High-quality firms—firms with robust profitability metrics, low debt and low variability in earnings—characterize one of many higher alternatives out there at present.

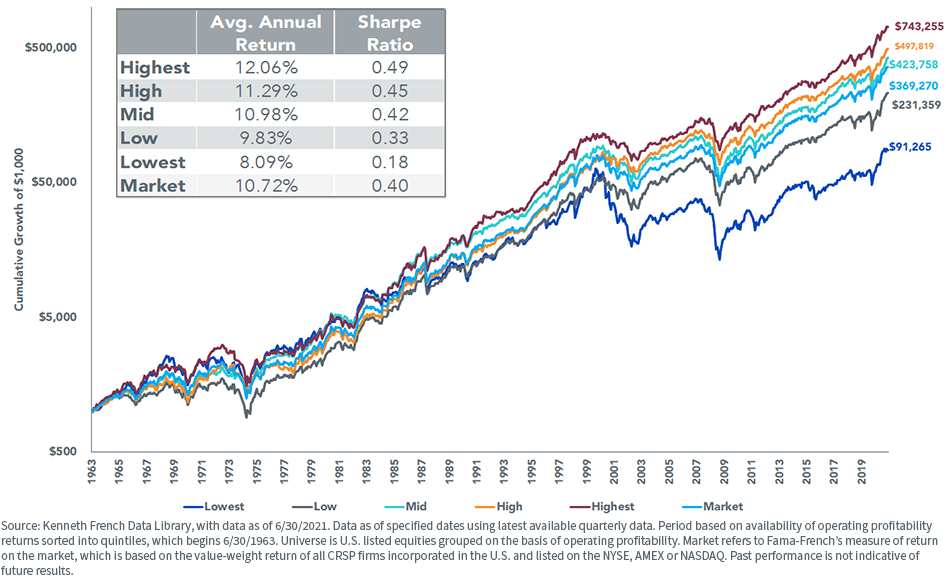

Tutorial analysis exhibits {that a} quite simple type of the market by a profitability metric often known as return on fairness (ROE) has delivered robust long-term returns. The return unfold between the very best and lowest ROE firms has been roughly 4% a yr going again virtually 60 years.

Trying over more moderen historical past, we see over the past 15 years that high-ROE shares have even expanded their lead over low and unfavourable ROE shares. However over the past yr, there was a big “junk rally” happening, with the market propelled by companies with unfavourable ROE or the bottom ROE.

WisdomTree believes fundamentals are going to begin to matter once more as we get later into the bull market cycle and have a return to the longer-term developments of profitability and ROE driving efficiency.

WisdomTree launched a household of high quality Indexes in 2013 that shifts the load to high-ROE shares—in addition to shares with low leverage and constructive anticipated earnings development developments. It manages valuations of this basket by incorporating a rebalancing course of again to dividends and the underlying money flows every year.

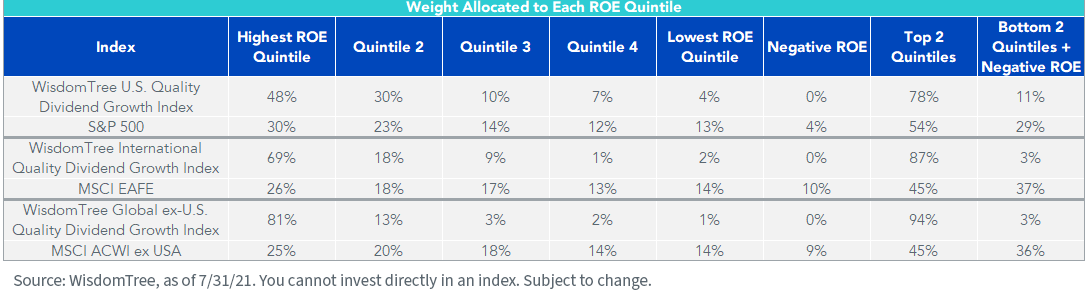

The next desk exhibits the load to the varied ROE quintiles throughout the U.S., developed worldwide and international ex-U.S. high quality Indexes.

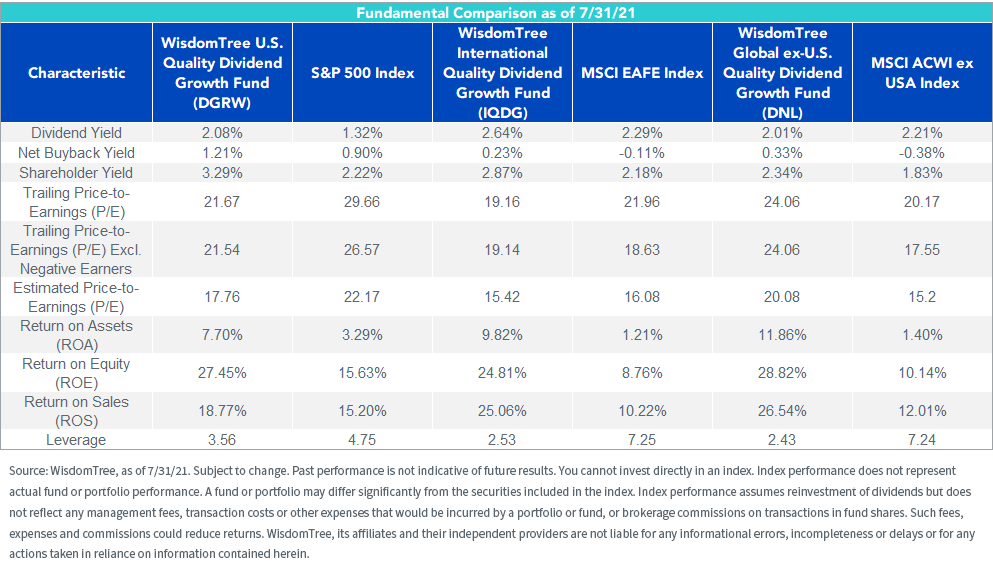

Whereas the U.S. market sees greater than 75% of its weight within the two highest ROE quintiles—a full 24 factors larger than the S&P 500—the worldwide variations of the technique see 87% and 94% of their weight allotted to the highest two quintiles, primarily doubling the load of the worldwide MSCI benchmarks. Worldwide shares have a repute of being cheaper than U.S. markets for good purpose. That’s as a result of they have a tendency to have decrease profitability and decrease development prospects. The MSCI EAFE Index, as an illustration, has an ROE of simply 8.8%, whereas the S&P 500 has 15.6% ROE.

Worldwide shares have a repute of being cheaper than U.S. markets for good purpose. That’s as a result of they have a tendency to have decrease profitability and decrease development prospects. The MSCI EAFE Index, as an illustration, has an ROE of simply 8.8%, whereas the S&P 500 has 15.6% ROE.

But while you make use of a top quality self-discipline in these international markets, you will get ROEs at vital premiums even to U.S. markets whereas retaining a valuation low cost.  General, we consider that there’s a possibility within the present high quality market that shouldn’t be missed. Markets might have dislocated from longer-term high quality developments over the previous yr, however we expect they’ll restore their choice for higher-quality firms quickly.

General, we consider that there’s a possibility within the present high quality market that shouldn’t be missed. Markets might have dislocated from longer-term high quality developments over the previous yr, however we expect they’ll restore their choice for higher-quality firms quickly.

Initially printed by WisdomTree, August 24, 2021.

U.S. traders solely: Click on right here to acquire a WisdomTree ETF prospectus which accommodates funding targets, dangers, fees, bills, and different info; learn and think about rigorously earlier than investing.

There are dangers concerned with investing, together with potential lack of principal. Overseas investing includes foreign money, political and financial danger. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller firms might expertise better value volatility. Investments in rising markets, foreign money, mounted earnings and different investments embrace further dangers. Please see prospectus for dialogue of dangers.

Previous efficiency isn’t indicative of future outcomes. This materials accommodates the opinions of the creator, that are topic to vary, and will to not be thought of or interpreted as a suggestion to take part in any explicit buying and selling technique, or deemed to be a suggestion or sale of any funding product and it shouldn’t be relied on as such. There isn’t any assure that any methods mentioned will work underneath all market circumstances. This materials represents an evaluation of the market surroundings at a selected time and isn’t meant to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation concerning any safety particularly. The person of this info assumes your entire danger of any use made from the knowledge supplied herein. Neither WisdomTree nor its associates, nor Foreside Fund Companies, LLC, or its associates present tax or authorized recommendation. Traders looking for tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Except expressly said in any other case the opinions, interpretations or findings expressed herein don’t essentially characterize the views of WisdomTree or any of its associates.

The MSCI info might solely be used on your inside use, might not be reproduced or re-disseminated in any type and might not be used as a foundation for or part of any monetary devices or merchandise or indexes. Not one of the MSCI info is meant to represent funding recommendation or a suggestion to make (or chorus from making) any sort of funding determination and might not be relied on as such. Historic knowledge and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI info is supplied on an “as is” foundation and the person of this info assumes your entire danger of any use made from this info. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI info (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this info, in no occasion shall any MSCI Get together have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss income) or every other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Companies, LLC.

WisdomTree Funds are distributed by Foreside Fund Companies, LLC, within the U.S. solely.

You can’t make investments immediately in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.

www.nasdaq.com