Small cap power is exhibiting itself within the Russell 2000, which is up over 46% throughout the f

Small cap power is exhibiting itself within the Russell 2000, which is up over 46% throughout the final six months. The Invesco S&P SmallCap Worth with Momentum ETF (XSVM), which is up nearly 60% in that very same time-frame, provides dashes of worth and momentum to the combo.

At a complete expense ratio of 0.39%, XSVM seeks to trace the funding outcomes (earlier than charges and bills) of the S&P Small Cap 600 Excessive Momentum Worth Index. The fund typically will make investments at the very least 90% of its whole belongings within the securities that comprise the underlying index.

Strictly in accordance with its pointers and mandated procedures, the index supplier compiles, maintains and calculates the underlying index, which is designed to trace the efficiency of roughly 120 shares within the S&P SmallCap 600® Index which have the very best “worth” and “momentum” scores.

XSVM has gained nearly 13% heading out of This fall 2020 and into the brand new 12 months.

September 18, 2020 marked the purpose at which the 50-day transferring averaged crossed up over the 200-day transferring common. This ‘golden cross’ is often adopted by a bullish uptrend and the fund did precisely that by gaining over 40% since that day.

When making use of a momentum indicator just like the relative power index (RSI), XSVM holds slightly below overbought ranges to verify the sturdy momentum. Including the worth issue to the fund helps display out high quality names throughout the index.

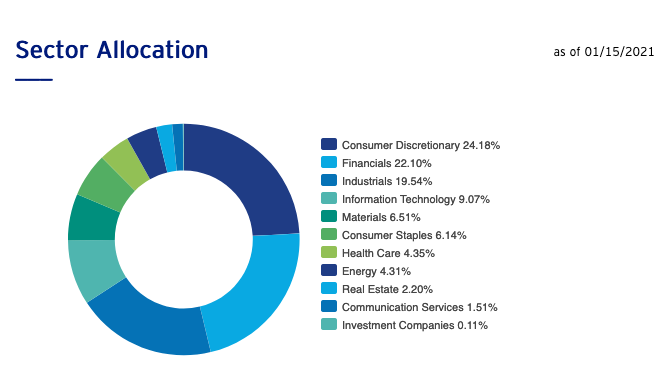

The portfolio’s holdings are a combined bag. On the high, there is a concentrated dose of shopper discretionary allocation, whereas financials and industrials spherical out the highest three sectors.

Outpacing the Russell 2000 and MSCI Indexes

The ETF has outperformed the Russell 2000 index by about 12%. Screening out holdings for momentum and worth seems to be working within the fund’s favor.

When extrapolating worth and momentum, into two separate indexes by way of the MSCI ACWI Small Cap Worth and MSCI EAFE Small Cap Momentum, XSVM additionally outperforms each these indexes. In comparison with the worth index, XSVM is larger by over 20% and when in comparison with the momentum index, the ETF is up over 30% larger general.

For extra information and knowledge, go to the Revolutionary ETFs Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.