By Steve Pitchford, Director of Tax and Monetary Planning A

By Steve Pitchford, Director of Tax and Monetary Planning

Accountable investing has captured public consideration in recent times. And with a plethora of accountable investing primarily based merchandise obtainable, the chance to make the most of these which are each in step with an investor’s private values and on the identical time proceed to satisfy the investor’s funding aims has by no means been higher. Under we’ll concentrate on the three most generally mentioned varieties and the variations between every.

Accountable Investing

Accountable investing (RI) is any funding technique which seeks to contemplate social/environmental points along with monetary return.

Whereas the earliest types of RI have been round because the 1960s, solely extra not too long ago has accountable investing gained noticeable prominence within the funding world. The tempo of progress in RI as we speak is nothing wanting exceptional.

In keeping with the US SIF Basis’s 2016 Report on US Sustainable, Accountable and Impression Investing Tendencies, as of year-end 2015, a couple of out of each 5 {dollars} beneath skilled administration in the USA —$8.72 trillion or extra—was invested in response to SRI (Socially Accountable Investing) methods.

Accountable investing provides a private, values-based layer to conventional investing, and might usually imply one thing completely different to every particular person.[1]

Consequently, there may be confusion amongst buyers, and even monetary professionals, on what precisely is the definition of a accountable funding. For instance, if decreasing tobacco use is necessary to investor A however not investor B, investor A would definitely contemplate an funding specializing in antitobacco firm adverts as a ‘accountable funding,’ whereas investor B wouldn’t.

An extra explanation for confusion is the various completely different names and terminologies used to explain accountable investing.

Some phrases usually used synonymously with accountable investing are SRI (socially accountable investing), ESG (environmental, social and governance) investing, influence investing, mission-based investing, socially aware investing, sustainable investing, and inexperienced investing.

Describing every class beneath the accountable investing umbrella could be an exhaustive course of and will solely result in additional confusion given the overlap between the various classes.

For the needs of this white paper, we’ll concentrate on three distinct (in our opinion) classes of accountable investing: SRI, ESG investing, and influence investing.[2]

Socially Accountable Investing

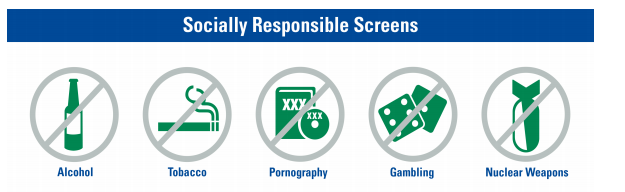

Accountable investing’s earliest iteration is named Socially Accountable Investing (SRI). Essentially the most elementary type of SRI, first gaining traction within the 1960s, employs a damaging screening tactic to exclude undesirable firms from an funding portfolio. “Sin shares”[3] and different firms which have questionable environmental and social insurance policies are most frequently these which are “weeded out.”

Frequent targets for damaging screening embody firms which are concerned in alcohol, tobacco, pornography, playing, or nuclear weapons.[4]

SRI continued to evolve and commenced together with optimistic screening components as nicely. For instance, firms which have sturdy environmental influence efficiency information, make the most of renewable power, or that foster variety and/or equal pay.

One clear advantage of SRI is the flexibility for an investor to keep away from offering capital to an organization not aligned with their private values.

Nevertheless, as a result of the earliest types of SRI usually targeted so solely on this private values part, funding efficiency was sacrificed. Ignored was the financial influence of avoiding investing in sure firms, finally reducing an investor’s chance of incomes aggressive returns.

Fashionable SRI merchandise have extra subtle screening techniques that provide an investor the chance to not solely have a portfolio that displays their private values, but additionally one that may supply aggressive funding returns.

SRI continues to be extremely popular as we speak.

Environmental, Social and Governance Investing

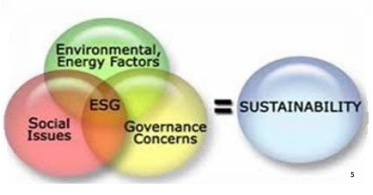

An outgrowth of SRI, the time period Environmental, Social and Governance (ESG) investing is usually used interchangeably with SRI. Nevertheless, there are basic variations between SRI and ESG investing.

ESG investing considers environmental, social and governance dangers when choosing firms and nations by which to speculate.

Environmental standards seems at how an organization interacts and impacts the pure setting. What

are an organization’s insurance policies on local weather change, renewable power, carbon emissions, and water recycling?

Social standards examines an organization’s relationships with its staff and the neighborhood. What are

an organization’s insurance policies on labor requirements, human capital, privateness, and information safety?

Governance standards focuses on an organization’s management, government pay, auditing procedures,

inner controls, and shareholder rights. What are an organization’s insurance policies on pay, possession,

corruption, and enterprise ethics and fraud?

Relative to SRI, ESG investing locations the next emphasis on monetary efficiency. The truth is, many funding firms and analysts consider screening for ESG components is a basic facet of evaluating the prospects of an funding’s long-term monetary efficiency, unbiased of the “morals” of investing in an organization.

As such, many funding analysts study an organization’s ESG components as they’d an organization’s stability sheet, revenue assertion, and money flows.

Whereas it’s nonetheless an open debate whether or not screening for ESG components positively or negatively impacts an funding’s monetary return, the argument that screening for these components being additive to long-term funding efficiency is intuitive.

For instance, an organization that meets one or a number of of the factors for ESG investing might concentrate on benchmark objectives somewhat than shorter-term quarterly income, selling a stronger longer-term progress trajectory for the corporate. Or, an organization that focuses on pay equality will usually have a extra steady workforce.

Impression Investing

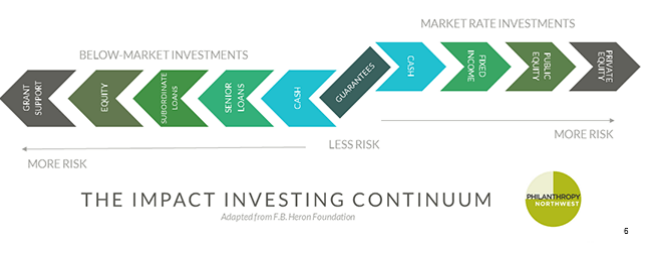

Impression investing differs from SRI and ESG investing in its degree of concentrate on direct and measurable environmental/social initiatives. Impression investments measure and report their progress on attaining their social/environmental trigger, usually subordinating funding efficiency to take action.

Impression investing is probably the most customized and customizable type of accountable investing, permitting an investor to search out an funding that matches particular causes they’re most obsessed with. For instance, an influence funding might be as targeted as solely funding enterprise capital financing for small to medium-sized enterprise in Ghana.

One problem related to influence investing is definitely finding the corporate or group concerned in a selected initiative an investor is obsessed with. In contrast to SRI and ESG investing, an investor can’t merely choose an influence funding inventory from the funding universe. As an alternative, finding and funding an influence funding is usually completed by analysis on choices inside the non-public market.

With the flexibility to search out (or construct) an influence funding for almost each social/environmental initiative, influence investing is among the broadest classes of accountable investing.

One technique to group influence investments is by the emphasis positioned on funding return.

Whereas precise funding returns is almost all the time of secondary significance with influence investments, many do goal to offer aggressive funding returns. For instance, a typical type of influence investing is a personal fairness funding (that helps an environmental or social trigger) that strives to generate return on the invested capital as nicely.

Nevertheless, with different influence investing initiatives, the investor could also be keen to just accept a reduced return from the outset. As a simplistic instance, an investor agrees to 10% complete return on a debt safety in an underserved market, the place one would usually count on a 20% return.

Whereas influence investing continues to be in its infancy relative to SRI and ESG investing, it’s a rising discipline that many see as the way forward for accountable investing.

Ought to I Contemplate Accountable Investing?

It is a private determination, primarily based in your particular person values, beliefs, and objectives, each personally and economically.

Whereas it may be tough for accountable investing to be as instantly impactful as extra conventional charitable giving methods, RI does present a approach for a person’s funding portfolio to higher mirror their private values and on the identical time, hold them on observe to attain their monetary objectives and aims.

At Towerpoint Wealth, we’re a authorized fiduciary to you, and all the time work 100% in your finest pursuits. We’re right here to serve you, and can try to match your private values together with your funding portfolio, ought to this be necessary to you. If you want to additional focus on accountable investing with us, we encourage you to name, 916-405-9166

or e-mail [email protected] to open an goal, no-strings-attached dialogue.

Initially printed by Towerpoint Wealth

Towerpoint Wealth, LLC is a Registered Funding Adviser. This materials is solely for informational functions. Advisory providers are solely supplied to shoppers or potential shoppers the place Towerpoint Wealth, LLC and its representatives are correctly licensed or exempt from licensure. Previous efficiency is not any assure of future returns. Investing entails danger and doable lack of principal capital. No recommendation could also be rendered by Towerpoint Wealth, LLC except a shopper service settlement is in place.

Supply:

Entrance Cowl: Alexandru Sava, Febuary 28, 2016, Does Socially Accountable Investing Make Monetary Sense?, digital picture, The Wall Avenue Journal, accessed July 11, 2018,

https://www.wsj.com/articles/does-socially-responsible-investing-make-financial-sense-1456715888

![]()

![]()

![]()

![]()

![]()

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.