Bond publicity is not restricted to hedging shares as a part of a standard portfolio combine, particularly when ultra-short bonds provide traders choices for a distinct state of affairs. That mentioned, when is it greatest to make use of them?

For the investor trying to park money within the interim whereas incomes a return, a typical alternative may be a cash market fund account. Nonetheless, getting essentially the most out of 1’s money in that quick period is tough with bottom-of-the-barrel charges within the present market.

That is the place ultra-short bonds come into play. The shorter maturity dates restrict the period danger traders are uncovered to in the event that they went with bonds hooked up to longer-dated maturities.

“Ultrashort-term bond funds will be good decisions for traders who need higher potential short-term yields than cash market accounts however much less market danger than short-term bond funds with longer maturities,” an article in The Stability defined.

“Conservative traders have a tendency to love ultrashort-term bond funds as a result of they’ve much less interest-rate sensitivity than short-term bond funds however will sometimes have increased yields than cash market funds,” the article added.

The Federal Reserve not too long ago opted to maintain charges close to zero regardless of rumblings of inflation showing in shopper value information. Regardless of that, the present price surroundings makes an ultra-short bond fund a main choice when in comparison with cash market funds with comparatively decrease charges.

“So if, in a low-interest-rate surroundings, an investor needs to get a yield increased than cash market funds however rates of interest are anticipated to rise within the close to future, ultrashort-term bond funds will be a good suggestion,” The Stability article added additional.

One Extremely-Quick Possibility from Vanguard

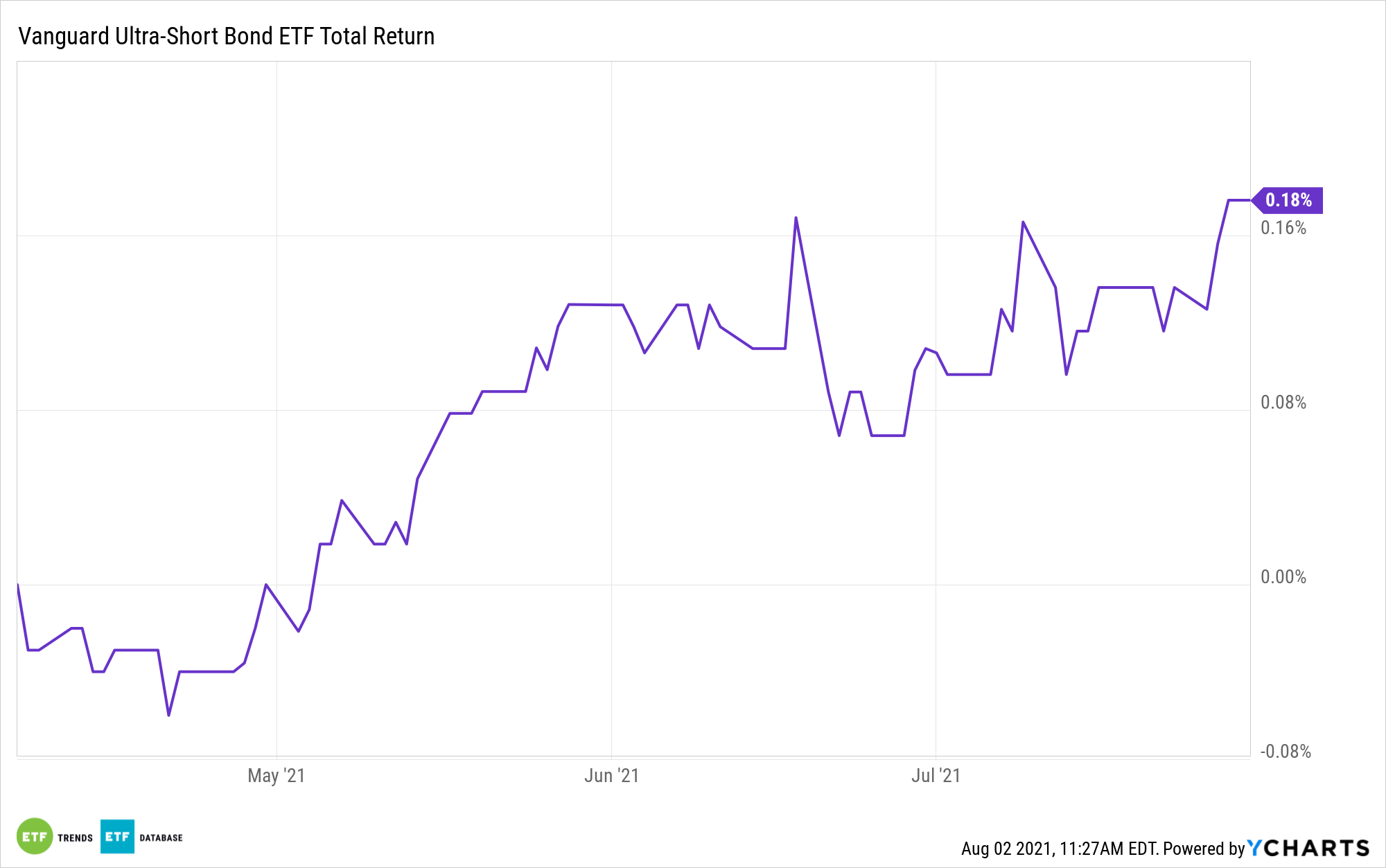

Given a plethora of fund decisions on the market, one to think about is the Vanguard Extremely-Quick Bond ETF (VUSB). It is simply one of many many decisions provided by Vanguard, which has a bond fund to suit any funding state of affairs.

With its low 0.10% expense ratio, VUSB’s funding goal is to hunt to supply present revenue whereas sustaining restricted value volatility. The fund invests in a diversified portfolio of high-quality and, to a lesser extent, medium-quality mounted revenue securities. It provides a dollar-weighted common maturity of Zero to 2 years.

Below regular circumstances, the fund will make investments not less than 80% of its property in mounted revenue securities. The fund is designed to present traders low-cost publicity to cash market devices and short-term high-quality bonds, together with asset-backed, authorities, and investment-grade company securities.

For extra information, data, and technique, go to the Mounted Revenue Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.