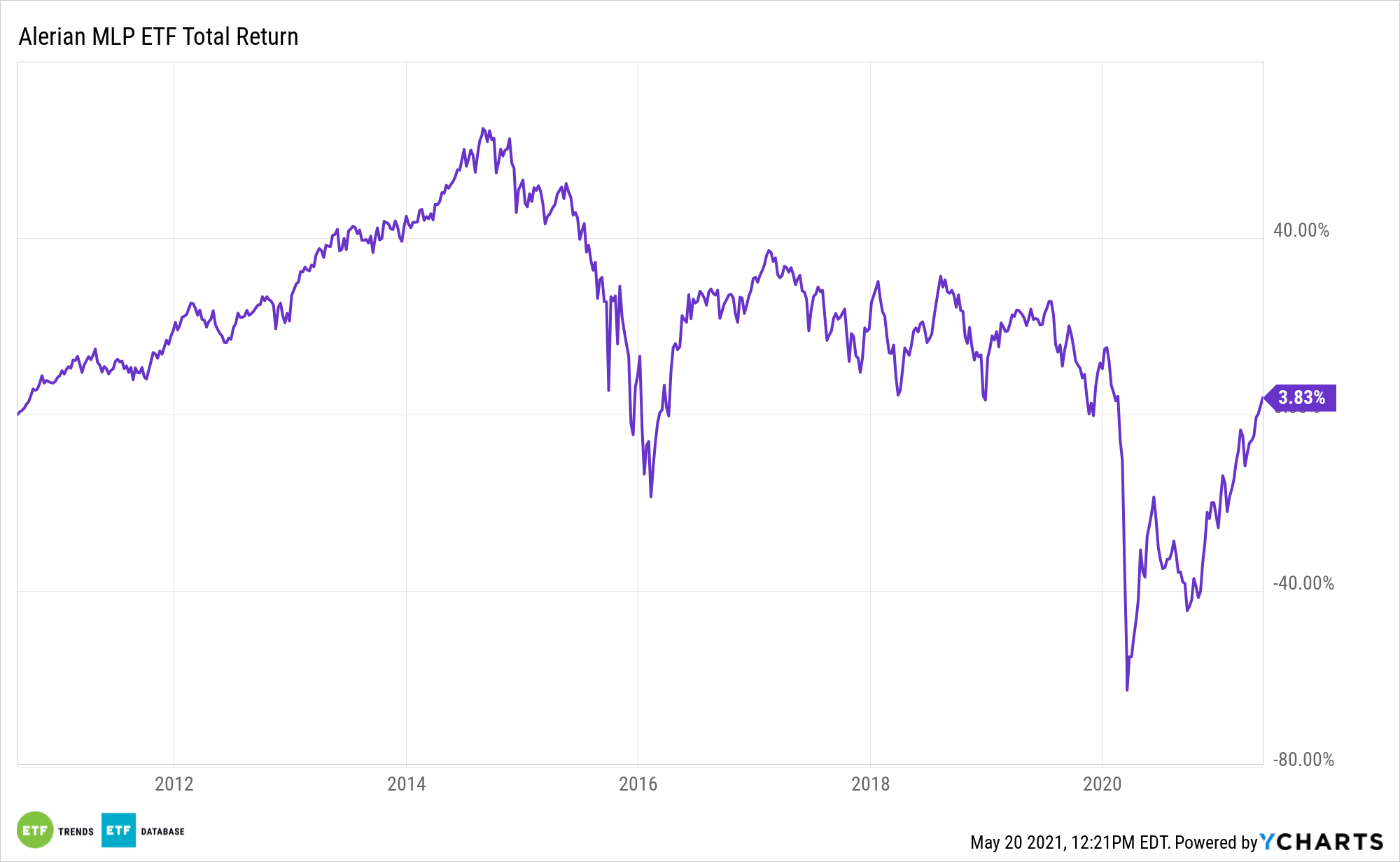

Midstream grasp restricted partnerships (MLPs), together with these residing within the the ALPS Alerian MLP ETF (NYSEArca: AMLP), are taking part on this power sector rally. In reality, AMLP and midstream names are among the many leaders.

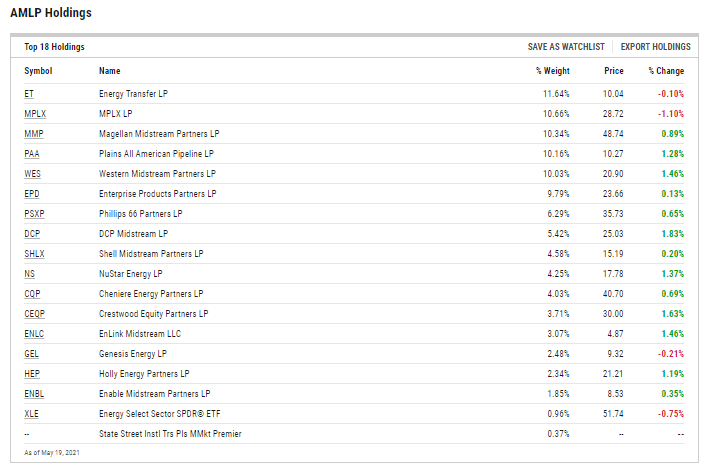

AMLP, the most important change traded fund devoted to MLPs, follows the Alerian MLP Infrastructure Index. That benchmark is dwelling to power infrastructure firms concerned in processing, storage, and transportation of oil and pure gasoline.

The ETF carried out admirably within the first quarter, and loads of its constituents delivered strong outcomes for the primary three months of the yr, regardless of some challenges.

“Although some firms confronted headwinds as a result of climate, these gave the impression to be pretty muted and offset to some extent by an general bettering macro backdrop,” writes Alerian Director of Analysis Stacey Morris. “Combining widespread beats with a stronger macro backdrop, administration groups largely struck an optimistic tone on the longer term. In lots of circumstances, steering will increase weren’t only a operate of the one-time storm advantages but in addition mirrored an bettering outlook for base companies as nicely. At present’s be aware appears to be like at a couple of key takeaways from midstream earnings season.”

Massive Names Enhance ‘AMLP’

Necessary to AMLP’s near-term fortunes is that among the fund’s largest names delivered strong first quarter outcomes.

“Enterprise Merchandise Companions (EPD), ONEOK (OKE), Targa Sources (TRGP) and Williams Corporations (WMB) are among the many firms that supplied spectacular beats due partly to weather-related advantages. Vitality Switch’s (ET) outcomes introduced on Could 6 put an exclamation mark on midstream earnings season, as the corporate decimated estimates for the quarter and reported a $2.four billion profit from the storm for full-year 2021,” in response to Morris.

Vitality Switch and Enterprise Merchandise are AMLP’s largest and sixth-largest holdings, respectively, combining for over 21% of the fund’s roster. Vitality Switch boosted its 2021 earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) forecast by $100 million.

One other catalyst for traders to look at is buybacks amongst AMLP parts, together with Magellan Midstream Companions (MMP) and Plains All American (PAA).

“PAA reiterated plans to allocate as much as 25% of 2021 free money movement (FCF) in extra of distributions to buybacks. Equally, MMP indicated that 2021 FCF after distributions, together with $270 million in current asset sale proceeds, could possibly be opportunistically used for buybacks,” added Morris.

These two shares mix for nearly 20.50% of AMLP’s portfolio.

For extra on cornerstone methods, go to our ETF Constructing Blocks Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.