Things are trying up for financial institution shar

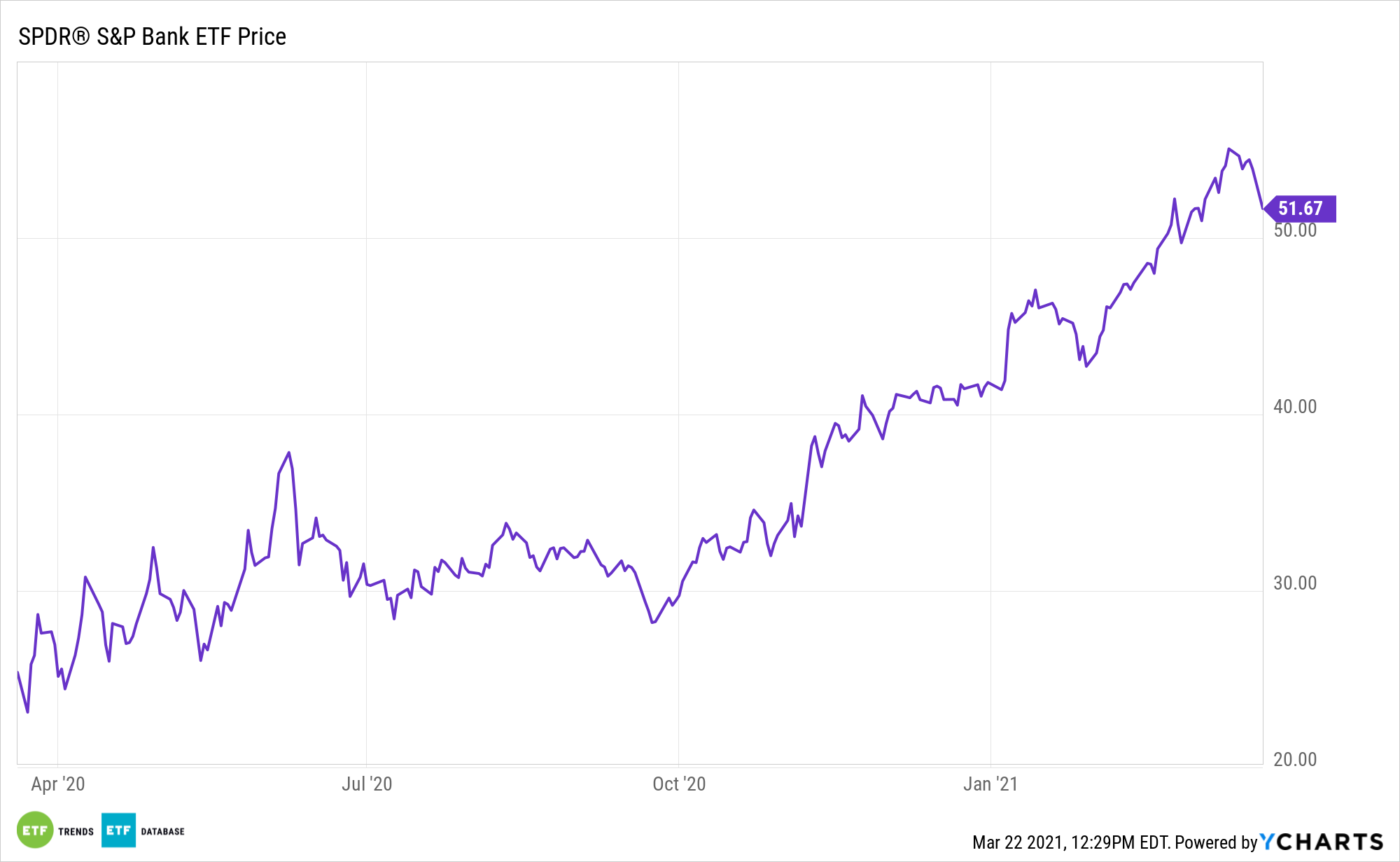

Things are trying up for financial institution shares, making choices just like the SPDR S&P Financial institution ETF (NYSEArca: KBE) interesting to a broader swath of traders.

Final week, JPMorgan Chase (NYSE: JPM) bought the OK to renew inventory buybacks and Moody’s Traders Service says excessive shareholder payouts early this 12 months gained’t pressure banks’ capital positions.

If the financial system improves, KBE holdings might not must cowl as many unhealthy loans as anticipated, which means these reserves might finally be became earnings. The massive banks are additionally at the moment well-capitalized.

See additionally: The Large Banks Are Again: Breaking Down the XLF ETF

“This 12 months, banks have been one of many better-performing sectors within the S&P 500. The SPDR S&P Financial institution exchange-traded fund (ticker: KBE) is up greater than 25%, outpacing the roughly 4% advance within the index,” stories Carleton English for Barron’s. “However even with the sudden run-up, income-hungry traders nonetheless have purpose to put money into the group. Many financial institution shares yield greater than the 1.4% supplied by the broad S&P 500, and several other have dividend yields in extra of three%. What’s extra, the Fed has allowed them to begin elevating their payouts once more, if solely in keeping with earnings.”

The Banks Are Booming

Rising bond yields assist strengthen the enchantment of financial institution shares. These betting on a restoration might do nicely to contemplate shopping for into the financials group because the yields begin to get better after the document lows.

KBE “yields 2%, and with financial-sector earnings set to develop by 50% in 2021, there’s room for that to get bigger. However for traders trying to perform a little extra work, there are a number of compelling alternatives,” based on Barron’s.

Moreover, many are betting on the improved financial situations that may assist assist loans and the additional enlargement of the financial system. Plus, there are some near-term catalysts for KBE and associates, together with strong credit score high quality.

“As Covid-19 vaccines had been rolled out and financial information improved, Wall Avenue was already anticipating that 2021 can be an excellent 12 months for banks. The primary three months of the 12 months have confirmed these hopes, and with the financial restoration nonetheless in its early innings, now may very well be an excellent time for traders to park their cash with banks,” concludes Barron’s.

For extra on revenue methods, go to our Retirement Revenue Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.