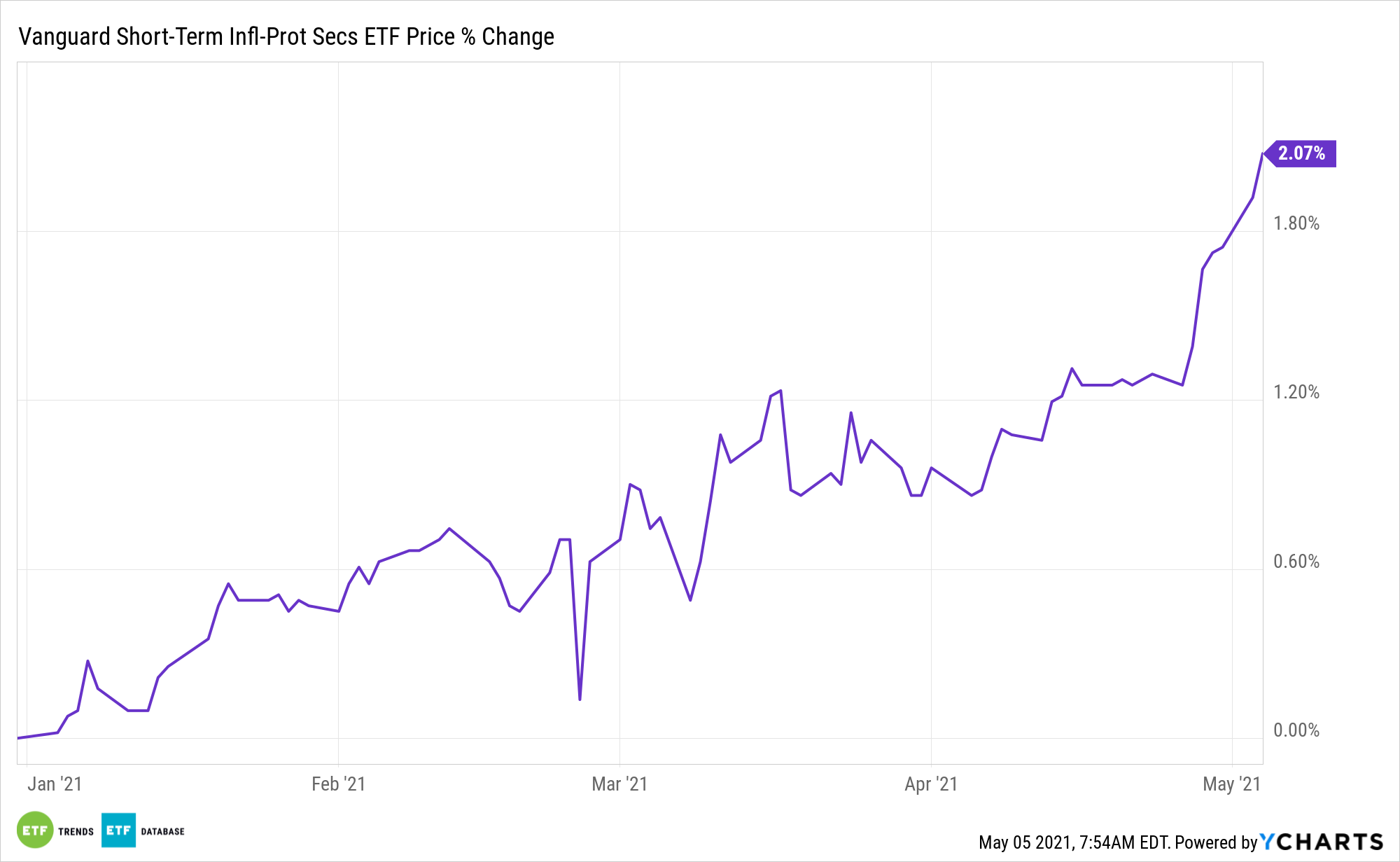

Legendary investor and Berkshire Hathaway CEO/chairman Warren Buffett sees “substantial inflation” on the horizon, boosting the case for belongings just like the Vanguard Quick-Time period Inflation-Protected Securities Index Fund ETF Shares (VTIP).

Gold, commodities, and Treasury inflation-protected securities (TIPS) are only a few methods to hedge towards the rising tide of inflation. An ETF like VTIP may also help buyers hedge on this method with out having to buy particular person hedging elements.

“We’re seeing very substantial inflation,” Buffett stated on the conglomerate’s annual shareholder assembly this previous weekend. “It’s very fascinating. We’re elevating costs. Persons are elevating costs to us and it’s being accepted.”

“We’ve received 9 homebuilders along with our manufacture housing and operation, which is the biggest within the nation. So we actually do quite a lot of housing. The prices are simply up, up, up. Metal prices, you realize, simply on daily basis they’re going up,” the legendary investor added.

VTIP seeks to trace the efficiency of the Bloomberg Barclays U.S. Treasury Inflation-Protected Securities (TIPS) 0-5 12 months Index. The index is a market-capitalization-weighted index that features all inflation-protected public obligations issued by the U.S. Treasury with remaining maturities of lower than 5 years.

The supervisor makes an attempt to copy the goal index by investing all, or considerably all, of its belongings within the securities that make up the index, holding every safety in roughly the identical proportion as its weighting within the index.

A Quick-Time period Resolution?

Yields have been on the rise, which helps to spark inflation fears amongst buyers. Since bond costs transfer conversely with yields, a short-term answer could possibly be best in limiting rate of interest danger.

As talked about on the Vanguard web site, VTIP is:

- Designed to generate returns extra intently correlated with realized inflation over the near-term, and to supply buyers the potential for much less volatility of returns relative to a longer-duration TIPS fund.

- Anticipated to have much less actual rate of interest danger, but additionally decrease whole returns relative to a longer-duration TIPS fund.

- Investing in bonds backed by the complete religion and credit score of the federal authorities and whose principal is adjusted semiannually primarily based on inflation.

- An possibility to supply safety from inflationary surprises or ”surprising inflation.”

For extra information, info, and technique, go to the Mounted Earnings Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.