Advisors are rapidly discovering that conventional

Advisors are rapidly discovering that conventional fastened revenue methods simply aren’t reducing it, notably with important publicity to long-dated Treasuries.

WisdomTree’s U.S. Conservative Progress Mannequin Portfolio is an possibility for larger high quality revenue with fairness publicity. The mannequin portfolio allocates 60 p.c of its weight to fastened revenue change traded funds, a lot of which are not closely depending on U.S. authorities debt.

“These U.S.-focused mannequin portfolios allocate to multi-factor fairness and stuck revenue ETFs throughout a number of danger profiles leveraging our Trendy Alpha® strategy,” in accordance with the issuer.

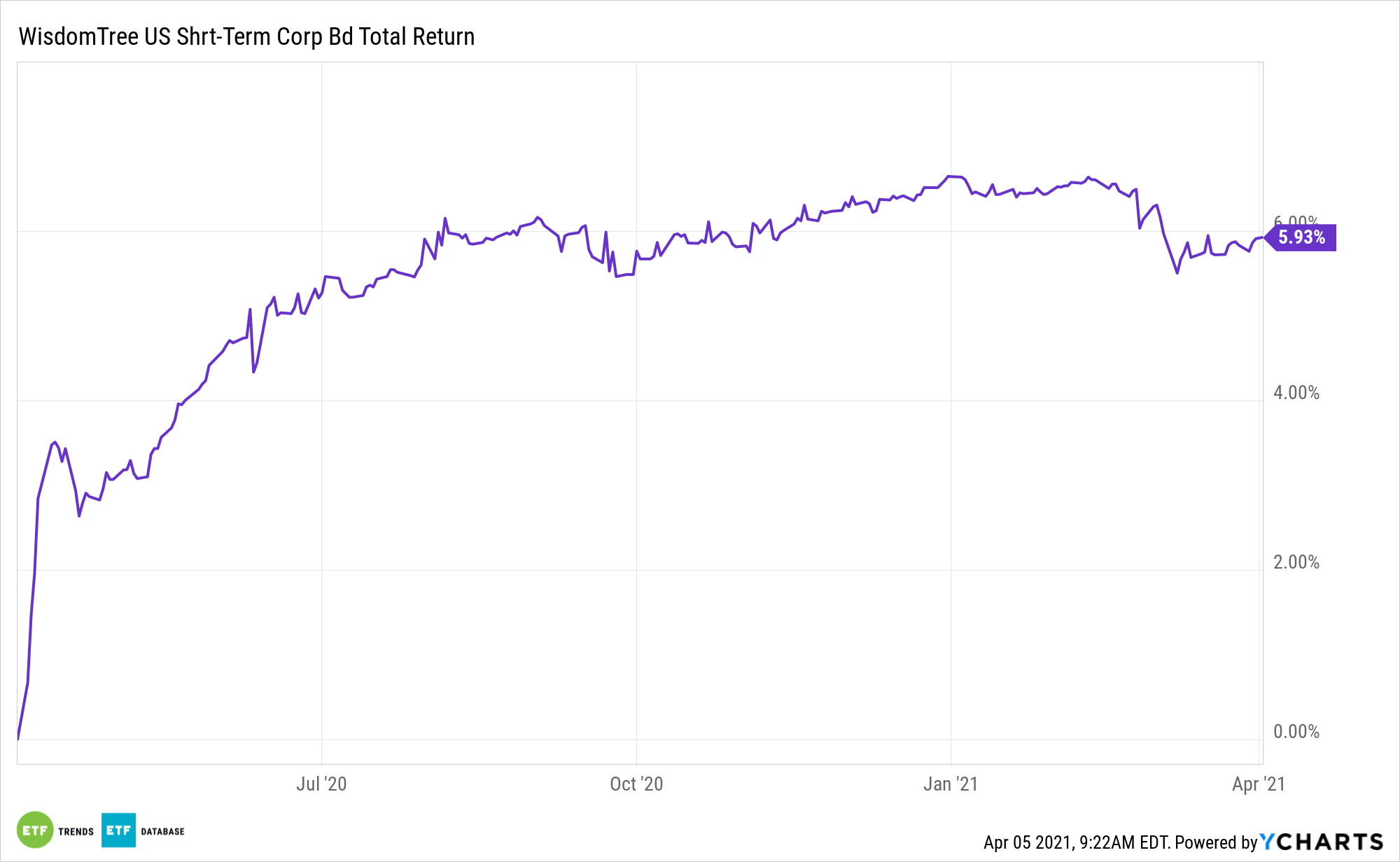

One other benefit of this mannequin portfolio is that it is not depending on lengthy period fare. Throughout the mannequin portfolio are some shorter period concepts, together with the WisdomTree Elementary U.S. Brief-Time period Company Bond Fund (CBOE: SFIG).

Floating Fare

The mannequin portfolio additionally options publicity to floating charge bonds – a related consideration at a time of rate of interest volatility.

The utility of floating charge notes (FRNs) and property just like the WisdomTree Bloomberg Floating Fee Treasury Fund (NYSEArca: USFR) stays in place.

Floaters have some benefits that TIPS do not supply. Floating charge observe coupon funds are based mostly on a reference charge (90-day t-bills) plus a diffusion. Since 90-day payments are auctioned each week, the efficient period of floating charge notes is one week, which permits buyers to seize larger charges of revenue as short-term charges rise. This additionally offers a possibility for buyers to spice up revenue because the Federal Reserve hikes rates of interest.

Wanting forward, the floating charge notes will generate extra curiosity if Treasury costs fall and yields rise additional, which ought to play out if the Fed continues on its rate of interest normalization schedule.

Floating charge notes, just like the title suggests, have a floating rate of interest. Particularly, the notes have a so-called reset interval with rates of interest tied to a benchmark, such because the Fed funds, LIBOR, the prime charge, or the U.S. Treasury invoice charge. As a result of their brief reset intervals, these floating charge funds have comparatively low charge danger.

For extra on methods to implement mannequin portfolios, go to our Mannequin Portfolio Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.