Even although the Federal Reserve is not trying to increase rates of interest till 2023, commodities can nonetheless present a portfolio with asset diversification with funds just like the Invesco DB Commodity Index Monitoring Fund (DBC).

The fund seeks to trace adjustments, whether or not constructive or detrimental, within the stage of the DBIQ Optimum Yield Diversified Commodity Index Extra Return™ (DBIQ Choose Yield Diversified Comm Index ER or Index) plus the curiosity revenue from the Fund’s holdings of primarily US Treasury securities and cash market revenue much less the Fund’s bills. The Fund is designed for traders who need a cost-effective and handy strategy to put money into commodity futures.

The Index is a rules-based index composed of futures contracts on 14 of probably the most closely traded and necessary bodily commodities on this planet. The Fund and the Index are rebalanced and reconstituted yearly in November.

Oil costs have been on the rise after rallying from final 12 months’s risky, pandemic-ridden 12 months. DBC’s largest holding consists of WTI Crude futures, giving traders publicity to rising oil costs in addition to gasoline futures.

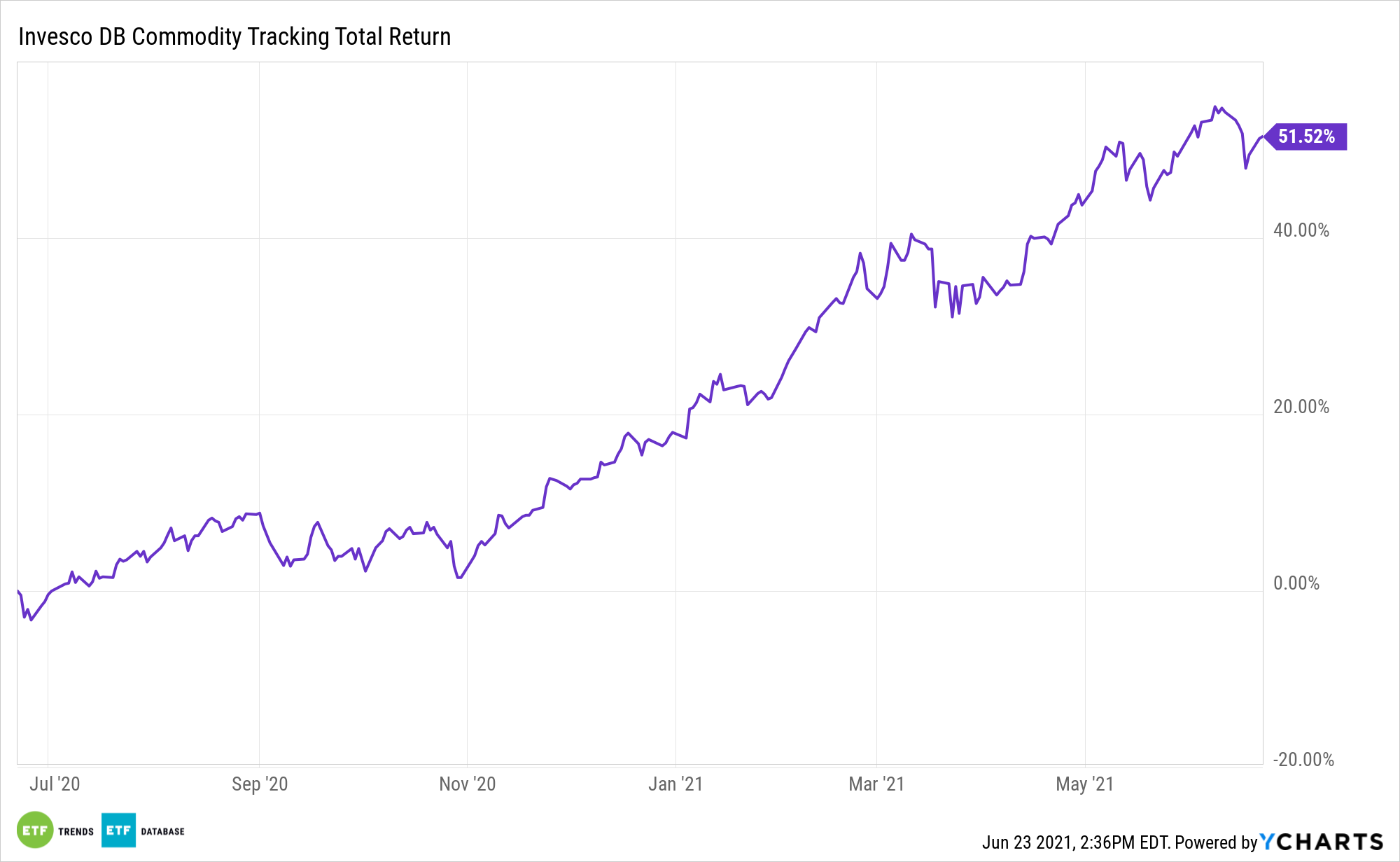

A Commodities Comeback

That comeback in oil costs and, subsequently, gasoline costs, highlights a fair greater comeback for commodities as an entire. Inflationary pressures are additionally paving the best way for traders to make use of commodities as a hedging various.

“Commodities bounced again Monday after a drubbing final week triggered by an more and more inflation-wary Federal Reserve,” a Barron’s article mentioned. “Each historical past and fundamentals present the one-day rally could possibly be changed into an honest-to-goodness profitable streak, in accordance with strategists.”

The Fed’s current assembly might have halted a number of the momentum in commodities, however the longer-term thesis continues to be constructive.

“The Fed, nonetheless, signaled two potential fee hikes in 2023 and acknowledged that members have began to debate tapering—or decreasing—the scale of its bond buying program,” the Barron’s article mentioned. “That brought about bond yields to tumble and the U.S. greenback to rise, each detrimental for commodities, that are priced within the buck.”

“However tapering may not be too damaging to the commodities complicated,” the article added. “In the course of the ‘Taper Tantrum’ in 2013, introduced on by the Fed’s abrupt resolution to scale back its bond purchases, the Bloomberg Commodity Index fell simply over 2% in three months, from the tip of Might to the tip of August, in accordance with Gavekal Analysis. That was the second-best efficiency—behind the S&P 500 —out of 12 belongings that Gavekal tracked for that point interval.”

For extra information and knowledge, go to the Revolutionary ETFs Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.