U.S. markets surged Monday, with the Dow Jones Industrial Common on tempo for its strongest session in over three months. Worth change traded funds took the lead, as buyers jumped again to vitality and different economically delicate sectors.

“It’s a Dr. Jekyll and Mr. Hyde market. Final week it was Mr. Hyde and at the moment it’s Dr. Jekyll popping out,” Jeff Carbone, co-founder of Cornerstone Monetary Companions, advised Reuters. “Immediately, there’s not lots of concern on the market, and that worries us greater than anything.”

Monday’s positive aspects was a stark distinction to the rally in development shares final week after the Federal Reserve’s hawkish indicators pointed to a shift in financial coverage and triggered the worst weekly efficiency of the Dow and S&P 500 in months.

However, buyers appeared optimistic about shares, with the idea that sooner development and inflation within the coming months will proceed to help the market total, even when the long-term price outlook rises barely.

“For many buyers, wanting throughout the asset panorama, there nonetheless stays no different to equities,” Fahad Kamal, chief funding officer at Kleinwort Hambros, advised the Wall Road Journal. “Hiring is occurring and normality is returning, and all of that’s actually optimistic for cyclicality.”

Buyers who’re thinking about a focused strategy to the worth section can look to the American Century STOXX U.S. High quality Worth ETF (NYSEArca: VALQ). VALQ’s inventory choice course of features a worth rating based mostly on worth, earnings yield, and money circulate yield, together with a sustainable earnings rating based mostly on dividend yield, dividend development, and dividend protection.

The American Century Targeted Massive Cap Worth ETF (FLV) tries to realize long-term returns by way of an funding course of that seeks to establish worth and reduce volatility. FLV holdings and worth shares normally commerce at decrease costs relative to basic measures of worth, like earnings and the guide worth of property.

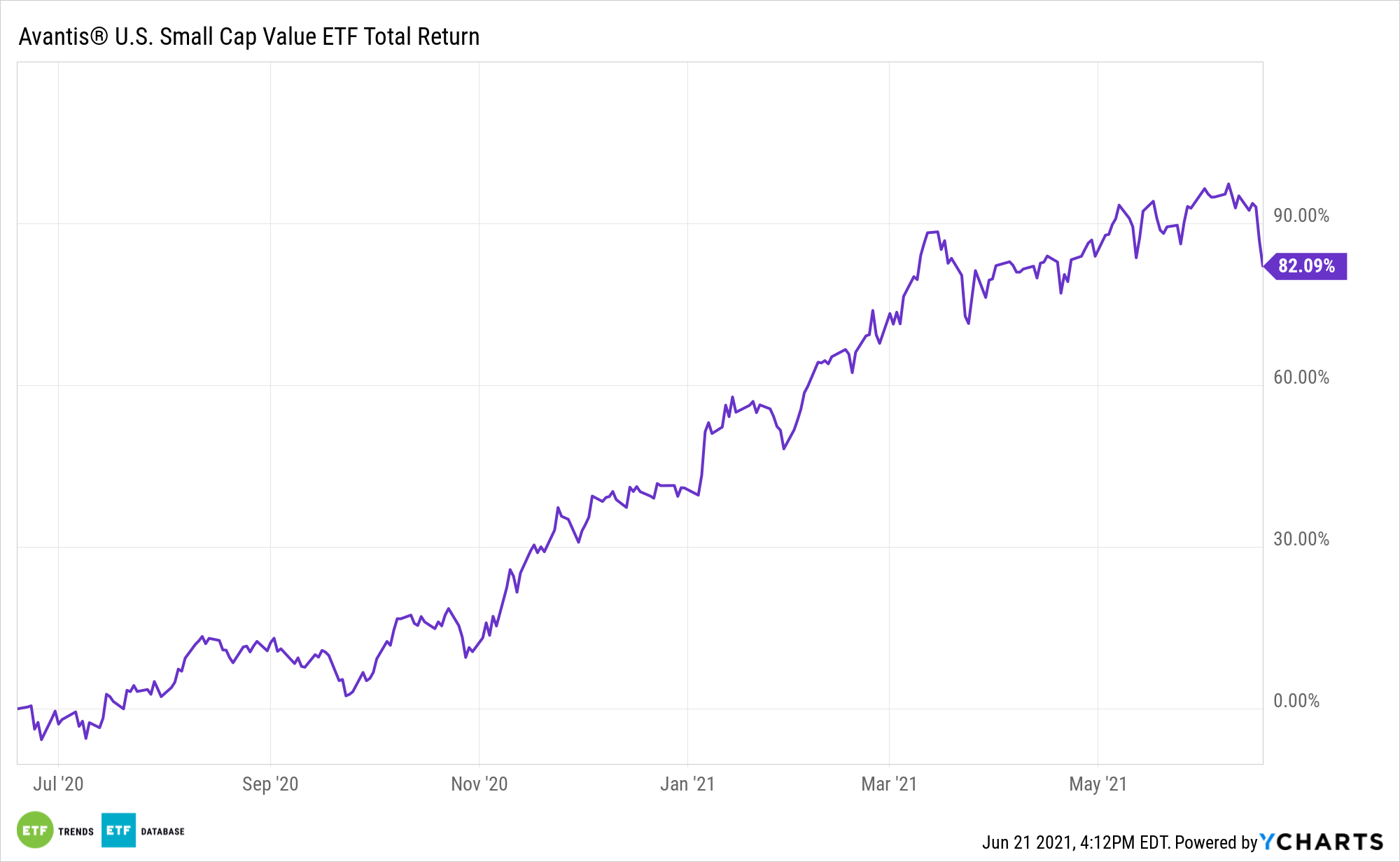

Lastly, the Avantis U.S. Small Cap Worth ETF (AVUV), an actively managed ETF, seeks long-term capital appreciation. The fund invests primarily in U.S. small cap firms and is designed to extend anticipated returns by specializing in companies buying and selling at what are believed to be low valuations with increased profitability ratios.

For extra information, data, and technique, go to the Core Methods Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.