MIDSTREAM RISES LAST WEEK WHILE RENEWABLES LAGFinal week, the Alerian MLP ETF (AMLP) surged over 9%

MIDSTREAM RISES LAST WEEK WHILE RENEWABLES LAG

- Final week, the Alerian MLP ETF (AMLP) surged over 9% on the heels of a 16% acquire from its Gathering & Processing MLPs. Crude oil gained roughly 2% final week after OPEC + (Group of the Petroleum Exporting Cooperation + Russia) agreed to a smaller than anticipated improve in its each day crude output with deliberate month-to-month conferences to reassess the quota because the pandemic performs out into 2021.

- Because the finish of October, AMLP has returned over 40% as midstream vitality infrastructure continues its worth restoration with the market’s rotation to worth shares. The value of crude oil has jumped over 27% throughout the identical interval with optimism rising that COVID-19 vaccines will start to be rolled out by year-end.

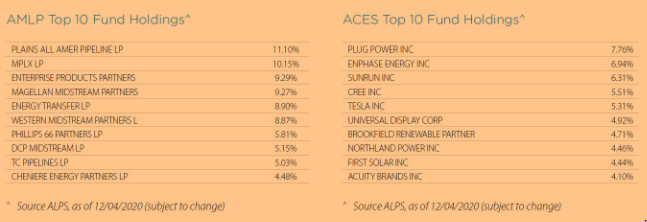

- Within the renewable clear vitality house, the ALPS Clear Vitality ETF (ACES) posted losses final week on weak spot from its Photo voltaic, Gasoline Cell, and Electrical Car (EV) segments that account for over 42% of the fund*, collectively. Delayed contract wins, valuation downgrades, and a photo voltaic battery recall acted because the catalyst for traders taking income in clear vitality names final week.

- Whereas ACES underperformed final week, the fund has climbed over 100% year-to-date because the transition to wash vitality manufacturing and consumption has been kickstarted, globally, underneath the premise of inexperienced stimulus plans.

THE LOOMING ENERGY TRANSITION WON’T OCCUR OVERNIGHT

- The IEA (Worldwide Vitality Company) now predicts that renewables would be the main international energy supply by 2025. Importantly, the growing share of renewable energy will come at the price of coal, moderately than pure gasoline, which the IEA expects to proceed to extend to over 25% of worldwide energy era by 2025.

- Equally, long-term development in oil demand will likely be tamed by the swap to extra environment friendly or electrical autos, the IEA forecast. Nevertheless, oil consumption will nonetheless improve by about 750,000 barrels a day every year to succeed in 103.2 million a day by 2030. That’s about 2 million a day lower than predicted in final 12 months’s IEA report, however nonetheless portends to continued development in midstream infrastructure.

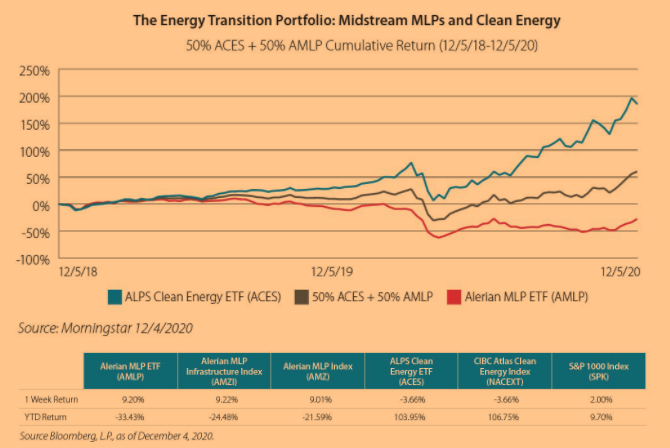

- An equal mix of ACES and AMLP could supply improved risk-adjusted returns and a powerful historic yield of 6.04% with its publicity to the midstream MLP sector and excessive development clear vitality names.

- AMLP and ACES have exhibited pretty reverse complete returns over the previous eighteen months. Whereas the causation of the alternative returns has been extra particular to the unfavorable market circumstances for midstream, moderately than cannibalization from clear vitality, pairing AMLP and ACES could assist seize either side of the anticipated development within the international vitality market over time.

Efficiency knowledge quoted symbolize previous efficiency. Previous efficiency isn’t any assure of future outcomes in order that shares, when redeemed could also be price roughly than their unique price. The funding return and principal worth will fluctuate. Present efficiency could also be larger or decrease than the efficiency quoted. For probably the most present month finish efficiency knowledge please name 844.234.5852. Efficiency consists of reinvested distributions and capital good points.

Previous efficiency shouldn’t be indicative of future outcomes. For standardized efficiency of the fund please click on right here: AMLP | ACES.

* Weights in ACES as of 12/4/2020

Initially revealed by ALPS

Necessary Disclosure & Definitions

An investor ought to take into account the funding goals, dangers, expenses and bills rigorously earlier than investing. To acquire a prospectus which comprise this and different info name 866.675.2639 or go to www.alpsfunds.com. Learn the prospectus rigorously earlier than investing.

Shares should not individually redeemable. Traders purchase and promote shares on a secondary market. Solely market makers or “licensed contributors” could commerce instantly with the fund, usually in blocks of 50,000 shares.

There are dangers concerned with investing in ETFs together with the lack of cash. Extra info relating to the dangers of this funding is on the market within the prospectus.

The Fund is topic to the extra dangers related to concentrating its investments in firms out there sector. Diversification doesn’t remove the chance of experiencing funding losses.

Foundation factors – One foundation level is the same as 1/100 of a %.

Clear Vitality Sector Danger. Obsolescence of present know-how, brief product cycles, falling costs and income, competitors from new market entrants and normal financial circumstances can considerably have an effect on firms within the clear vitality sector. As well as, intense competitors and laws leading to extra strict authorities laws and enforcement insurance policies and particular expenditures for cleanup efforts can considerably have an effect on this sector. Dangers related to hazardous supplies, fluctuations in vitality costs and provide and demand of other vitality fuels, vitality conservation, the success of exploration tasks and tax and different authorities laws can considerably have an effect on firms within the clear vitality sector. Additionally, provide and demand for particular services or products, the availability and demand for oil and gasoline, the worth of oil and gasoline, manufacturing spending, authorities regulation, world occasions and financial circumstances could have an effect on this sector. At the moment, sure valuation strategies used to worth firms concerned within the clear vitality sector, notably these firms that haven’t but traded publicly, haven’t been in widespread use for a major time frame. In consequence, using these valuation strategies could serve to extend additional the volatility of sure clear vitality firm share costs.

Focus Danger. The fund seeks to trace the underlying index, which itself could have focus in sure areas, economies, international locations, markets, industries or sectors. Underperformance or elevated danger in such concentrated areas could end in underperformance or elevated danger within the fund.

NACEX Index – The CIBC Atlas Clear Vitality Index is an adjusted market cap weighted index designed to supply publicity to a various set of U.S. or Canadian primarily based firms concerned within the clear vitality sector together with renewables and clear know-how.

SPK Index – The S&P 1000 combines two main indices, the S&P MidCap 400 & the S&P SmallCap 600, to kind an investable benchmark for the midsmall cap universe of the U.S. fairness market. S&P 1000 measures the efficiency of broadly out there and extremely liquid shares, making the S&P 1000 the suitable mid-small cap index for traders searching for to duplicate the efficiency of the U.S. fairness market.

The Alerian MLP Infrastructure Index is a composite of vitality infrastructure Grasp Restricted Partnerships (MLPs).

Alerian MLP Index is the main gauge of vitality infrastructure Grasp Restricted Partnerships (MLPs). The capped float-adjusted, capitalization-weighted index, whose constituents earn nearly all of their money circulate from midstream actions involving vitality commodities, is disseminated real-time on a worth return foundation (AMZ) and on a total-return foundation (AMZX).

Underneath present regulation, the AMLP shouldn’t be eligible to elect remedy as a regulated funding firm resulting from its investments primarily in MLPs. The Fund should be taxed as an everyday company for federal earnings functions. Whereas the NAV of Fund Shares is decreased by the accrual of any deferred tax liabilities, the Alerian MLP Infrastructure Index is calculated with none tax deductions.

An investor can’t make investments instantly in an index.

The Fund employs a “passive administration”- or indexing- funding approached and seeks to trace the funding outcomes of an index composed of worldwide firms that enter conventional markets with new digital types of manufacturing and distribution, and are more likely to disrupt an present market or worth community. In contrast to many funding firms, the Fund shouldn’t be “actively” managed. Subsequently, it might not essentially promote a safety as a result of the safety’s issuer was in monetary bother until that safety is faraway from the CIBC Atlas Clear Vitality Index. Equally, the Fund doesn’t purchase a safety as a result of the safety is deemed engaging until that safety is added to the CIBC Atlas Clear Vitality Index.

ALPS Portfolio Options Distributor, Inc. is the distributor for the ALPS Clear Vitality ETF.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.