By DeFred Folts III, Managing Companion

By DeFred Folts III, Managing Companion, Chief Funding Strategist, and Eric Biegeleisen, CFA, Managing Director, Analysis Portfolio Supervisor

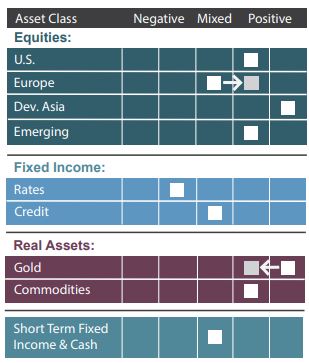

Equities:

Equities:

- U.S. Equities: Main U.S. fairness market indices proceed to succeed in all-time highs in addition to document ranges of overvaluation by our measure. Nevertheless, even at elevated valuations, financial and financial stimulus stays supportive. As well as, high-yield credit score spreads stay slender. A steepening international yield curve can also be a optimistic improvement signaling increased development prospects. U.S. equities additionally proceed to profit, no less than within the short-term, from optimistic value momentum and favorable investor conduct which could possibly be described as market euphoria. The acute stage of overvaluation of the U.S. fairness markets continues to spotlight their potential draw back threat.

- Japanese equities stay essentially the most enticing fairness asset class in our mannequin analysis. Extra compelling valuations, a continued narrowing of high-yield credit score spreads, a steepening yield curve and sustained financial stimulus from the Financial institution of Japan all contribute favorably to this outlook. Japan has handled the coronavirus pandemic higher than many different international locations, and due to its export-oriented economic system is well-positioned to profit from a rebound in international financial exercise. The potential for persevering with optimistic investor psychology may additional improve the outlook for Japanese equities as projected 2021 earnings for the businesses within the Japan MSCI index are anticipated to extend dramatically all through the rest of 2021.

- European Equities: European firms ought to proceed to profit from the sustained and extraordinary financial and financial stimulus required to assist the area due to a slower restoration from the coronavirus pandemic and inconsistent progress on vaccinations. Additionally, the latest energy of the U.S. greenback relative to the Euro could possibly be optimistic for European equities since a cloth share of firms primarily based in Europe export their merchandise worldwide. Decrease native alternate charges may help exporters both broaden market share and/or revenue margins as a result of value benefits a decrease alternate price gives.

- Rising Market Equities: The optimistic influence of a steepening U.S. yield curve is offset by rising yields on longer-term U.S. Treasuries and a commensurate strengthening of the U.S. greenback, negatively impacting the attractiveness of EM equities. Nevertheless, rising market international locations and their fairness markets ought to proceed to profit from any further fiscal stimulus from the U.S. authorities given the diploma to which the U.S. imports from rising market international locations.

[wce_code id=192]

Mounted Earnings:

- Within the first quarter of 2021, rates of interest on longer-term U.S. Treasuries elevated dramatically. Even at these increased yields, U.S. Treasuries symbolize an unattractive risk-return trade-off as they proceed to yield lower than the market’s anticipated inflation price throughout almost all maturities. Ought to rates of interest proceed to maneuver increased, bond market buyers would additionally face the prospect of additional capital depreciation.

- Brought on partly by buyers trying to find yield, expectations for financial restoration and the Fed’s continued tacit assist of the credit score markets (company bonds), credit score spreads – the distinction between high-yield and AAA-grade bond yields – proceed to slender. Quick-term dangers to credit score stay as any accident within the monetary markets may trigger credit score spreads to widen abruptly.

Actual Property:

- Though gold has struggled so far in 2021, it continues to be supported by destructive actual (nominal charges minus inflation expectations) rates of interest. Gold is an asset class than can function a important portfolio hedge in opposition to the prospects of future central financial institution cash printing and monetary repression over the long run. Gold may additionally profit from continued fiscal stimulus from the Biden administration which may increase the prospects of future inflation, particularly if the Fed additionally acts to additional repress long-term bond yields. Nevertheless, rising actual long-term rates of interest are presently performing as a headwind for gold within the shorter to intermediate time period, and sustained downward stress on the worth of gold may encourage additional promoting and negatively influence the mannequin outlook.

- Commodities stay enticing as a result of longstanding relative undervaluation of actual belongings and the prospect of a powerful international financial restoration within the second half of 2021. Different elements positively impacting actual belongings embrace; appreciation of the Chinese language yuan, slender high-yield credit score spreads, a steepening of U.S. and international yield curves and optimistic value momentum. These positives are considerably offset by the rise within the worth of the U.S. greenback so far in 2021

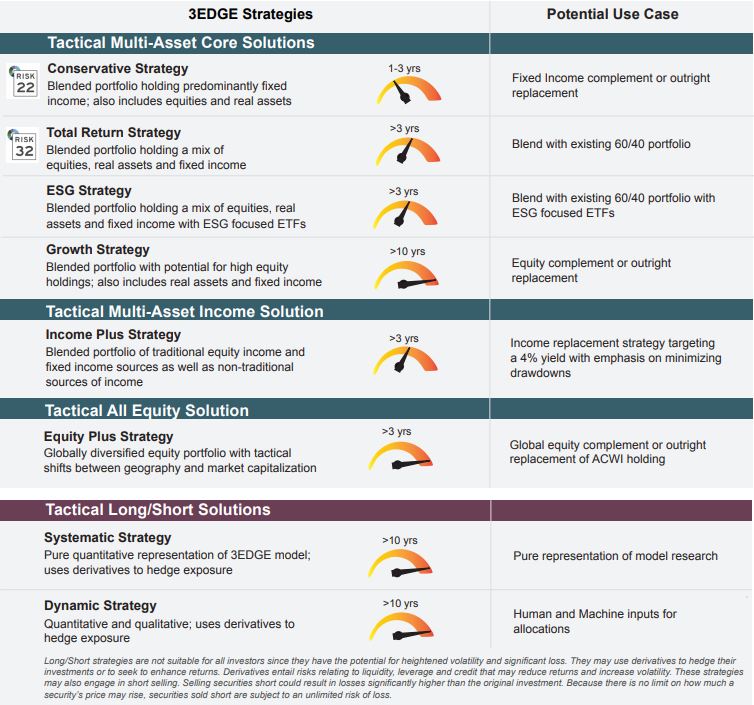

3EDGE Options Designed to Easy the Journey

Looking for to handle volatility and draw back threat whereas offering the potential to be additive to funding returns

About 3EDGE

3EDGE Asset Administration, LP, is a world, multi-asset funding administration agency serving institutional buyers and personal purchasers. 3EDGE methods act as tactical diversifiers, looking for to generate constant, long-term funding returns, no matter market circumstances, whereas managing draw back dangers.

The first funding autos utilized in portfolio building are index Alternate Traded Funds (ETFs). The funding analysis course of is pushed by the agency’s proprietary international capital markets mannequin. The mannequin is stress-tested over 150 years of market historical past and interprets a long time of analysis and funding expertise right into a system of causal guidelines and algorithms to explain international capital market conduct. 3EDGE provides a full suite of options, every with a goal price of return and threat parameters, to fulfill buyers’ completely different targets.

DISCLOSURES: This commentary and evaluation is meant for data functions solely and is as of April 2, 2021. This commentary doesn’t represent a suggestion to promote or solicitation of a suggestion to purchase any securities. The opinions expressed in View From the EDGE® are these of Mr. Folts and Mr. Biegeleisen and are topic to vary with out discover in response to shifting market circumstances. This commentary just isn’t meant to offer private funding recommendation and doesn’t consider the distinctive funding targets and monetary scenario of the reader. Traders ought to solely search funding recommendation from their particular person monetary adviser. These observations embrace data from sources 3EDGE believes to be dependable, however the accuracy of such data can’t be assured. Investments together with widespread shares, mounted revenue, commodities, ETNs and ETFs contain the danger of loss that buyers needs to be ready to bear. Funding within the 3EDGE funding methods entails substantial dangers and there may be no assurance that the methods’ funding targets will probably be achieved. Actual Property (Gold & Commodities) consists of treasured metals resembling gold in addition to investments that function and derive a lot of their income in actual belongings, e.g., MLPs, metals and mining companies, and so forth. Intermediate-Time period Mounted Earnings consists of mounted revenue funds with a median period of higher than 2 years and fewer than 10 years. Quick-Time period Mounted Earnings and Money consists of money, money equivalents, cash market funds, and glued revenue funds with a median period of two years or much less. Previous efficiency is probably not indicative of future outcomes.

The Threat Quantity®, a proprietary scaled index developed by Riskalyze to quantify the danger of a portfolio, is calculated primarily based on draw back threat on a scale from 1- 99. The higher the potential loss, the higher the quantity. The Threat Quantity® consists of evaluation and proprietary data of Riskalyze. As of three/31/21. Additional data accessible at Riskalyze.com.

View from the EDGE is a registered trademark of 3EDGE Asset Administration, LP

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.