By Jeff Weniger, CFA, Head of Fairness

By Jeff Weniger, CFA, Head of Fairness Technique

If low inflation after the 2009 world monetary disaster meant progress inventory dominance all these years, does an inflation shock result in new management by worth shares?

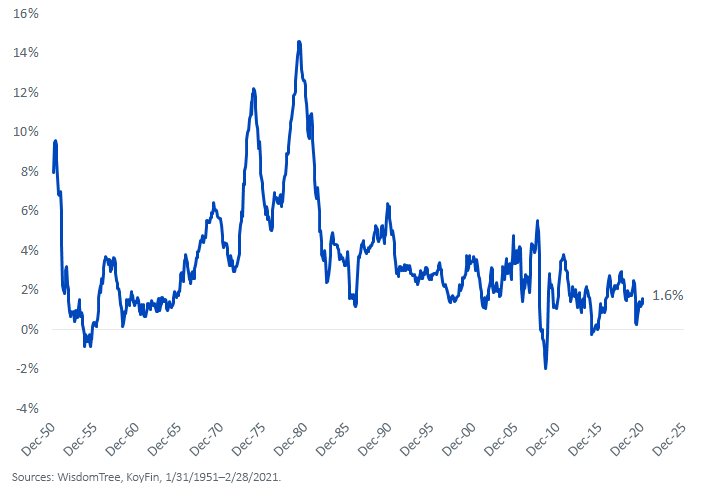

Worth stress in on a regular basis items and companies has been trending decrease since I breathed my first breath 4 a long time in the past. As our collective recollections age and fade, I believe many discover it exhausting to think about that U.S. client value inflation (CPI) was operating at 10%–14% yearly from 1979–1981.

Determine 1: Annual U.S. Shopper Worth Inflation (CPI)

Annual M2 cash provide progress averaged 6.4% within the 40 years to January, together with the large surge during the last yr, which witnessed it rise 25.8%. With such will increase within the variety of {dollars} in our pockets, why then is it a matter of routine to witness inflation within the 1%–2% vary?

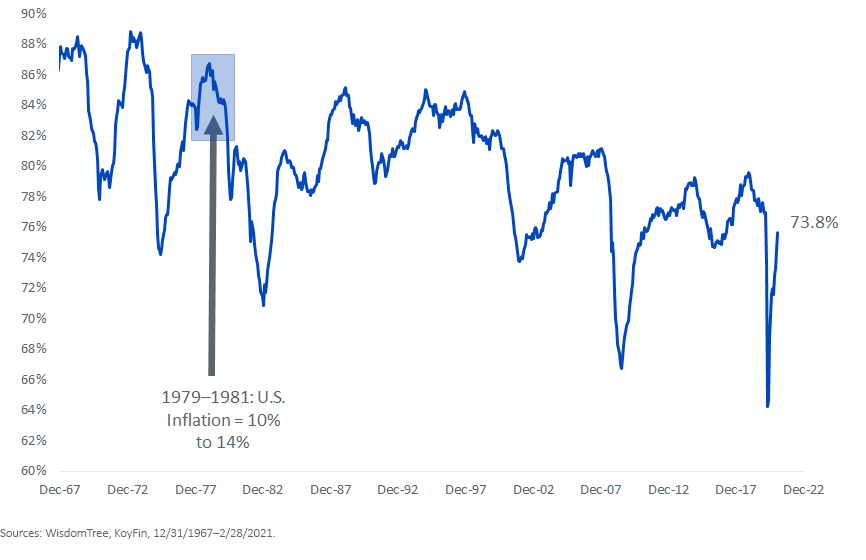

Capability utilization partly explains it. The USA’ industrial machine is barely operating at 73.8% of its full-throttle functionality (determine 2). The downtrend over the a long time is obvious and current.

Determine 2: U.S. Capability Utilization

Nonetheless, a couple of issues are happening. First, final yr’s 26% progress in cash provide should still be filtering its approach into the system, aching to point out up within the costs on the grocery store. And if the U.S. does hit COVID-19 herd immunity within the coming months, a surge in demand for items and companies may carry capability utilization in step with ranges according to a buzzing rebound.

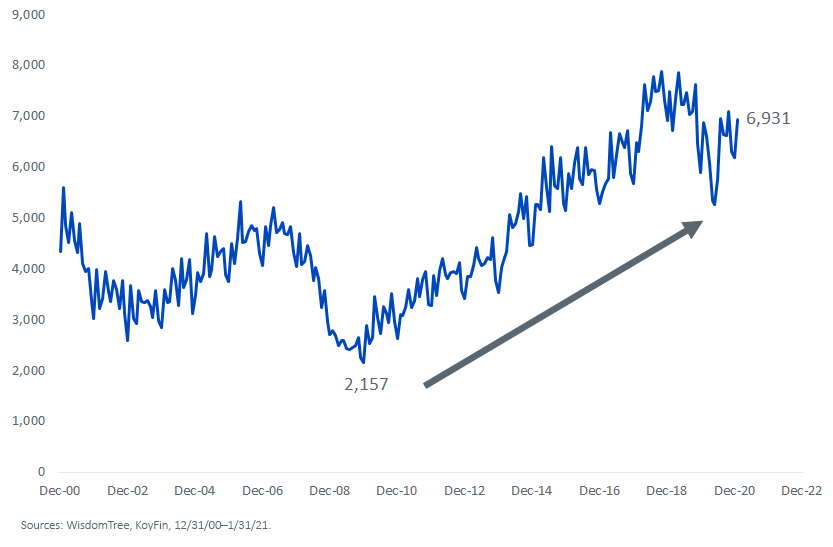

Not like the final restoration, the place job seekers in 2010 and 2011 may select from simply two or three million jobs, proper now there are practically seven million job postings (determine 3). Not solely that, however “laptop computer employees” could have a neater go at discovering the right match now that many can work from anyplace. Employers want these jobs to be stuffed; wage inflation is the doubtless recipe.

Determine 3: U.S. Complete Nonfarm Job Openings (Thou.)

The themes of the inventory market’s rally from the worldwide monetary disaster low on March 9, 2009 to its pre-crash highs on February 19, 2020: disinflation and progress shortage.

Over these practically 11 years, the S&P 500 Development Index outperformed S&P 500 Worth by 248 foundation factors (bps) yearly (19.42% vs. 16.94%, respectively). Within the crash itself, the S&P 500 Development outperformed but once more, declining “solely” 31.33% from February 19, 2020 to March 23, 2020, whereas the S&P 500 Worth Index fell 36.78%.

When the market turned on a dime final March, definitely that will be the time for worth to shine, proper?

Fallacious.

Although shares have been on rocket boosters, the bond market was nonetheless pricing in disinflation: The 10-Yr U.S. Treasury word yield saved drifting decrease. Although it yielded 0.79% in March when the inventory market bottomed, by August 4, 2020, it was all the way down to 0.51%.

The bond market’s disinflation/deflation forecast confirmed up within the returns of progress and worth. The S&P 500 Development Index received the early levels of the COVID-19 restoration rally, rising 56.6% by way of August 4, 2020. Worth struggled to maintain up, operating 38.4% greater.

In order that we now have this straight: Development outperformed throughout an 11-year rally, then outperformed once more in a crash, then outperformed once more within the restoration. A depressing scenario for worth traders.

However the story doesn’t finish on August 4, 2020. Since then, the t-note yield has turned tail, with the bond market promoting pushing its yield to 1.72%.

The trigger: an inflation buzz. From the bond market’s August excessive by way of March 30, 2021, the S&P 500 Worth Index has rallied 27.8%, trudging forward of the 15.1% return of the S&P 500 Development Index.

The bond market is guiding the inventory market. If falling charges meant progress inventory dominance, it might appear the other would imply…nicely, the other. A nascent worth cycle could also be beneath approach.

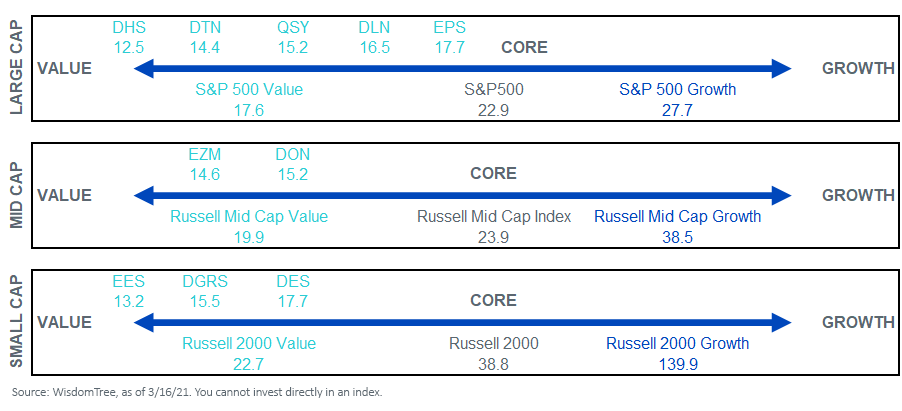

Here’s a value-core-spectrum for selecting how one can play U.S. equities through WisdomTree.

Determine 4: WisdomTree’s Worth-Oriented U.S. ETFs, by Ahead Worth-to-Earnings (P/E) Ratio

For definitions of indexes within the chart, please go to our glossary.

For standardized efficiency of the Funds within the chart, please click on right here.

Initially printed by WisdomTree, 4/5/21

Necessary Dangers Associated to this Article

There are dangers related to investing, together with the attainable lack of principal. Funds focusing their investments on sure sectors improve their vulnerability to any single financial or regulatory growth. This may occasionally lead to larger share value volatility. Please learn every Fund’s prospectus for particular particulars concerning the Fund’s danger profile.

U.S. traders solely: Click on right here to acquire a WisdomTree ETF prospectus which incorporates funding targets, dangers, expenses, bills, and different info; learn and take into account rigorously earlier than investing.

There are dangers concerned with investing, together with attainable lack of principal. Overseas investing includes forex, political and financial danger. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller corporations could expertise larger value volatility. Investments in rising markets, forex, fastened revenue and different investments embrace extra dangers. Please see prospectus for dialogue of dangers.

Previous efficiency will not be indicative of future outcomes. This materials incorporates the opinions of the writer, that are topic to vary, and may to not be thought of or interpreted as a suggestion to take part in any specific buying and selling technique, or deemed to be a proposal or sale of any funding product and it shouldn’t be relied on as such. There isn’t any assure that any methods mentioned will work beneath all market circumstances. This materials represents an evaluation of the market atmosphere at a selected time and isn’t supposed to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation concerning any safety particularly. The person of this info assumes all the danger of any use made from the data supplied herein. Neither WisdomTree nor its associates, nor Foreside Fund Companies, LLC, or its associates present tax or authorized recommendation. Traders searching for tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Except expressly said in any other case the opinions, interpretations or findings expressed herein don’t essentially signify the views of WisdomTree or any of its associates.

The MSCI info could solely be used to your inner use, might not be reproduced or re-disseminated in any kind and might not be used as a foundation for or part of any monetary devices or merchandise or indexes. Not one of the MSCI info is meant to represent funding recommendation or a suggestion to make (or chorus from making) any form of funding determination and might not be relied on as such. Historic information and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI info is supplied on an “as is” foundation and the person of this info assumes all the danger of any use made from this info. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI info (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this info, in no occasion shall any MSCI Social gathering have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss income) or another damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Companies, LLC.

WisdomTree Funds are distributed by Foreside Fund Companies, LLC, within the U.S. solely.

You can’t make investments instantly in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.