To say it isn't simple investing in bonds nowadays

To say it isn’t simple investing in bonds nowadays is an understatement, however traders can enhance their probabilities of success with the appropriate methods. The FlexShares Prepared Entry Variable Revenue Fund (RAVI) might assist with that problem.

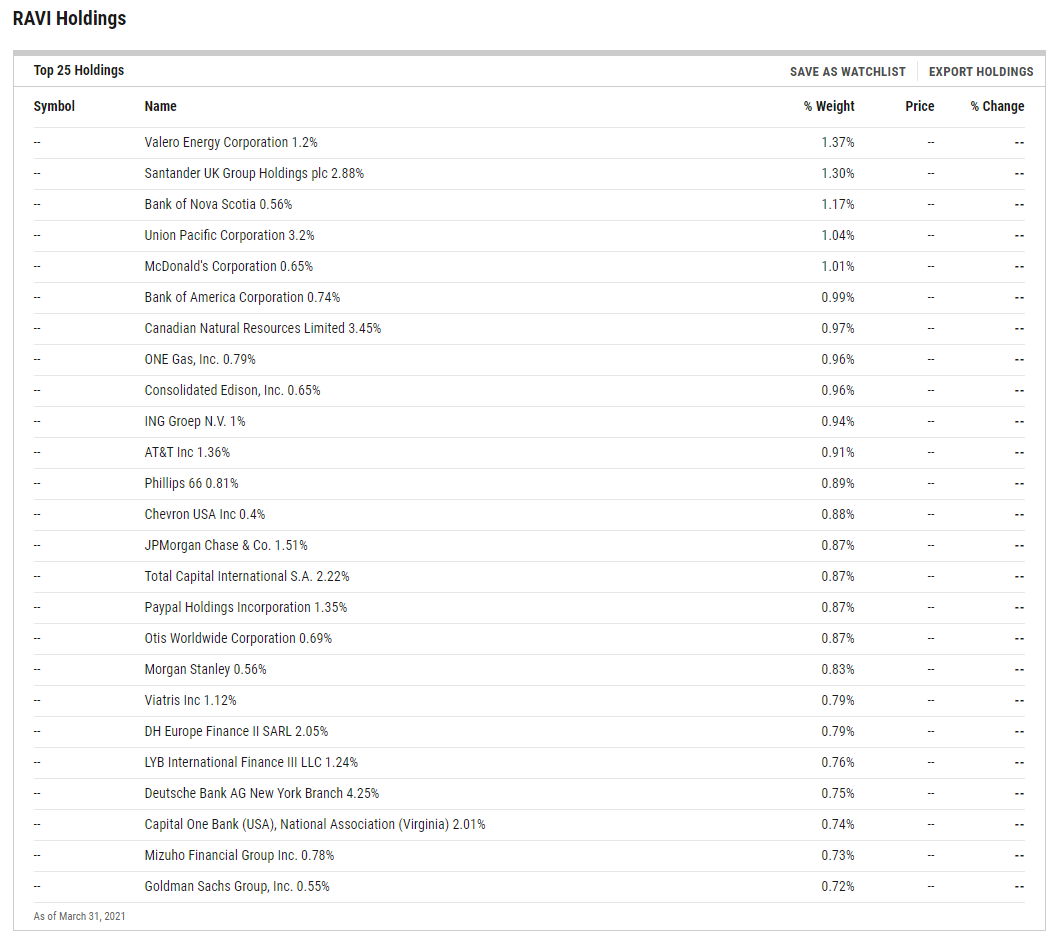

RAVI primarily invests in investment-grade debt securities with a heavy tilt towards U.S. company bonds. In accordance with the fund prospectus, the ETF can also make investments, with out limitation, in mounted revenue securities and devices of overseas issuers in developed and rising markets, together with debt securities of overseas governments, and will make investments greater than 25% of its whole belongings in securities and devices of issuers in a single developed market nation. RAVI can maintain as much as 20% of its whole belongings in mounted revenue securities and devices of issuers in rising markets.

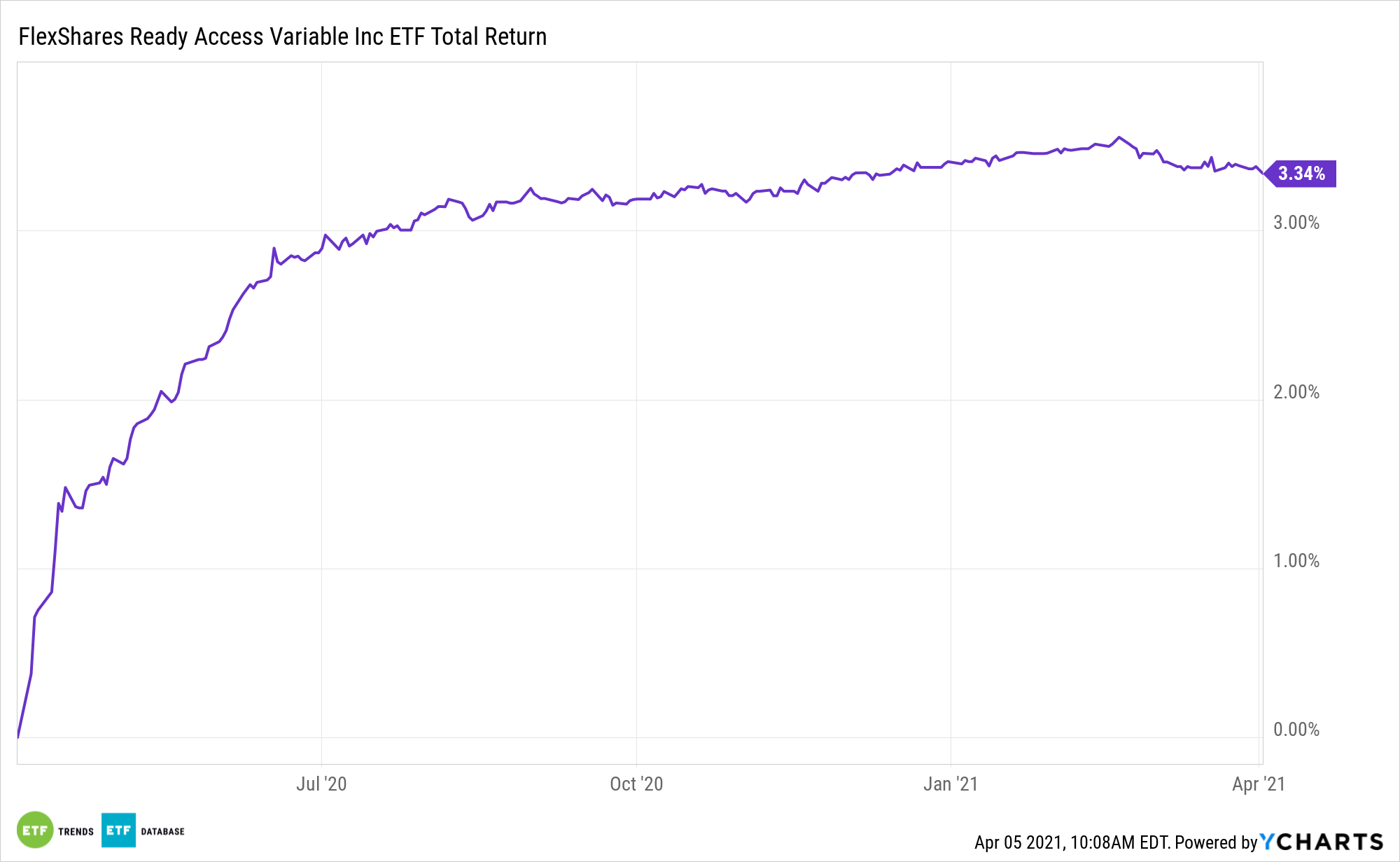

RAVI could also be one thing for traders searching for just a little extra yield than what’s offered by cash market funds, however don’t wish to transfer too far out of the short-duration finish of the yield curve. Moreover, RAVI’s current efficiency has been stable.

A Altering Cash Market Panorama

The continuing low-yield setting and enhancing financial sentiment has helped push traders towards company debt. Nonetheless, potential traders ought to be conscious that company bonds have traditionally exhibited higher volatility than U.S. Treasuries as a result of elevated volatility in company money flows and credit score dangers, together with higher liquidity dangers.

The standard cash market fund panorama has modified for the reason that monetary disaster, as regulatory hurdles beforehand fettered this mounted revenue phase. RAVI was born out of the pending rules following the monetary disaster that many cash market funds confronted.

RAVI is actively managed and tries to generate most present revenue according to the preservation of capital and liquidity by short-term investment-grade debt securities and money equivalents.

For extra on multi-asset methods, go to our Multi-Asset Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.