The first quarter ended final week and, amongst different issues, meaning one other earnings season will quickly kick off. That additionally implies that, per typical, monetary providers shares will get the ball rolling, placing the Invesco KBW Financial institution ETF (NASDAQ: KBWB) in focus.

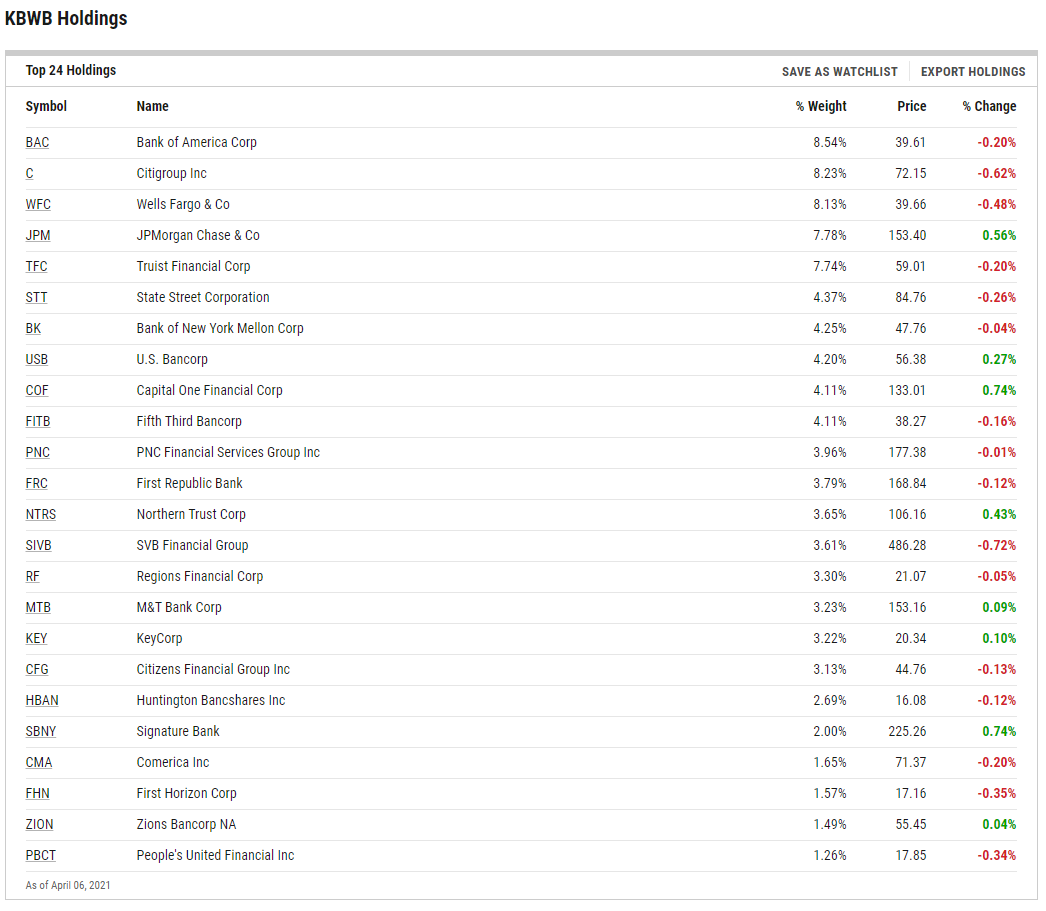

KBWB tracks the extensively adopted KBW Nasdaq Financial institution Index.

“The Index is a modified-market capitalization-weighted index of firms primarily engaged in US banking actions. The Index is compiled, maintained and calculated by Keefe, Bruyette & Woods, Inc. and Nasdaq, Inc. and consists of enormous nationwide US cash facilities, regional banks and thrift establishments which might be publicly traded within the US,” in keeping with Invesco.

Buyers could wish to put together for some nice features from KBWB this earnings season.

Matt O’Connor, analyst at Deutsche Financial institution, “sees earnings per share rising by as a lot as 20% in 2023 and 2024 and shares gaining as a lot as 50% over the subsequent two to 3 years. Banks will proceed to learn from the issues which have helped them this yr, however O’Connor additionally expects that mortgage development shall be a driver of leads to the again half of the yr because the financial system is on even firmer footing,” experiences Carleton English for Barron’s.

Earnings, Fund Constituents, Mortgage Loss Reserves, and Extra

Up 24.91% year-to-date, KBWB is benefiting from the worth rotation – a transfer market observers consider has potential to final for awhile longer. Robust earnings can add to the medium-term case for KBWB as will rising rates of interest.

Deutsche Financial institution’s O’Connor “went on to notice {that a} 10% soar in mortgage development provides roughly 8% to banks’ earnings. The sector typically must see a full share level enhance in rates of interest to see an analogous impression to earnings,” in keeping with Barron’s.

KBWB incorporates the who’s-who of the home financial system’s monetary gamers, together with JP Morgan, Wells Fargo, and plenty of extra. This makes it a great play on the U.S. financials world.

“Goldman Sachs additionally issued a bullish word on the sector. With large banks set to report earnings subsequent week, analysts at Goldman Sachs mentioned they anticipate executives to strike an optimistic tone for this yr and subsequent,” provides Barron’s.

Lastly, extra KBWB catalysts embrace buybacks and dividend development later this yr and banks releasing their mortgage loss reserves because the financial system improves.

For extra information, info, and technique, go to the ETF Training Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.