It’s an odd sight to see. The pandemic is nearly within the rearview as vaccines proceed to roll out and mandates are eased and even lifted in some circumstances. At its peak, the unemployment price within the US was round 14%. Immediately, that quantity stands at slightly over 6%. Whereas consultants estimated that nonfarm payroll employment might enhance by as a lot 1,000,000 in April, these estimates fully missed the mark; nonfarm payroll employment solely elevated by 266,000 final month.

Take a drive round city. I glided by a Burger King and McDonalds each with “assist wished” indicators displayed providing $13/hour wages. Chipotle wasn’t even accepting walk-up orders as they didn’t have the workers to satisfy them (you needed to order on-line forward of time). Actually, final week, Chipotle raised their minimal wage to $15/hour at 2,800 hundred areas to draw employees. Amazon introduced they have been providing $1,000 signing bonuses at a median pay of $17/hour. With the present unemployment advantages, individuals simply don’t need to return to work.

[wce_code id=192]

Supply: WSJ: Amazon, McDonald’s, Others Woo Scarce Hourly Staff With Larger Pay

What does that imply for the markets? Effectively, proper now, it hasn’t appeared to have an effect on them in any main approach. Till the technical traits of the market start to alter, the market stays in a low volatility state.

The S&P 500 skilled just a few “outlier” days (a buying and selling day past +/-1.50%) final week. A -2% down day was adopted by +1.00% and +1.50% up days. The information cycle attributed the outlier down day to “downbeat remarks from the federal reserve.” Was it that, or was it anticipated?

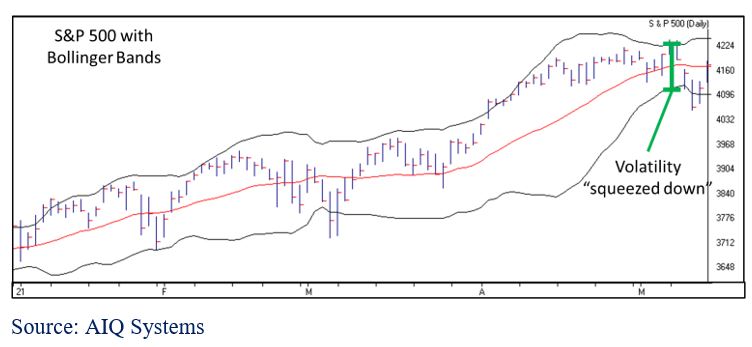

The market’s volatility was getting squeezed down. Much like pinching a spring, finally you’re sure to see some type of “pop.” One straightforward option to visualize the compression of volatility, is by taking a look at Bollinger Bands. With out getting too technical, Bollinger Bands have a look at how vast the every day fluctuations of market are, or customary deviation. There may be an higher and decrease band, centered round a short-term shifting common of the market’s worth. When the higher and decrease bands are expanded, every day fluctuations have been wider; when they’re shut, market fluctuations have been tighter. You possibly can see within the chart beneath, that up till final week, volatility within the markets had been compressed:

Proper now, we’re seeing regular market fluctuations. Volatility reached a bottleneck and expanded consequently. The occasion that supposedly brought about the growth is unimportant.

As a further level, we have now mentioned that technology-related shares have been lagging different market sectors, which has been uncommon for the previous 10 years. The “pop” in volatility we noticed final week was led by technology-related, which has been par for the course up to now this yr.

Market Management

Fashion Indexes

We all know from earlier updates that Worth is main Development throughout the board. What is especially odd is that when taking a look at 6 model indexes (massive cap, mid cap, small cap—progress & worth), massive cap worth has one of the best danger adjusted rating. Then again, massive cap progress has the worst danger adjusted rank. In different phrases, whereas massive caps present energy in worth amongst comparable indexes, massive caps have been weak in progress.

Commodities

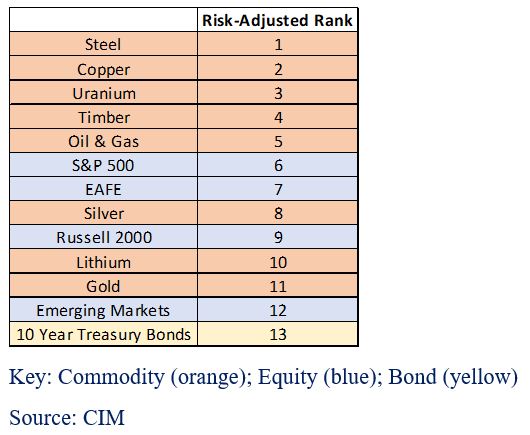

Many are conscious of the costs surging because the colonial pipeline was briefly closed, and anybody who has tried a house transform lately will know that lumber costs are by means of the roof. Commodities have been a sizzling space within the markets lately. The desk beneath desk exhibits the risk-adjusted rankings of a choose few commodity indexes together with some equities and 10-year treasury bonds. As a word, you will notice commodities are exhibiting management. Gold, which has struggled up till final month, is beginning to stand up our risk-adjusted rating.

Backside Line

The pattern continues as worth leads progress, massive expertise shares proceed to underperform, and commodities lead in relative energy. The outlier days we skilled within the markets final week don’t point out any issues simply but. We’re nonetheless in a bullish Market State as danger stays comparatively low. Basically, I’m certain there are a lot of issues that exist: individuals staying unemployed, corporations struggling to rent employees, and it’s exhausting to think about house valuations and commodities keep this sizzling. Fortuitously, fundamentals don’t make or break markets. Markets are pushed by provide and demand.

Nobody can see into the longer term and make an correct name to the market’s course. What we will do, is have a look at the present technical traits within the markets, and decide whether or not it’s dangerous or not. Immediately, the markets have low danger. Ought to danger start to rise, we will make the most of adaptive portfolio administration to regulate our allocations and holdings to cope with a brand new setting.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.