Charts, charts, charts. Let’s

Charts, charts, charts. Let’s briefly look at what is occurring within the markets by way of using just a few charts.

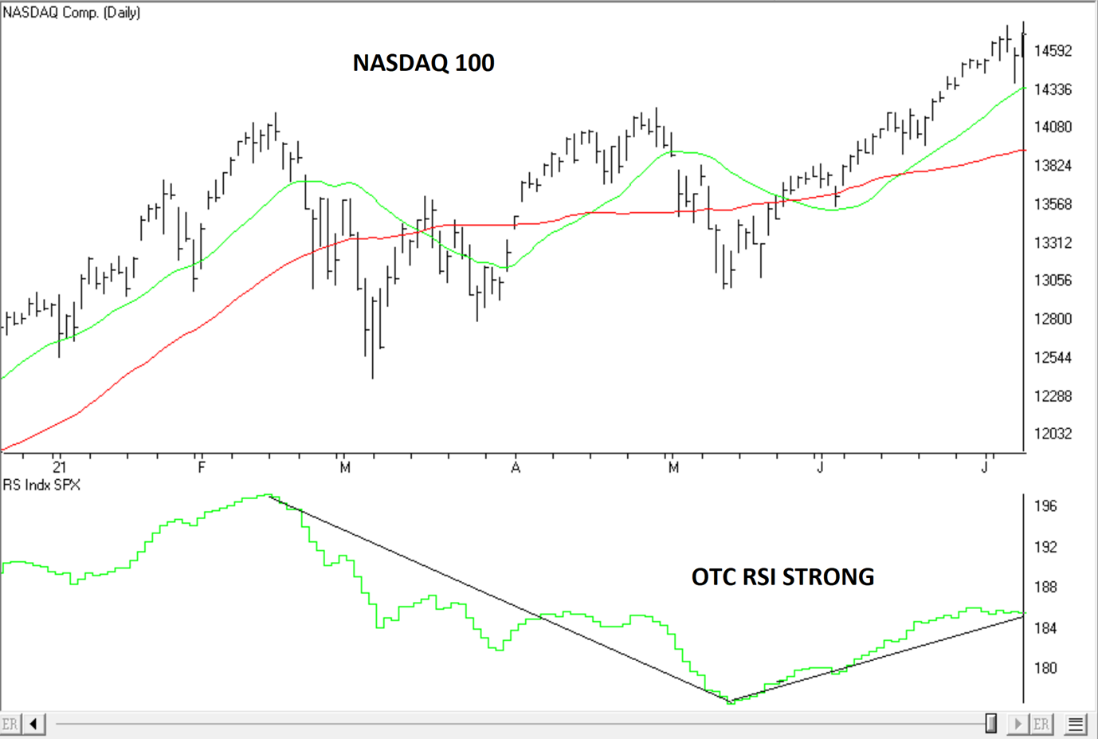

Chart #1: The Nasdaq 100

The Nasdaq 100 index represents principally know-how shares, similar to Apple, Microsoft, Amazon, Tesla, Google, and so forth. You’ll be able to see within the chart under, that the Nasdaq, or know-how shares, have had a powerful displaying of relative efficiency verses the S&P 500. Research do present that the markets carry out higher when the Nasdaq is main. This has to do with the truth that the S&P 500’s weighting is closely favored in direction of technology-related shares.

Chart #1- Nasdaq has robust relative efficiency versus S&P 500, supply AIQ

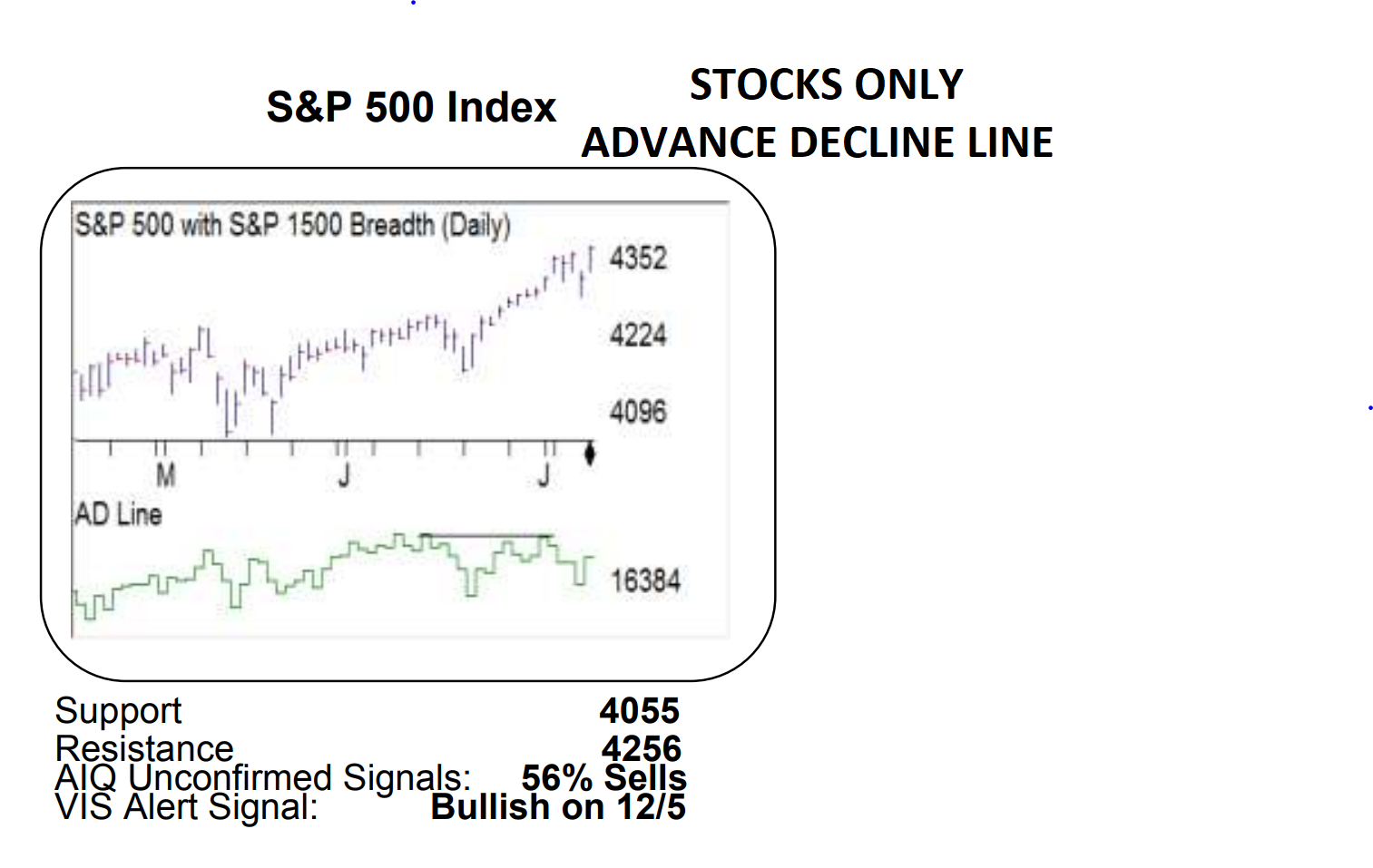

Chart #2: Advance/Decline Line

If we take a look at a chart of the S&P 500, together with its stocks-only Advance Decline Line, we’ll see that the market index is rising whereas the A/D Line is flat. The A/D Line exhibits market breadth, what number of shares are going up versus what number of shares are declining. A powerful, rising market shall be coupled with a rising A/D Line. Which means a rising tide is lifting all ships. A weak, rising market would present a declining A/D Line. Proper now, the S&P 500 is rising, whereas the A/D Line is flattening out. This chart was offered by David Vomund, an knowledgeable market technician.

[wce_code id=192]

Chart #2- Advance Decline is flattening in a rising market, supply: David Vomund

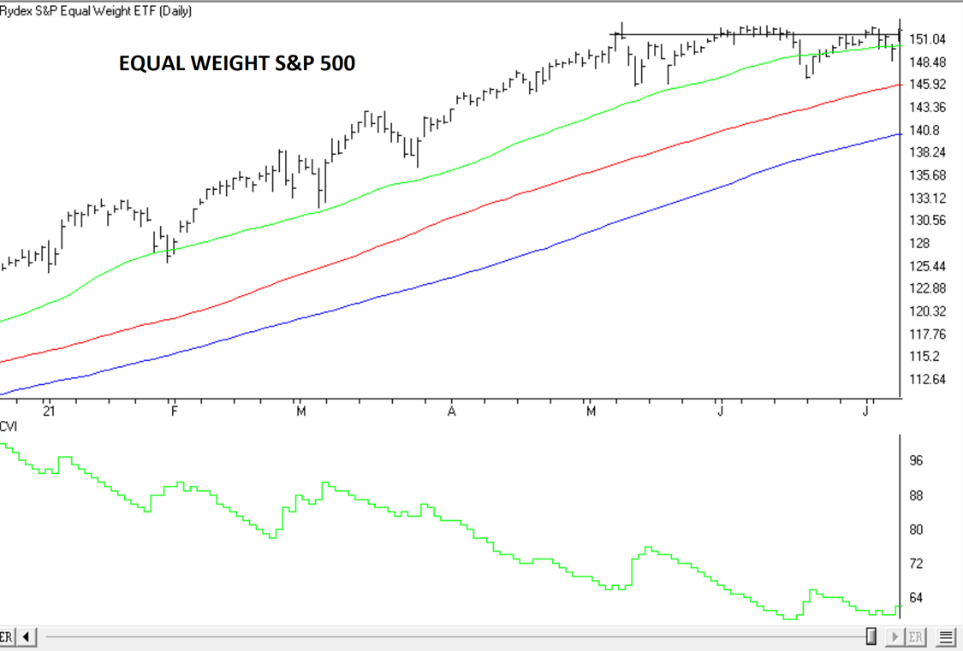

Chart #3: S&P 500 Equal Weight

We simply acknowledged that the S&P 500 is rising and placing in new highs whereas the A/D Line is flat, that means that not all shares are rising. The truth is, the S&P 500 is made up of about 40% technology-related shares, which we confirmed in chart #1 had been very robust not too long ago. Most of the largest shares within the S&P 500 are know-how shares. So, just a few giant tech shares are carrying the market within the short-term. That is proven through the use of an equal weight S&P 500 the place all 500 firm shares are given the identical allocation. The Equal weight index, just like the A/D Line, is flat over the previous month.

Chart #3- S&P 500 Equal Weight Index is flat whereas the market is rising, supply: AIQ

Backside Line

From the few charts displayed above, the underside line is that this: know-how is main, and actually, carrying the markets greater. Know-how-related shares make up the most important portion of the S&P 500 index and have outperformed over the previous month. We will see from the charts, and extra particularly, the Advance-Decline Line that not as many shares are taking part within the current rise of equities. An equal weight index, versus the tech-heavy capitalization weighted index, has been moved flat since early Might, very like the A/D Line.

Now, simply because a rising tide isn’t at present lifting all ships doesn’t imply doom-and-gloom for the markets. The A/D line is flat- not declining. That is additionally only a short-term motion. We shall be involved if the A/D Line begins falling whereas the market rises over an extended time period. Know-how can also be main the markets, which is often a constructive signal.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.