By Julian Koski, CIO at New Age Alpha

In his 2004 bestseller The Knowledge of Crowds, James Surowiecki famously gives proof that when appearing independently and in their very own self-interest, the actions of particular person members of a crowd lead to an environment friendly end result. Following this logic, if buyers act independently of their pursuit of extra returns, the market shall be environment friendly. After all, the title of Surowiecki’s ebook is a nod to the basic tome by Charles Mackay, Extraordinary Fashionable Delusions and the Insanity of Crowds (emphasis mine). What occurs when the people in a crowd behave systematically equally, not independently?

Look no additional than the previous yr for the reply to that query. There are many causes to elucidate why the market has completed nicely: fiscal stimulus, financial stimulus, the conclusion that the pandemic didn’t have the financial impression many feared, to call a couple of. However sure particular person shares are clearly being impacted by the insanity of crowds. Now we have seen this in big mega-cap shares and we’ve got seen it amongst shares dealing with chapter. When crowds type, and people, being social beings, start letting one another affect their resolution making, bubbles usually type.

I’m not right here to inform you the market is in a bubble. An excessive amount of ink has been spilled during the last decade amongst pundits attempting to name the highest, who’ve largely all been flawed. Nevertheless, there are, and all the time shall be, bubbles in particular person shares. These are the shares with costs which have been impacted by buyers deciphering imprecise and ambiguous data in a systematically incorrect method. That’s, the herd speaks louder than the person. In such a scenario, even Surowiecki concedes a breakdown in value effectivity.

At this time’s surroundings is replete with data that’s related to inventory costs, however imprecise sufficient or ambiguous sufficient to permit buyers to interpret it incorrectly. Think about the turbulent inventory of Tesla, hovering by means of most of 2020 earlier than its latest 30% drop. Whereas the corporate could be robust and promising, the conduct across the inventory value might be an issue. A gaggle of buyers systematically over- or underconfident in an organization can ship the inventory rocketing to document valuations or careening downward. The lesson is easy: When imprecise or ambiguous data abounds, costs will behave wildly.

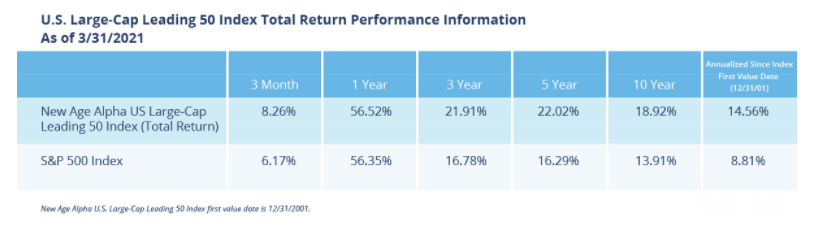

The answer to this downside is to keep away from the insanity. Keep away from the imprecise and ambiguous data. That is our aim at New Age Alpha and the primary quarter of 2021 has offered ample alternative to take action. We consider our U.S. Massive-Cap Main 50 Index gives proof of this. The Index is a part of our index household and employs our rules-based, proprietary methodology to pick out 50 shares that we consider have the least imprecise and ambiguous data impacting the inventory value. Within the first quarter of 2021, the Index outperformed the S&P 500® Index by 211 foundation factors. Further efficiency data may be discovered under:

LOOKING AHEAD

Thus far in 2021 the main focus has surrounded the steep climb of yields as measured by the ten-year Treasury and the chance this may increasingly create for valuations. Surowiecki, nonetheless, might have one thing to say about investor’s capability to accurately interpret such expectations. Notably when, traditionally, we not often see the commonest worry come to fruition as anticipated. Extra doubtless it’s a variant or a barely totally different tipping level that causes upheaval in an unexpected method. And the explanation danger not often works in such a linear vogue is as a result of it originates in human conduct. At New Age Alpha, we settle for this and make it work to our benefit. We don’t try and predict the longer term however, as a substitute, solely concentrate on the identified data. So, as examples, we’re additionally at present listening to considerations about an uptick in inflation or the continued refrain of valuation worries. But, has anybody thought-about:

- The psychological impression of renewed shutdowns ought to the vaccines fail towards virus mutations?

- A repo market computational / SWIFT failure that the Fed can’t backstop?

- Potential for geopolitical strife and Reopening, in unison, taking pictures oil costs sky excessive?

The record goes on. With robust tailwinds from each Reopening and extra stimulus, it feels as if the market’s considerations have shifted to ideas of an excessive amount of tailwind, forgetting any form of headwind can exist. In our view, that is human conduct at its worst and one thing we search to keep away from. Within the examples above, we don’t intend to be doomsayers however, moderately, we try and illustrate the elusive nature of danger. We don’t actually consider any of those eventualities would possibly or will come to cross exactly as a result of such conditions not often happen as envisioned. We merely level out that there are dangers associated to human conduct that nobody is taking into consideration. And that’s precisely why we use the actuarial processes just like these utilized by insurance coverage firms to concentrate on the identified information within the monetary world…in 2Q21 and going ahead.

New Age Alpha’s proprietary Human Issue methodology is designed to take care of the imprecise and ambiguous data within the inventory market. As conjecture and hypothesis have overtaken disciplined evaluation, the Human Issue – the likelihood an organization will fail to ship the expansion implied by its inventory value – has change into pronounced. As of March 31, 2021, the median Human Issue of all firms within the S&P 500® sits at 53.4%, in comparison with an historic common of 47%.

CONCLUSION

If the second quarter of 2021 is something just like the previous 5 quarters, we must always anticipate the surprising. Nobody noticed the pandemic coming, a lot much less the near-instantaneous restoration of the market whereas nonetheless within the throes of it. And, going one step additional, who might’ve anticipated the rise of the “retail investor” in consequence? The sequence of occasions blew aside prognosticator’s rigorously structured evaluation worldwide. To attempt to predict what’s going to occur subsequent is folly. We consider the one method that works throughout all time intervals and all market cycles is the avoidance of the chance of human conduct.

Initially printed by New Age Alpha

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.