately.

“The renewables origination success remained significantly sturdy, with the group including greater than 5,800 megawatts to our backlog over the previous yr as we proceed working in what we consider to be the very best renewables improvement atmosphere in our historical past.” – Jim Robo, CEO, Nextera Vitality, January 24, 2020

Electrical automobiles/storage

Electrical automobiles (EVs) are more and more accepted as viable options to inner combustion engines as battery applied sciences enhance, charging infrastructure is constructed out, and automotive corporations provide an expanded vary of fashions. Bloomberg New Vitality Finance (BNEF) estimates that electrical SUVs and huge vehicles will attain worth parity with conventional inner combustion engines by 2022 attributable to decrease gas effectivity of conventional inner combustion engines, adopted by small and medium-sized automobiles in 2024.[4] In truth, electrical automobiles embody far more than simply passenger automobiles, with substantial potential for different makes use of, together with buses, scooters, and business automobiles, like supply vans, rubbish vehicles and long-haul tractor trailers.

California and different states are already placing mandates in place, such because the Superior Clear Vans (ACT) rule, that broadly search to realize gross sales of solely zero-emission business automobiles by 2045.[5] Most of these insurance policies are sometimes accompanied by a whole bunch of tens of millions of {dollars} in spending for EV charging infrastructure, which ought to assist decrease shopper anxiousness round vary and additional the adoption of electrical automobiles.

“Based mostly on the chart, by 2035, analysts undertaking over 100 million electrical automobiles will probably be bought worldwide, together with over 40 million electrical passenger automobiles.”

Along with powering the shift to EVs, batteries are additionally enabling additional penetration of renewables. As a result of intermittent nature of wind and photo voltaic, continued adoption of renewables would require storage to supply backup energy and keep grid stability. Stationary storage turns into the crucial hyperlink to supply that resiliency. Battery storage has emerged as an answer, given its quickly declining price and improved security and efficiency. Pairing batteries with renewables extends the time that renewable energy can meet demand in addition to smooths out the inherent fluctuations that come from the wind and solar.

Utilities have already begun to put in large-scale batteries on the grid with projections for an enormous enhance in deployments to return. On the finish of 2018, the U.S. had 1.5 gigawatts (GW) of power storage programs put in, which is anticipated to extend over 100 instances to 178 GW by 2040, in response to BNEF.[6]

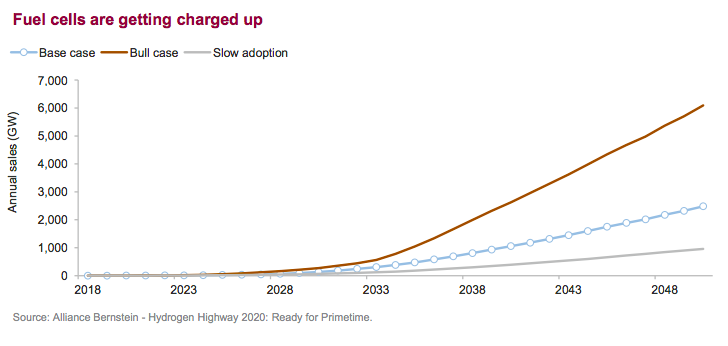

Gasoline cell

Gasoline cells use an electrochemical course of to transform gas and oxygen from the air into electrical energy, water and warmth. Relying on the gas supply, gas cells might play a key position in decarbonizing the world financial system over the approaching a long time. There are a variety of applied sciences being pursued, however most depend on some mixture of supplies to separate molecules into protons and electrons to generate electrical energy. Already, the worldwide market in 2019 reached roughly 70,000 items shipped, equal to 1.2 GW of energy.[7]

Gasoline cells typically use hydrogen as an enter to supply electrical energy however may also use options like renewable pure fuel because it turns into extra extensively out there. Particularly, pairing gas cells with hydrogen produced with renewable power, often known as inexperienced hydrogen, holds actual promise to considerably cut back carbon emissions from a number of the extra energy-intense segments of the financial system. The obvious utility is to decarbonize the heavy transportation {industry}, significantly heavy-duty trucking and transport, which requires journey over lengthy distances between refueling. There are a number of different purposes not nicely suited to battery electrical options which are anticipated to assist drive broad-based hydrogen and gas cell adoption as nicely, together with industrial power, constructing warmth and stationary energy technology.

In line with {industry} analysts, the worldwide gas cell market is poised to develop from 1 GW in 2019 to 133 GW by 2030 and a couple of,500 GW by 2050. Whereas important price declines are essential to drive widespread adoption, this degree of deployments might nonetheless equate to gross sales rising from $300 million in 2019 to $12.5 billion by 2030 and $150 billion by 2050.[7]

One of many essential challenges to scaling hydrogen use in gas cells whereas retaining emissions low is transitioning from fossil gas primarily based manufacturing (gray hydrogen) to fossil fuel-based manufacturing with carbon seize and storage (blue hydrogen), and at last to full renewable-energy electrolysis (inexperienced hydrogen). However the fast growth of wind and photo voltaic, pushed by important price declines, will assist obtain this as nicely. In truth, the price of electrolysis fell 60% from 2010 to 2020 and is anticipated to fall one other 60% by 2030.[8]

“Gasoline cell gross sales might enhance from $300 million in 2019 to $150 billion by 2050.”

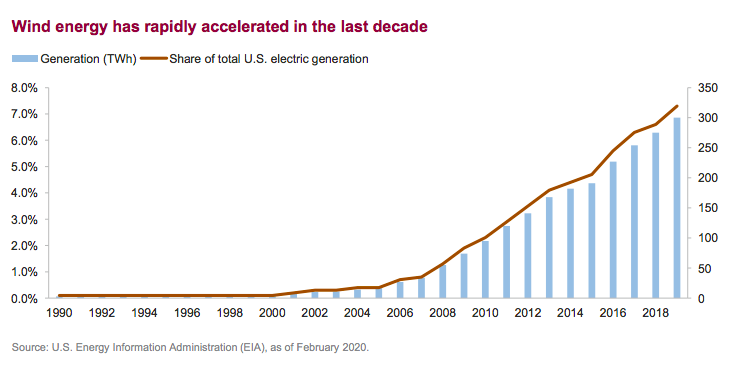

Wind Wind power has been one of many fastest-growing applied sciences within the electrical technology mixture of the U.S., rising from solely 6 billion kilowatt hours in 2000 to 300 billion kilowatt hours in 2019, making up over 7% of U.S. utility scale electrical energy technology and surpassing hydro because the most-used renewable supply within the nation. [9],[10] Complete wind capability was over 105 GW within the U.S. on the finish of 2019, and the wind {industry} supported over 120,000 jobs within the nation (25,000 in Texas alone).[11]

Though the wind {industry} has been supported by tax credit traditionally, authorities help is way much less related immediately. Utilities are more and more supportive of wind power, as evidenced by the substantial enhance in market share of electrical energy technology within the U.S. The biggest wind developer within the nation, NextEra Vitality, initiatives that wind and photo voltaic will probably be costcompetitive with current coal and nuclear energy technology in lower than 5 years with no subsidies.[12]

The economics of wind energy are largely primarily based on turbine measurement and peak, and wind generators have persistently grown in measurement and scale for many years. The key of wind economics lies in the truth that bigger blades generate exponentially extra energy as they seize considerably extra wind. Within the mid-1990s, common wind generators had lower than 1 megawatt capability, had been roughly 50 meters in diameter, and had been roughly 80 meters tall from backside to tip.[13] Trendy wind generators are considerably bigger, and the most important turbine on the earth has already reached 12 megawatt capability, 220 meters in diameter, and 260 meters in peak. Moreover, it’s able to producing energy for 16,000 households with a single turbine.[14] Giant wind installations can attain into the a whole bunch of generators. Whereas the typical turbine put in immediately shouldn’t be this huge, future turbine trajectories proceed to extend in measurement, energy and technology, whereas price is decrease.

“Wind energy generates over 7% of U.S. electrical energy already and is the primary supply of renewable power within the U.S.”

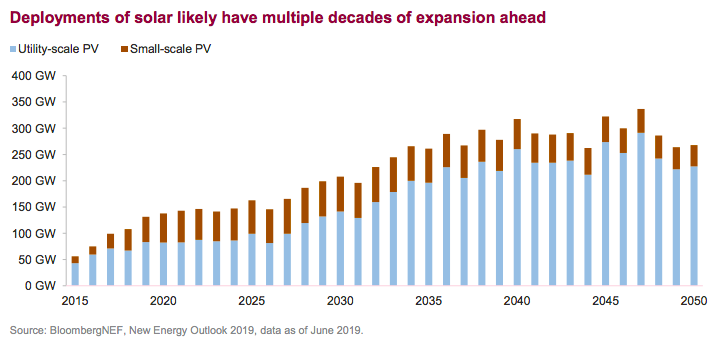

Photo voltaic

Photo voltaic power has expanded quickly within the U.S. and globally during the last decade, accounting for over 35 GW of current utility and small-scale energy manufacturing capability by year-end 2019 within the U.S., in comparison with solely 0.Four GW in 2010.[15] Nonetheless, this compares to roughly 1,100 GW for the entire U.S. power-generating capability, so photo voltaic remains to be a comparatively small portion of the entire and is a equally low proportion of the entire in most superior economies.

Whereas the bulk (95%+) of the electrical energy is produced by photovoltaic (PV) energy cells, photo voltaic thermal technology might help present energy when the solar shouldn’t be shining, although advances in battery know-how are making a mix of PV energy cells and batteries more and more viable. Moreover, small-scale rooftop photo voltaic is more and more vital, since many homes can help photo voltaic panels. It’s this sizing and scalability that makes photo voltaic distinctive amongst renewable applied sciences, as it may apply to something from a calculator battery to an enormous utility-scale photo voltaic set up. Like a lot of the renewable power {industry}, photo voltaic’s success is due largely to huge price reductions: U.S. common PV system prices have dropped greater than 70% during the last decade.[16]

Whereas photo voltaic PV has been used for many years, electrical utilities solely began to embrace photo voltaic as a cost-competitive supply of technology between 2015 and 2020, which considerably accelerated {industry} progress. In line with the Edison Electrical Institute, greater than half of all new electrical energy technology capability added over the previous eight years within the U.S. has been wind and photo voltaic. 15 As of 2019, carbon dioxide emissions from the electrical energy sector are roughly 30% decrease than 2005 ranges, and the {industry} is focusing on an 80% discount by 2050, with some corporations going past this and focusing on a net-zero carbon emissions in that very same time interval.[17] The electrical {industry}’s most evident methodology to realize that is via changing fossil fuel-based technology, significantly coal, with renewable technology sources like wind and photo voltaic, which additionally must be paired with battery storage for provide when renewable assets are low. Whereas the U.S. gives an illustrative instance of the facility of renewables, world deployments yearly are nicely above 100 GW and are projected to almost double over the subsequent decade, with additional progress past, as proven within the chart.

“Common price of photo voltaic has declined 70% since 2010, and world annual installations might double within the subsequent decade.”

Effectivity/LED/good grid

The primary simplest strategy to cut back carbon emissions and different pollution is thru not utilizing the power to start with, which is the objective of power effectivity broadly. The Worldwide Vitality Company (IEA) measures power depth of economies around the globe, and information during the last a number of a long time has proven a transparent decoupling of financial progress from power utilization. Mentioned in another way, gross home product is rising sooner than power consumption over time. For instance, the power depth of economies decreased globally by 35% between 1990 and 2017, with larger declines in nations outdoors of the Group for Financial Co-operation and Improvement.[18] Whereas a lot of this decline is from structural shifts in the direction of know-how in superior economies, clear know-how additionally had a job to play within the type of merchandise particularly designed to scale back power use, like light-emitting diodes (LEDs), superior supplies and good grids.

Whereas LEDs had been thought of too costly for shopper or business use just some years in the past, they’ve largely changed incandescent bulbs within the U.S. and may simply final 10 instances so long as older applied sciences whereas utilizing a fraction of the facility. LEDs have largely shifted to a extra mature know-how, however different power effectivity merchandise are nonetheless being developed and deployed regularly, conserving electrical energy and saving companies cash. For instance, superior composite supplies assist cut back the burden of electrical automobiles to increase their driving ranges, whereas superconductors enhance effectivity {of electrical} transmission to scale back line loss.

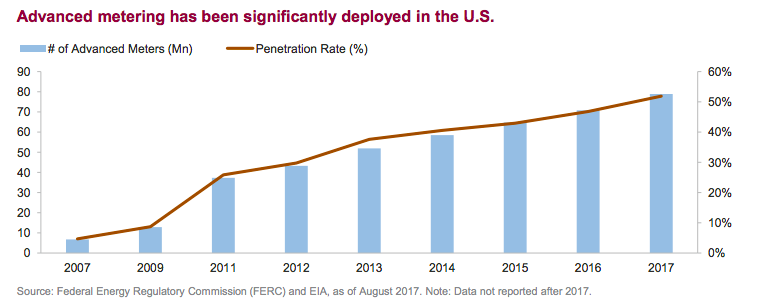

{The electrical} grid has been deployed in some type because the early 1900s, however the trendy electrical grid is more and more depending on superior know-how, multi-way communication and grid resiliency—all of which fall beneath the umbrella of a sensible grid. The standard U.S. electrical grid is a real engineering marvel, made up of a whole bunch of 1000’s of miles of transmission strains, 1000’s of energy crops, over 5 million miles of distribution strains, and innumerable substations, transformers and meters.19 Nonetheless, the grid of the 21st century is more and more targeted on making the grid good. For instance, good meters allow two-way communication, electrical energy synchronization, complicated minute-by-minute shifts to account for good electronics and may also assist combine distributed and intermittent power technology (like rooftop photo voltaic). U.S. customers and companies are extra reliant on {the electrical} grid than ever earlier than, a lot of the good grid will more and more blur the strains between community safety, effectivity, grid resiliency to scale back outages, and higher integration with good electronics. In the end, the good grid will allow the electrification transformation by serving to deliver all of those varied applied sciences collectively extra successfully.

“Within the span of 10 years, the U.S. elevated superior metering penetration from 5% to over 50%.”

Biomass/biofuel Biomass and biofuels are renewable fuels derived from crops or waste feedstocks, used both to supply electrical energy like a conventional energy plant or to interchange petroleum merchandise to be used as liquid fuels. First-generation biofuels, principally ethanol and biodiesel, account for almost all of liquid biofuels produced within the U.S. immediately at roughly a million barrels per day.19 Within the U.S., biofuels have obtained substantial authorities help and have been criticized for competing with meals consumption, rendering them much less common lately from an financial and meals safety standpoint. Nonetheless, next-generation biofuels, like renewable diesel, cellulosic ethanol and algae-derived fuels, maintain extra promise sooner or later. Trendy biomass power manufacturing primarily based on sustainable forestry practices is rising quickly to displace coal and considerably cut back internet carbon emissions. As well as, capturing methane (pure fuel) from renewable sources reminiscent of landfills, water remedy crops, agricultural and forest residue is especially efficient at decreasing greenhouse fuel emissions because it prevents pure launch. Because of this, the event of renewable pure fuel (RNG) presents one other clear pathway to economically supply power from biomass immediately and doesn’t require any adjustments to the nation’s fuel distribution programs. A latest research by the American Gasoline Basis (AGF) estimates there are between 1.5 to three.7 trillion British thermal items of recoverable renewable fuel useful resource within the U.S., sufficient to displace roughly 5% to 13% of present U.S. pure fuel consumption.20

“Renewable pure fuel has potential to displace 5% to 13% of U.S. fuel consumption.”

Hydro/geothermal

Hydroelectric and geothermal crops use pure assets to supply electrical energy from sources which are capable of present baseload energy, both year-round (geothermal) or seasonally (hydro). Not like wind and photo voltaic, each hydro and geothermal are extra restricted of their capacity to develop given their dependence on out there assets, however they’re anticipated to stay an vital part of the renewable power combine, given their extra constant technology profile. The world’s first hydroelectric energy plant was commissioned in 1882, and there are nonetheless a number of hydroelectric dams working immediately that had been constructed earlier than 1930.18 This makes hydroelectric-generating stations the oldest energy crops within the U.S. The huge potential of working water additionally permits for enormous installations that may dwarf fossil gas crops with the correct assets. The Robert-Bourassa hydroelectric-generating station in northern Quebec, Canada has a capability of seven.7 GW—nearly twice as giant as the most important U.S. nuclear plant capability (Palo Verde: 3.93 GW). However even that is a lot smaller than the Three Gorges Dam in China, which has a producing capability of 22.5 GW and is the most important energy plant on the earth. Hydropower is among the steadiest and easiest options to producing renewable power at a comparatively low price, given scale advantages. Much like hydropower, geothermal energy crops have been working for a lot of a long time, though the know-how is much less mature and is barely price aggressive with typical energy in areas the place magma warmth is near the floor of the earth. The biggest geothermal complicated on the earth is situated at The Geysers in California and is a collection of energy crops that are roughly similar to a medium-sized fossil gas plant.21 Utility-scale geothermal often operates on steam manufacturing and can be able to offering baseload energy because the earth’s molten core is a continuing supply of power.

1. https://www.eia.gov/todayinenergy/element.php?id=43895

2. https://www.epa.gov/ghgemissions/sources-greenhouse-gas-emissions

3. http://datadrivenlab.org/featured/press-release-momentum-towards-zero-emissions-accelerates-alongside-climate-week/

4. BNEF electrical automobile outlook 2020, https://www.bnef.com/insights/23133/view

5. https://ww2.arb.ca.gov/our-work/applications/advanced-clean-fleets

6. BloombergNEF: 2019 Lengthy-Time period Vitality Storage Outlook

7. Alliance Bernstein, Hydrogen Freeway 2020: Prepared for Primetime

8. https://hydrogencouncil.com/wp-content/uploads/2020/01/Path-to-Hydrogen-Competitiveness_Full-Research-1.pdf

9. https://www.eia.gov/energyexplained/wind/electricity-generation-from-wind

10. https://www.eia.gov/todayinenergy/element.php?id=42955

11. https://www.awea.org/wind-101/basics-of-wind-energy/wind-facts-at-a-glance

12. http://www.investor.nexteraenergy.com/~/media/Information/N/NEE-IR/news-and-events/events-and-presentations/2020/8-10- 2020/August%202020%20Investor%20Presentation%20vF.pdf

13. https://www.nrel.gov/docs/fy14osti/61063.pdf

14. https://windeurope.org/wp-content/uploads/recordsdata/about-wind/statistics/WindEurope-Annual-Statistics-2019.pdf

15. Estimated Web Summer time Photo voltaic Photovoltaic Capability From Utility and Small Scale Amenities (Megawatts) – https://www.eia.gov/electrical energy/month-to-month/epm_table_grapher.php?t=table_6_01_a 16. https://www.seia.org/solar-industry-research-data#:~:textual content=Progress%20in%20Photo voltaic%20is%20Led,historical past%20throughout%20all%20market%20segments.

17. https://www.eei.org/issuesandpolicy/Paperwork/Leading_on_Clean_Energy_Handout.pdf

18. https://www.iea.org/experiences/energy-efficiency-indicators-2020#data-service

19. https://www.eia.gov/totalenergy/information/month-to-month/

20. AGF, Renewable Sources of Pure Gasoline, Dec 2019.

21. https://www.eia.gov/todayinenergy/element.php?id=30312#tab1

22. https://www.calpine.com/operations/power-operations/applied sciences/geothermal

CIBC Personal Wealth Administration contains CIBC Nationwide Belief Firm (a limited-purpose nationwide belief firm), CIBC Delaware Belief Firm (a Delaware limited-purpose belief firm), CIBC Personal Wealth Advisors, Inc. (a registered funding adviser)—all of that are wholly owned subsidiaries of CIBC Personal Wealth Group, LLC—and the personal wealth division of CIBC Financial institution USA. All of those entities are wholly owned subsidiaries of Canadian Imperial Financial institution of Commerce.

This doc is meant for informational functions solely, and the fabric offered shouldn’t be construed as a proposal or suggestion to purchase or promote any safety. Ideas expressed are present as of the date of this doc solely and will change with out discover. Such ideas are the opinions of our funding professionals, a lot of whom are Chartered Monetary Analyst® (CFA®) charterholders or CERTIFIED FINANCIAL PLANNER™ professionals. Licensed Monetary Planner Board of Requirements Inc. owns the certification marks CFP® and CERTIFIED FINANCIAL PLANNER™ within the U.S.

There isn’t a assure that these views will come to move. Previous efficiency doesn’t assure future comparable outcomes. The tax data contained herein is normal and for informational functions solely. CIBC Personal Wealth Administration doesn’t present authorized or tax recommendation, and the data contained herein ought to solely be utilized in session along with your authorized, accounting and tax advisers. To the extent that data contained herein is derived from third-party sources, though we consider the sources to be dependable, we can not assure their accuracy. The CIBC emblem is a registered trademark of CIBC, used beneath license. Accredited 686-20. Funding Merchandise Provided are Not FDIC-Insured, Could Lose Worth and are Not Financial institution Assured.

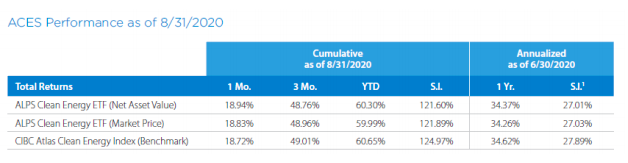

Efficiency information quoted represents previous efficiency, which isn’t a assure of future outcomes. Present efficiency could also be decrease or larger than the efficiency quoted. You possibly can get hold of efficiency information present to the latest month finish by calling (866)759-5679 or go to www.aplsfunds.com. The funding return and principal worth and funding return of an funding will fluctuate in order that your shares, when redeemed, could also be value roughly than their unique price. Gross Expense Ratio: 0.65%

1. Fund inception date of 6/28/2018

2. Market Worth is predicated on the midpoint of the bid/ask unfold at Four p.m. ET and doesn’t signify the returns an investor would obtain if shares had been traded at different instances.

An investor ought to contemplate the funding goals, dangers, prices and bills rigorously earlier than investing. To acquire a prospectus which include this and different data name 866.759.5679 or go to www.alpsfunds.com. Learn the prospectus rigorously earlier than investing.

ALPS Clear Vitality ETF shares are usually not individually redeemable. Traders purchase and promote shares of the ALPS Clear Vitality ETF on a secondary market. Solely market makers or “approved individuals” could commerce instantly with the fund, sometimes in blocks of 50,000 shares.

There are dangers concerned with investing in ETFs together with the lack of cash. Extra data relating to the dangers of this funding is on the market within the prospectus.

An funding within the Fund is topic to funding danger together with the doable lack of the whole principal quantity that you just make investments.

Clear Vitality Sector Threat. Obsolescence of current know-how, quick product cycles, falling costs and earnings, competitors from new market entrants and normal financial circumstances can considerably have an effect on corporations within the clear power sector. As well as, intense competitors and laws leading to extra strict authorities rules and enforcement insurance policies and particular expenditures for cleanup efforts can considerably have an effect on this sector. Dangers related to hazardous supplies, fluctuations in power costs and provide and demand of other power fuels, power conservation, the success of exploration initiatives and tax and different authorities rules can considerably have an effect on corporations within the clear power sector. Additionally, provide and demand for particular services or products, the provision and demand for oil and fuel, the value of oil and fuel, manufacturing spending, authorities regulation, world occasions and financial circumstances could have an effect on this sector. At present, sure valuation strategies used to worth corporations concerned within the clear power sector, significantly these corporations that haven’t but traded publicly, haven’t been in widespread use for a big time period. Because of this, using these valuation strategies could serve to extend additional the volatility of sure clear power firm share costs.

Focus Threat. The fund seeks to trace the underlying index, which itself could have focus in sure areas, economies, nations, markets, industries or sectors. Underperformance or elevated danger in such concentrated areas could lead to underperformance or elevated danger within the fund.

Canadian Funding Threat. The fund could also be topic to dangers referring to its funding in Canadian securities. The Canadian financial system could also be considerably affected by the U.S. financial system, provided that the USA is Canada’s largest buying and selling accomplice and international investor. Any unfavorable adjustments in commodity markets might have an ideal impression on the Canadian financial system. As a result of the fund will put money into securities denominated in foreign currency and the revenue obtained by the fund will usually be in international forex, adjustments in forex change charges could negatively impression the fund’s return.

Micro-Capitalization Firm Threat. Micro-cap shares contain considerably larger dangers of loss and worth fluctuations as a result of their earnings and revenues are usually much less predictable (and a few corporations could also be experiencing important losses), and their share costs are usually extra risky. The shares of micro-cap corporations are inclined to commerce much less regularly than these of bigger, extra established corporations, which may adversely have an effect on the pricing of those securities and the long run capacity to promote these securities.

Small- and Mid-Capitalization Firm Threat. Smaller and mid-size corporations typically have narrower markets, much less liquidity, extra restricted managerial and monetary assets and a much less diversified product providing than bigger, extra established corporations. Because of this, their efficiency will be extra risky, which can enhance the volatility of the Fund’s portfolio.

Giant Capitalization Firm Threat. The big capitalization corporations through which the Fund invests could underperform different segments of the fairness market or the fairness market as a complete.

NACEX Index – The CIBC Atlas Clear Vitality Index is an adjusted market cap weighted index designed to supply publicity to a various set of U.S. or Canadian primarily based corporations concerned within the clear power sector together with renewables and clear know-how.

One can not make investments instantly in an index.

There isn’t a assurance that the market developments and sector progress mentioned on this Perception will come to move.

The Fund’s investments in non-U.S. issuers could contain distinctive dangers in comparison with investing in securities of U.S. issuers, together with, amongst others, much less liquidity usually, larger market volatility than U.S. securities and fewer full monetary data than for U.S. issuers. As well as, opposed political, financial or social developments might undermine the worth of the Fund’s investments or stop the Fund from realizing the complete worth of its investments. Lastly, the worth of the forex of the nation through which the Fund has invested might decline relative to the worth of the U.S. greenback, which can have an effect on the worth of the funding to U.S. buyers.

One can not make investments instantly in an index.

ALPS Portfolio Options Distributor, Inc. is the distributor for the ALPS Clear Vitality ETF. CLN000247 9/27/2021

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.