Recent lethargy in smaller shares may spell alterna

Recent lethargy in smaller shares may spell alternative some traders seeking to belongings just like the ERShares NextGen Entrepreneurs ETF (ERSX).

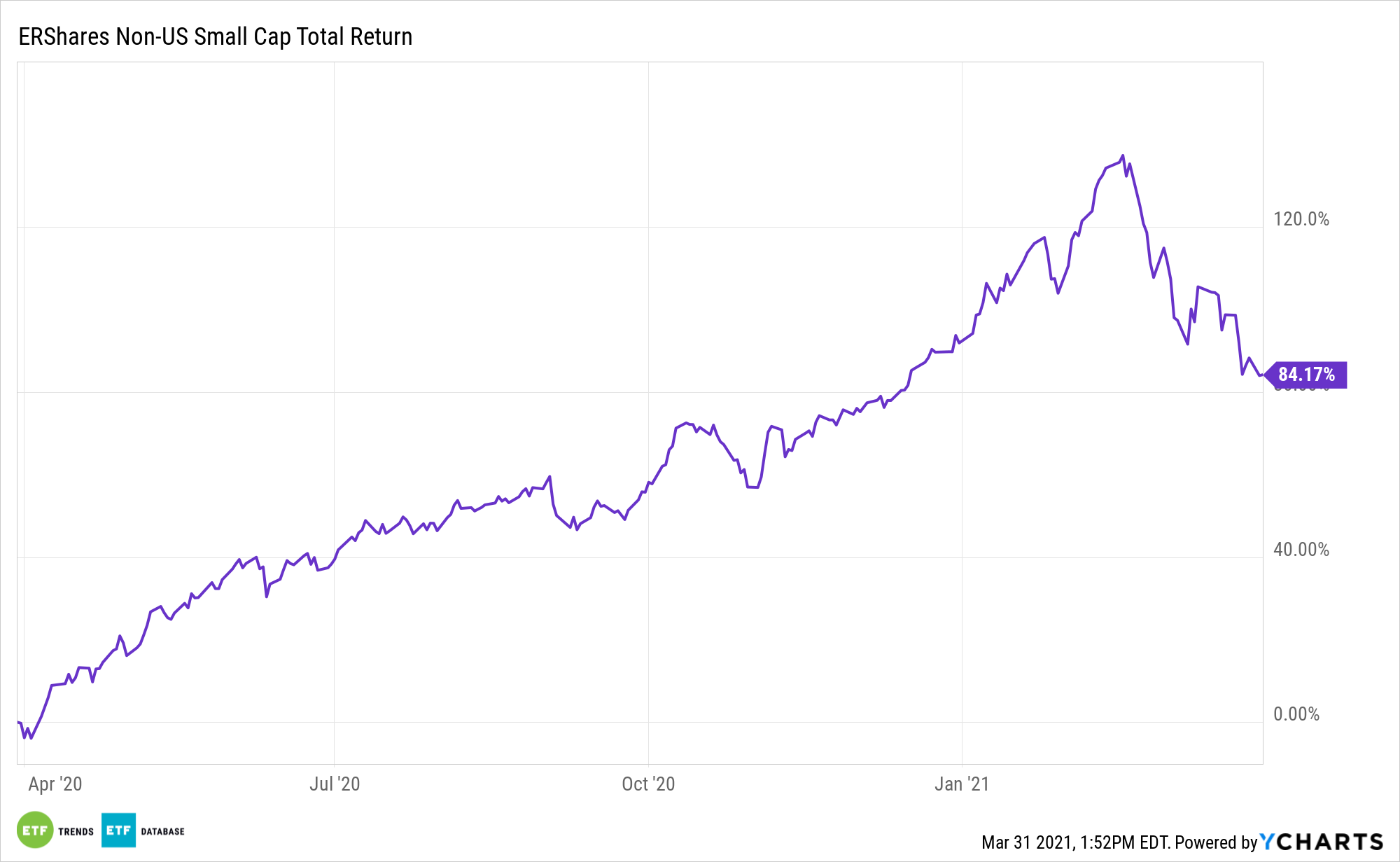

ERSX selects probably the most entrepreneurial, primarily non-U.S. small cap firms that meet the thresholds embedded in its proprietary Entrepreneur Issue (EF). ERShares’ ETF delivers sturdy efficiency throughout a wide range of funding methods with out disrupting traders’ underlying threat profile metrics. Their geographic range permits them to harness world benefits by way of extra returns related to foreign money fluctuations, strategic geographic allocations, comparative commerce imbalances, and relative provide/demand strengths.

Amid rising Treasury yields, smaller shares briefly fell out of favor, however the 2021 set-up for the asset class stays compelling.

“Small-cap shares have had a exceptional run through the pandemic. Because of this development, many merchants have been left to query whether or not or not this pattern will proceed within the months forward,” notes Schaeffer’s Funding Analysis. “In accordance with Todd Salamone, the technical image of Russell 2000 and ETFs just like the iShares Russell 2000 ETF (IWM) does recommend that the rising pattern will doubtless proceed.”

Smaller Can Be Higher

The small cap class has underperformed its massive cap friends, notably these mega cap tech firms that benefited within the post-coronavirus surroundings. Nevertheless, a broader market rally has helped small caps outperform in 2021, and even outpace the tech-heavy Nasdaq. Even with latest weak spot, small caps are topping large- and mid-caps this yr.

“Talking on small caps holistically, Salamone singled out the iShares Russell 2000 ETF (IWM) as providing various publicity to the small cap phase. The ETF is comprised of shares all through 11 completely different sectors, with the 5 greatest areas of publicity being a mixture of development and worth segments like well being care (the most important), shopper cyclicals, industrials, monetary providers, and know-how (the smallest),” notes Schaeffer’s.

ERSX isn’t a standard ETF. It blends home and worldwide publicity, which is related at time when many markets are betting worldwide smaller shares will high U.S. equivalents. Non-U.S. equities are poised to take flight, and it’s attainable that this asset class is in for a considerable interval of out-performance.

For extra investing concepts, go to our Entrepreneur ETF Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.