With a decrease unemployment fee and constructive job positive factors reported, the financial outlook for the remainder of the yr is trying extraordinarily robust, stories Reuters. Whereas earnings season noticed some preliminary issues of how a lot development the large- and mega-caps might proceed to supply, as most outperformed but once more, a rising has helped assuage issues.

The unemployment fee fell to five.4% in July, down from the 5.9% in June, a 16-month low. Payrolls (non-farm) additionally elevated 943,000 in July, with common hourly wages rising 0.4%. This displays probably the most staff employed in nearly a yr, with wages persevering with to rise.

“We’re charting new financial enlargement territory within the third quarter,” Brian Bethune, professor of apply at Boston School in Boston, instructed Reuters. “The general momentum of the restoration continues to construct.”

General, 4.three million jobs this yr have been created, however the financial system nonetheless displays a 5.7 million job deficit from peak February 2020 numbers. The long-term unemployment determine fell to three.Four million from Four million in June, with the length of unemployment additionally falling to 15.2 weeks from 19.eight weeks.

‘CFA’ Presents Massive Cap Publicity with Volatility Weighting

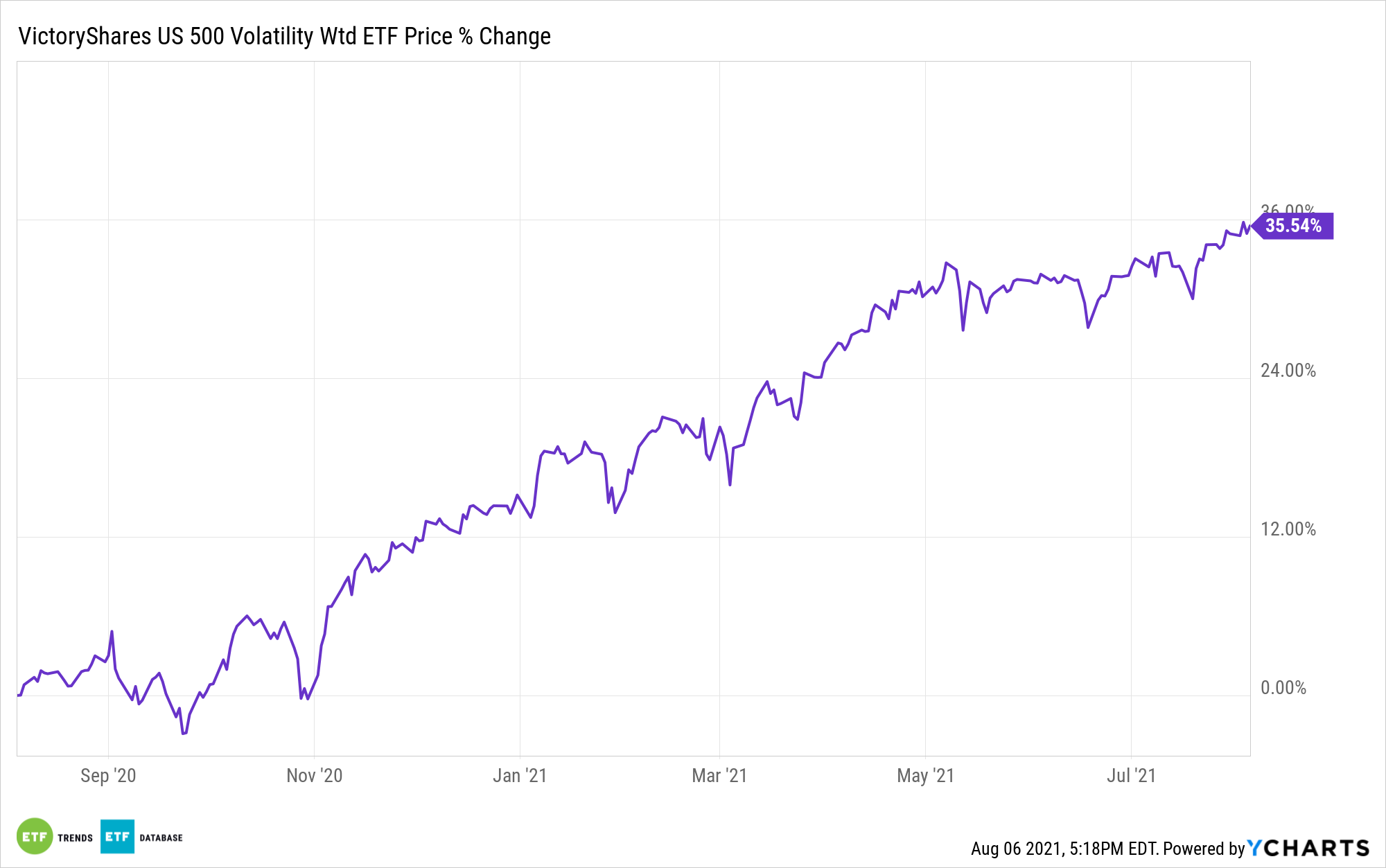

For cautious traders that wish to capitalize on the continued development anticipated by economists, the VictoryShares US 500 Volatility Wtd ETF (CFA) is a stable possibility. The fund permits traders to realize balanced publicity to massive cap U.S. equities with a novel volatility-weighted method.

CFA tracks the Nasdaq Victory US Massive Cap 500 Volatility Weighted Index. The benchmark screens all publicly traded U.S. shares and solely contains these with constructive earnings in the newest Four quarters.

From there, the benchmark takes the highest 500 shares by market cap and weights them primarily based on the volatility of their worth adjustments over the earlier 180 days. These with lowest volatility get the very best weighting, whereas these with highest volatility have the bottom weighting.

CFA’s sector breakdown as of finish of June features a 17.63% allocation to industrials, a 16.03% allocation to info expertise, 15.97% to financials, 14.27% to healthcare, 9.97% in client discretionary, and numerous smaller allocations.

The fund has an expense ratio of 0.35%.

For extra information, info, and technique, go to the Nasdaq Portfolio Options Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.