Wall Road thought 2020 was the 12 months of the SPA

Wall Road thought 2020 was the 12 months of the SPAC, or particular objective acquisition firm (SPAC).

Seems, this title was untimely.

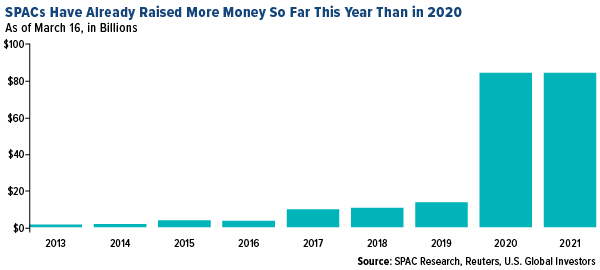

We’re not fairly three months into 2021, and but U.S. SPACs have already raised more cash than the document $83.four billion that was raised in all of 2020.

click on to enlarge

So what precisely are SPACs, and why have they turn into so fashionable abruptly?

Also called clean examine firms, SPACs are firms that don’t have any specific marketing strategy aside from to accumulate or merge with an unspecified personal firm in some unspecified time in the future. They’ve been round for the reason that 1990s however haven’t drawn a complete lot of investor consideration till lately, for causes I’ll get into later.

The Fundamentals of SPACs

The way in which SPACs work is, they record on an trade just like the New York Inventory Trade (NYSE) after which sometimes have as much as 24 months to accumulate a goal firm. If a deal isn’t made by the two-year mark, they need to dissolve and return the gross proceeds to shareholders.

One of the well-known examples is Virgin Galactic, which started buying and selling underneath the ticker SPCE in October 2019 after merging with Social Capital Hedosophia, a SPAC based by enterprise capitalist Chamath Palihapitiya.

Since SPACs don’t make something or personal any belongings, it’s the founders which might be the primary draw. Assume Palihapitiya, an early Fb government, outspoken advocate of bitcoin and potential California gubernatorial candidate. Different SPAC sponsors have included huge names corresponding to Invoice Ackman, Shaquille O’Neal and former Home Speaker Paul Ryan. Buyers could financial institution on founders having the correct connections to shut a take care of a scorching tech startup and produce it to market.

In different phrases, it’s a case of betting on the jockey (the founders) fairly than the horse (the corporate).

Once more, SPACs had been as soon as quirky backwaters within the $50 trillion U.S. inventory market. The NYSE didn’t trouble itemizing any till Might 2017. Simply 5 years in the past, Goldman Sachs had a strict coverage in opposition to them.

Flash ahead to at this time, and junior Goldman bankers are issuing complaints of grueling working circumstances as a result of increase in SPAC issuances. A survey of first-year Goldman analysts confirmed that many have been working 100-hour weeks on common since January. “My physique bodily hurts on a regular basis and mentally I’m in a extremely darkish place,” one respondent wrote.

An Different to Conventional IPOs

With regards to tapping public markets, the pattern is unquestionably in SPACs’ favor. Final yr, 248 SPACs listed, a document, in comparison with 209 conventional preliminary public choices (IPOs). To my data, that is the primary time SPAC issuances outpaced IPO issuances. The amount of money raised was additionally an almost one-to-one ratio.

The pattern has solely accelerated thus far this yr. Final month, for each $1 raised in an IPO, the SPAC market raised $3.76.

So let me return to an earlier query: Why are these firms so fashionable rapidly?

The quick reply is that, in numerous methods, it’s simpler for a corporation to go public by way of an acquisition or reverse merger than to leap by way of the regulatory hoops and get listed on an trade. Conventional IPOs clearly have advantages, together with larger visibility and status, however they are often pricey and time intensive. An IPO can take as much as two to 3 years to shut, whereas a SPAC may be accomplished in as little as two to 3 months.

There are different upsides to SPACs, together with requiring fewer disclosures. Deal factors are restricted to the SPAC founder(s) and chief government of the goal firm; due to this fact, investor roadshows are successfully eradicated.

This was an particularly engaging characteristic in 2020 through the pandemic, which can have contributed to the SPAC increase.

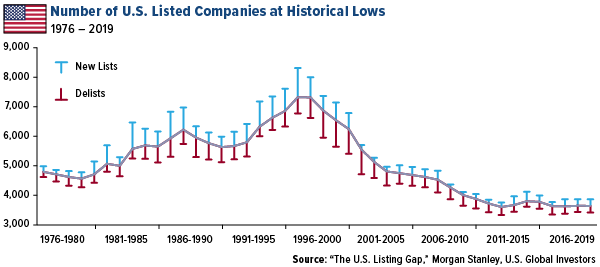

I’ve written earlier than about how the variety of IPOs has been shrinking for years—each within the U.S. and overseas—as the rise in laws makes it more durable and costlier to get (and keep) listed. Corporations are selecting to stay personal for longer durations of time, usually going public years after they’ve already turn into multibillion-dollar companies with family title manufacturers. (Assume Uber, Lyft, Airbnb and DoorDash, all of which started buying and selling up to now two years.)

This hurts retail traders, who by no means get to take part in an organization’s meteoric rise from nothing.

click on to enlarge

For a lot of traders and executives, SPACs may be seen as a “loophole” of types, permitting firms to get a public itemizing with out going by way of the extra typical channels. I don’t know if I might agree with that time period, however I wouldn’t be stunned if regulators begin to crack down on these kind of transactions.

Inflation Considerations at a File Excessive?

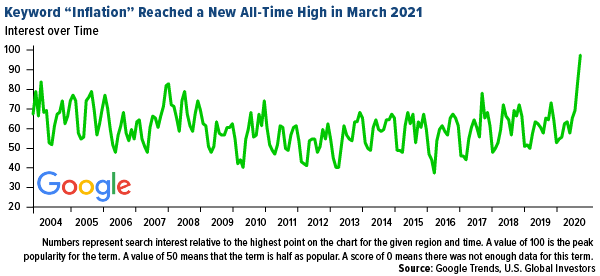

Switching gears, I realized final week that Google searches for the key phrase “inflation” hit their highest stage this month since not less than 2004, when the net search large started accumulating data. This tells me that individuals are beginning to get involved with the course shopper costs are headed in, and the way it will have an effect on their pocketbooks and investments.

click on to enlarge

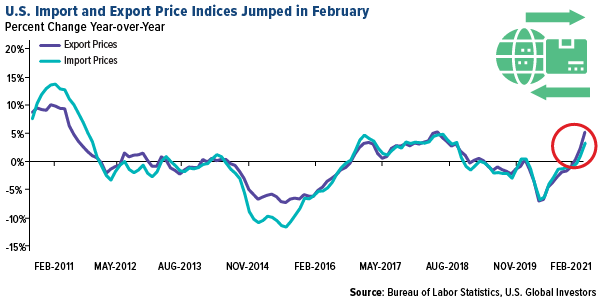

The buyer value index (CPI) rose 1.7% year-over-year final month, however as I’ve stated earlier than, is the CPI “faux information”? This measure doesn’t embody meals and power, and but these are the products and companies seeing a few of highest inflation proper now. Grocery costs elevated probably the most in almost a decade final yr, and this price might surge much more this yr as delivery charges go up. In February, the fee to export from the U.S. jumped 5.2% over final yr, probably the most since June 2018, whereas import prices rose 3.0%.

click on to enlarge

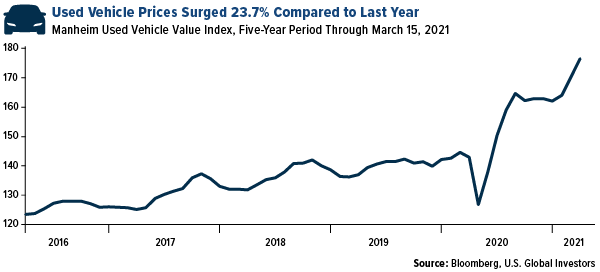

This, coupled with rising commodity costs, is having an enormous impact on big-ticket objects like vehicles and vans. In accordance with the Manheim Used Automobile Worth Index, wholesale costs for preowned cars elevated a jaw-dropping 23.7% from March 2020 to at this time. Like I stated lately, in the event you’re out there for a brand new automotive, you may wish to lock in at this time’s costs earlier than they go up any extra.

click on to enlarge

Final week, Federal Reserve Chair Jerome Powell stated he expects the U.S. economic system to develop 6.5%, which might be probably the most in nearly 40 years. Even when this leads to higher-than-normal inflation, Powell dedicated to proceed high-growth financial insurance policies, together with near-zero charges and asset purchases.

That stated, I feel gold is a prudent funding to assist stem the affect of inflation in your portfolio. I usually advocate the 10% Golden Rule, with 5% in gold bullion (bars, cash, jewellery) and 5% in gold mining shares, mutual funds and ETFs.

Initially revealed by US Funds, 3/22/21

Some hyperlinks above could also be directed to third-party web sites. U.S. World Buyers doesn’t endorse all data provided by these web sites and isn’t accountable for their content material. All opinions expressed and information offered are topic to alter with out discover. A few of these opinions is probably not acceptable to each investor.

The Client Worth Index (CPI) is likely one of the most well known value measures for monitoring the value of a market basket of products and companies bought by people. The weights of elements are primarily based on shopper spending patterns. The Manheim Used Automobile Worth Index is a measurement of used car costs that’s unbiased of underlying shifts within the traits of autos being offered. Statistical evaluation is utilized to its database of greater than 5 million used car transactions yearly.

Holdings could change every day. Holdings are reported as of the newest quarter-end. The next securities talked about within the article had been held by a number of accounts managed by U.S. World Buyers as of (12/31/2020): Fb Inc.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.