The title of this weblog is, definitely, what buyers are fairly keen to seek out out. Two weeks in the past the markets acquired the July information for each the Shopper Worth Index (CPI) in addition to the Producer Worth Index (PPI). The lion’s share of the headlines tends to go to the CPI, however this report is like trying within the rearview mirror, to coin a phrase. As a way to see the place the street to inflation could also be headed, the PPI figures could present higher insights.

After posting outsized good points within the prior 4 months, the July CPI enhance was pegged at a extra reasonable 0.5% on a month-to-month foundation. Nonetheless, the year-over-year fee remained unchanged at its elevated 5.4% studying. However, some market contributors have been fast to level out that the latest string of year-over-year good points had not continued.

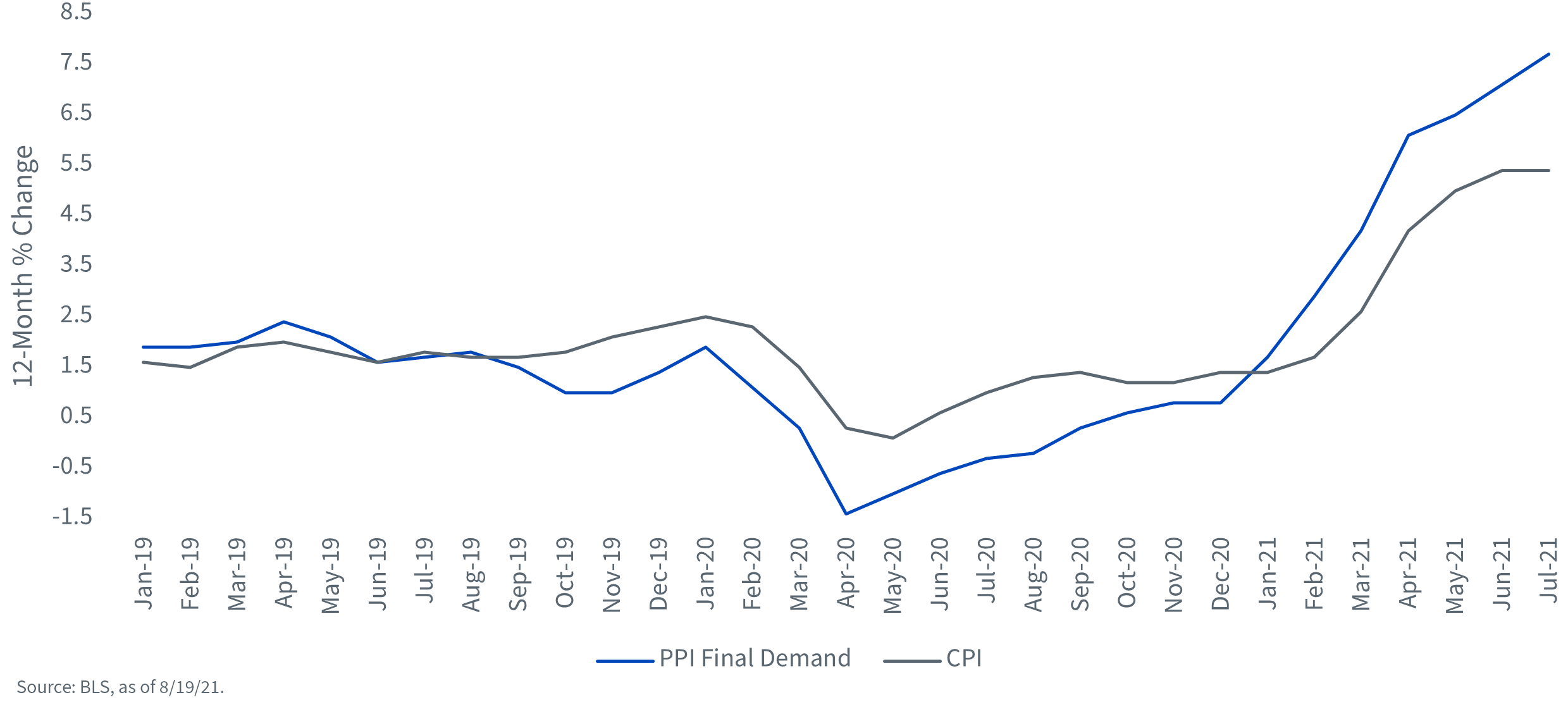

Determine 1: U.S. Closing Demand & CPI That is the place the PPI information comes into view. However earlier than I get into that dialogue, first some Inflation 101. The PPI report represents value developments on the wholesale degree whereas CPI information represents retail costs. So, in concept, one may make the case that the pattern in place for wholesale costs may logically work its approach by means of to the retail degree. For the report, it’s not at all times a clear pass-through, however as you may see from the graph (Determine 1), the trendlines have appeared to suit for essentially the most half over the previous couple of years.

That is the place the PPI information comes into view. However earlier than I get into that dialogue, first some Inflation 101. The PPI report represents value developments on the wholesale degree whereas CPI information represents retail costs. So, in concept, one may make the case that the pattern in place for wholesale costs may logically work its approach by means of to the retail degree. For the report, it’s not at all times a clear pass-through, however as you may see from the graph (Determine 1), the trendlines have appeared to suit for essentially the most half over the previous couple of years.

Again then to PPI, the place the Bureau of Labor Statistics (BLS) reported that the 12-month enhance for the ultimate demand index rose 0.5 share factors to 7.8%, the most important advance since this information was first calculated in November 2010. Is that this a harbinger of what’s to return? At a minimal, it definitely represents a problem to the ‘inflation is transitory’ case.

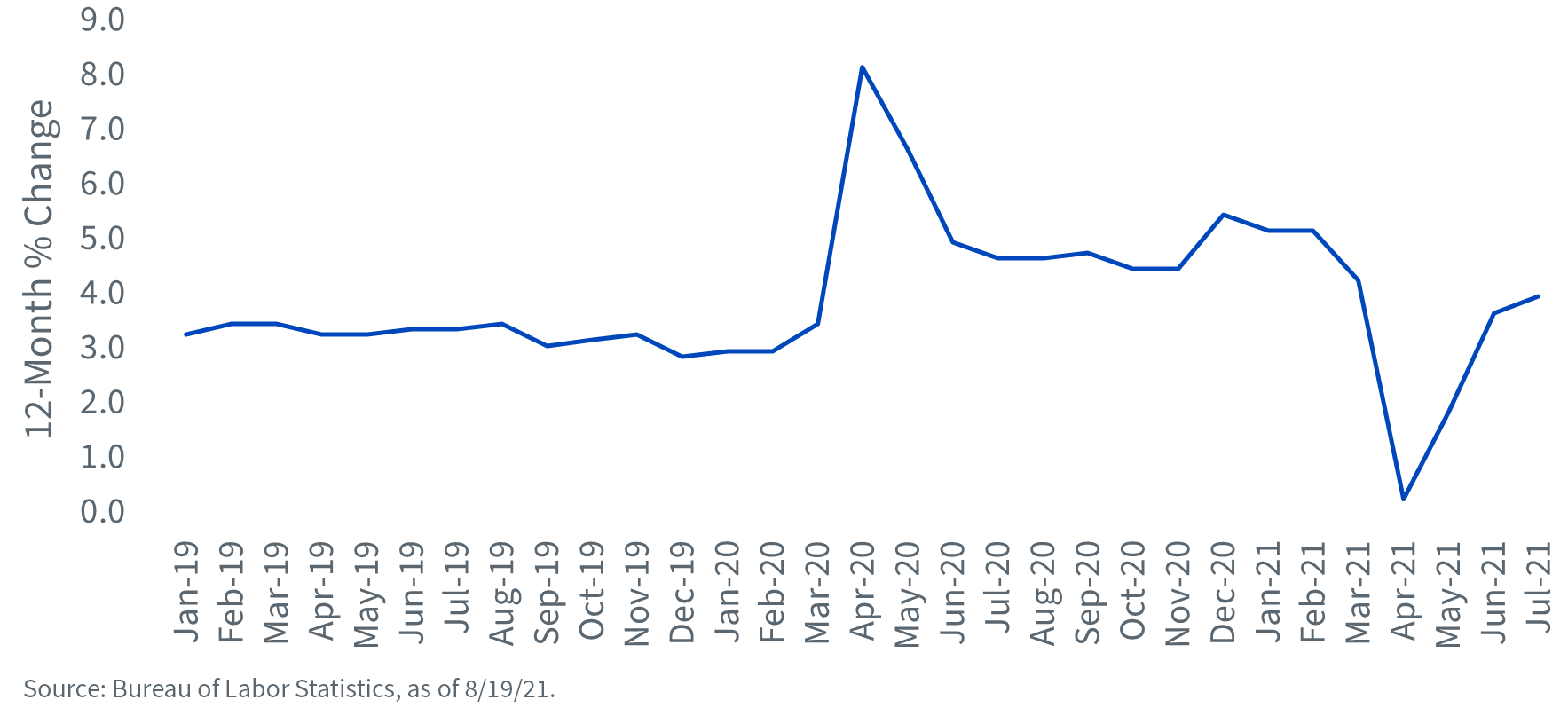

You already know one other pattern that bears watching? Wage will increase. The graph under underscores how the year-over-year enhance for common hourly earnings has been on a roller-coaster experience during the last 12 to 18 months. Previous to the COVID pandemic, the 12-month acquire for wages had been fairly range-bound across the 3.0% to three.5% band. As soon as the financial system locked down after February of final yr, the rise spiked to as excessive as 8.2% in April. With low-wage earners being hit disproportionately more durable by the lockdown and changing into unemployed, the labor market information was left primarily with the higher-wage employee element. Thus, the spike. As you may see, because the labor market started to normalize, the pattern started to reverse, and when the lower-wage employee returned, the 12-month acquire really sank to a low of 0.3% in April of this yr.

Determine 2: Common Hourly Earnings

Now, with a ‘fairer’ illustration amongst those that are employed, one can draw an attention-grabbing conclusion; particularly, wage good points seem like gaining traction even with the inclusion of the low-wage earner. Actually, the 12-month enhance for July was pegged at 4.0%.

The underside line message is that if the rising pattern in wholesale costs get handed by means of to households and wage developments turn out to be visibly elevated, it’s troublesome to examine inflation coming again down towards the Fed’s 2% goal any time quickly, and maybe, within the foreseeable future.

Initially printed by WisdomTree, August 25, 2021.

U.S. buyers solely: Click on right here to acquire a WisdomTree ETF prospectus which accommodates funding targets, dangers, expenses, bills, and different info; learn and contemplate fastidiously earlier than investing.

There are dangers concerned with investing, together with potential lack of principal. Overseas investing includes forex, political and financial threat. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller firms could expertise better value volatility. Investments in rising markets, forex, fastened earnings and various investments embrace extra dangers. Please see prospectus for dialogue of dangers.

Previous efficiency will not be indicative of future outcomes. This materials accommodates the opinions of the writer, that are topic to vary, and will to not be thought of or interpreted as a advice to take part in any specific buying and selling technique, or deemed to be a suggestion or sale of any funding product and it shouldn’t be relied on as such. There isn’t any assure that any methods mentioned will work below all market situations. This materials represents an evaluation of the market setting at a particular time and isn’t supposed to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation concerning any safety particularly. The person of this info assumes your entire threat of any use manufactured from the data supplied herein. Neither WisdomTree nor its associates, nor Foreside Fund Providers, LLC, or its associates present tax or authorized recommendation. Traders in search of tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Until expressly said in any other case the opinions, interpretations or findings expressed herein don’t essentially characterize the views of WisdomTree or any of its associates.

The MSCI info could solely be used to your inside use, might not be reproduced or re-disseminated in any kind and might not be used as a foundation for or element of any monetary devices or merchandise or indexes. Not one of the MSCI info is meant to represent funding recommendation or a advice to make (or chorus from making) any type of funding determination and might not be relied on as such. Historic information and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI info is supplied on an “as is” foundation and the person of this info assumes your entire threat of any use manufactured from this info. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI info (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this info, in no occasion shall any MSCI Occasion have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss earnings) or another damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Providers, LLC.

WisdomTree Funds are distributed by Foreside Fund Providers, LLC, within the U.S. solely.

You can’t make investments straight in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.

www.nasdaq.com