Traditional fossil gas corporations and their renewable power counterparts are sometimes pitted in opposition to one another. The previous is seen as a first-rate contributor to air pollution and and considered as a lumbering, outdated trade with its greatest days behind it.

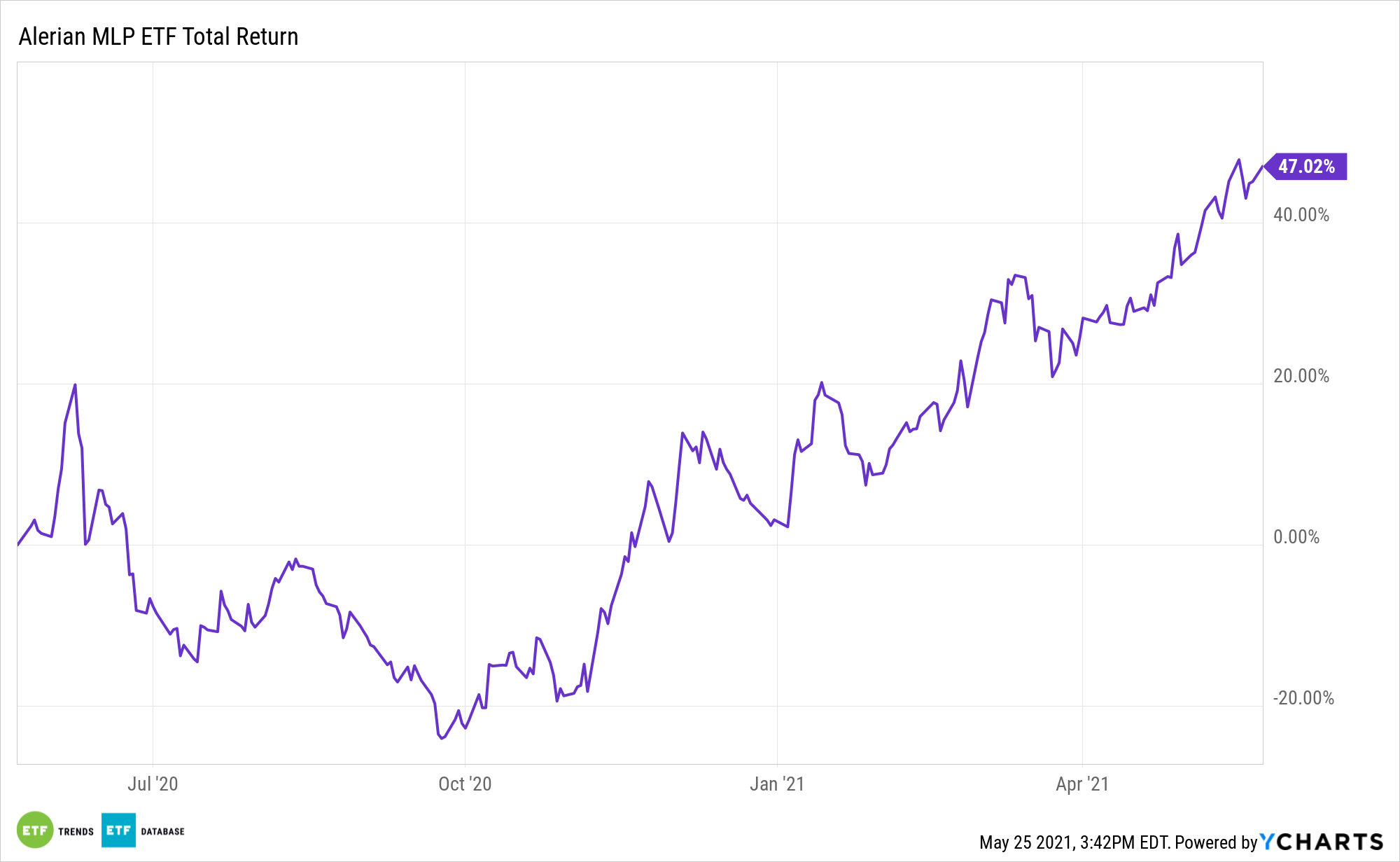

Alternatively, renewables suppliers are sometimes nimble progress corporations. But many older producers, together with midstream names residing within the ALPS Alerian MLP ETF (NYSEArca: AMLP), need to play more and more outstanding inexperienced power roles.

For many years, the bread and butter of midstream corporations and grasp restricted partnerships (MLPs) was the processing, storage, and transportation of pure gasoline and oil. Nonetheless, the power panorama is quickly altering, and lots of producers should adapt or die.

“Per latest quarters, alternatives associated to the power transition and renewables have been a standard subject throughout earnings calls,” says Alerian Director of Analysis Stacey Morris. “For a lot of corporations, these evaluations are of their early levels. Traders will largely want to remain tuned for extra particulars round potential tasks and initiatives involving carbon seize, hydrogen, renewable diesel and associated feedstocks, renewable pure gasoline, and different alternatives round sourcing energy from wind or photo voltaic amenities.”

Midstream Examples Piling Up

As one instance of a midstream title turning an eye fixed in the direction of renewables, Williams Cos. (NYSE: WMB) has recognized three new photo voltaic tasks, bringing its backlog to 16. Whereas Williams is not an AMLP holding, among the fund’s parts are boosting their inexperienced power footprints.

“Whereas particulars stay restricted, some corporations offered a glimpse underneath the hood into tasks being developed,” provides Morris. “ET’s administration indicated that they’re engaged on a carbon seize mission on the Marcus Hook terminal, which seems viable even with out federal tax credit. Enbridge (ENB) talked about the potential for a carbon dioxide trunkline in Northern Alberta and in addition expanded on its not too long ago introduced renewable pure gasoline partnership with Walker Industries – a significant landfill participant – and Comcor Environmental. Along with the Niagara mission that’s underneath building, the companions are taking a look at 10-15 different alternatives at present.”

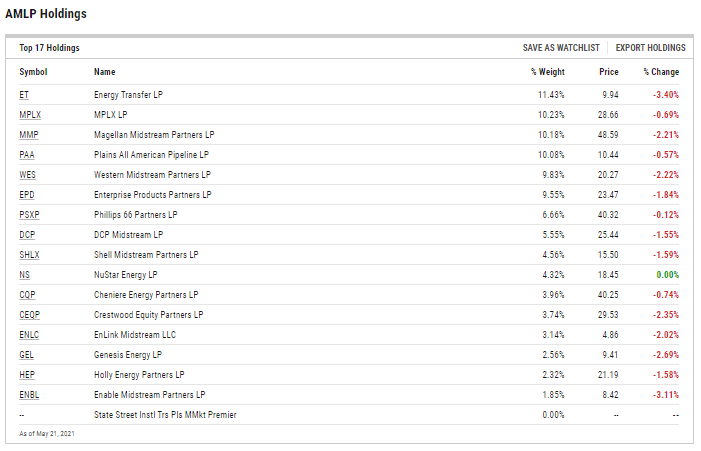

“ET” refers to Power Switch (NYSE: ET), AMLP’s greatest constituent at a weight of 11.43%. EnLink Midstream (NYSE: ENLC) has its personal clear power ambitions, with a objective of being web zero for carbon by 2050. That small cap midstream title accounts for 3.14% of AMLP’s roster.

For extra on cornerstone methods, go to our ETF Constructing Blocks Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.