It was a tough first half of 2020 by way of dividend cuts and suspensions, however issues perked up

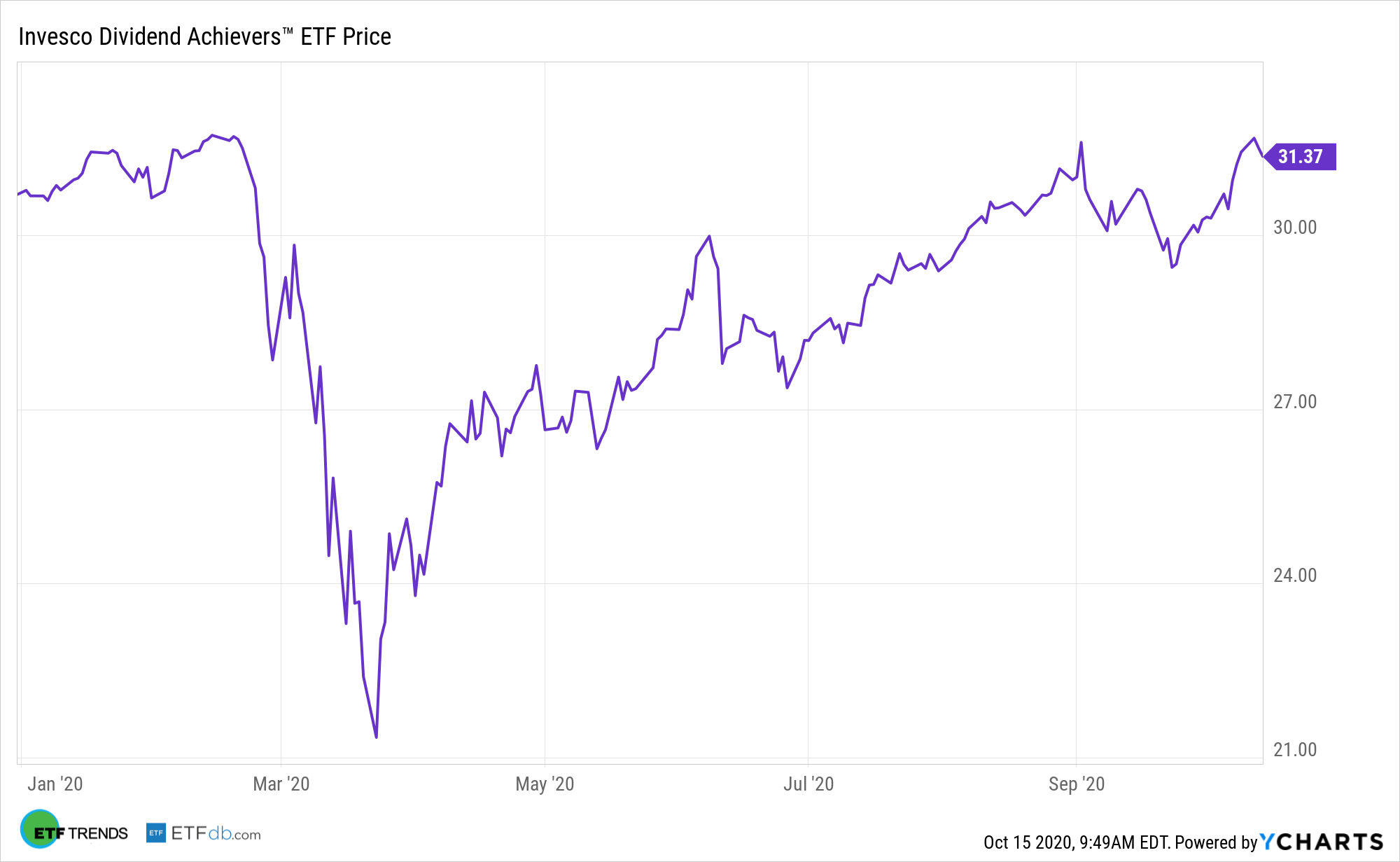

It was a tough first half of 2020 by way of dividend cuts and suspensions, however issues perked up within the third quarter, shining a light-weight on the advantages of alternate traded funds, such because the Invesco Dividend Achievers ETF (NASDAQ: PFM).

PFM, which yields 2.09%, is larger by almost 19% over the previous six months. The $433 million PFM is greater than 15 years previous and follows the NASDAQ US Broad Dividend Achievers. That benchmark requires member companies to have dividend enhance streaks of a minimum of 10 years.

“As yield-paying firms get well from the coronavirus-driven slowdown that led lots of them to chop their payouts earlier within the yr, buyers could also be questioning whether or not the dividend commerce is but secure,” reviews Lizzy Gurudus for CNBC.

As a consequence of its emphasis on payout development quite than excessive yields, PFM is a secure thought for buyers seeking to revisit dividend shares over the near-term.

Highly effective PFM Payout Development

PFM’s emphasis on dividend growers is especially related in immediately’s market setting. Dividend-growing firms are additionally top quality names. Regular dividend payouts have additionally helped produce improved risked-adjusted returns over time.

The high-quality focus can also assist dividend growers outperform or do much less poorly than the broader markets throughout weaker durations.

Dividends have added considerably to returns over time, contributing roughly 32% of the S&P 500’s complete return since 1960. Throughout the return-challenged 1970s, dividends made up almost three-quarters of S&P 500 returns – whereas buyers earned a cumulative complete return of 77% from the S&P 500 in that decade, 60% of that 77% was from dividends.

PFM holds almost 300 shares and its second-largest sector weight is know-how at nearly 16%. That is significant for buyers within the present setting and going ahead.

For years, know-how was the not first sector buyers considered once they considered dividends. The biggest sector weight within the S&P 500 is altering that and that change has been a boon for an array of ETFs. The truth is, in greenback phrases, know-how is now the biggest dividend-paying sector within the U.S.

Furthermore, many tech firms already paying dividends have the steadiness sheets to assist and develop these payouts.

For extra on progressive portfolio concepts, go to our Nasdaq Portfolio Options Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.