The 2020 coronavirus market sli

The 2020 coronavirus market slide could appear to be a distant reminiscence at this time, but it surely taught buyers some necessary classes. One lesson was that when the going will get powerful, it is best to aspect with sturdy corporations whereas eschewing financially flimsy fare.

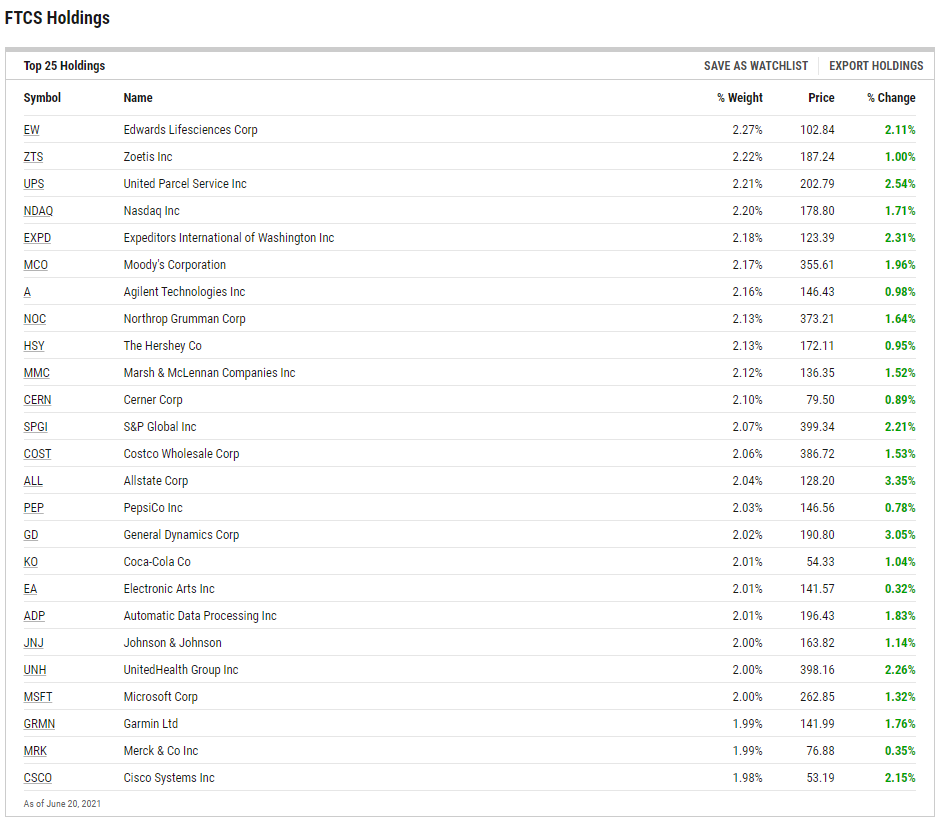

Buyers that need to concentrate on corporations with reliable monetary energy can discover a basket of these names within the First Belief Capital Energy ETF (FTCS). The $eight billion FTCS tracks the Capital Energy Index.

“The Capital Energy Index seeks to supply publicity to well-capitalized corporations with sturdy market positions which have the potential to supply their stockholders with a higher diploma of stability and efficiency over time,” based on Nasdaq World Indexes. “The businesses are screened in order that the index constituents usually have sturdy steadiness sheets, a excessive diploma of liquidity, the power to generate earnings progress, and a file of economic energy and revenue progress. The Index consists of 50 shares chosen objectively primarily based on money available, debt ratios and volatility. The index parts are equally weighted at every quarterly rebalance.”

Breaking Down the FTCS Methodology

One of many key factors relating to the early 2020 fairness market slide was that corporations with weak steadiness sheets have been uncovered. These proved to be among the many extra unstable names when shares tumbled and lots of have been dividend offenders, reducing or suspending payouts.

FTCS goes in the wrong way, specializing in steadiness sheet energy, lack of leverage, and low volatility as standards for inclusion. The 51 parts within the First Belief ETF are “ranked by a mixed short-term (90 days) and long-term (260 days) realized volatility,” based on the issuer.

FTCS additionally options high quality traits, that are related for long-term buyers because of the sturdiness of the standard issue. Moreover, the standard issue could possibly be poised to return again into vogue because the financial restoration strikes into the mid-cycle section. The First Belief ETF mandates that member corporations have long-term debt-to-market capitalization ratios of lower than 30% and return on fairness (ROE) exceeding 15%.

The ETF has one other benefit: its parts are equally weighted, a technique that is topping cap-weighted benchmarks this yr. In different phrases, single inventory danger is minimized in FTCS.

Industrial shares account for nearly 30% of the fund – the best trade weight permitted by the fund’s guidelines. Healthcare and shopper staples names mix for over 36%. No vitality, supplies, actual property, and utilities shares at present reside in FTCS.

For extra information, info, and technique, go to the Nasdaq Portfolio Options Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.