A weaker USD is often a superb signal for commodity costs. For the USD/CAD, this dynamic is doubly true and is encouraging information for CAD bac

A weaker USD is often a superb signal for commodity costs. For the USD/CAD, this dynamic is doubly true and is encouraging information for CAD backers. Nevertheless, the previous day hasn’t introduced a lot volatility to this pair. Though WTI crude oil has cracked the $41.00 deal with and the FED is betting large on greenback devaluation, the Loonie has been quiet. Going into Friday’s session, the USD/CAD has posted a meager 120 pip weekly vary amid quiet buying and selling circumstances.

So, why the hesitation from foreign exchange merchants? Given the present fundamentals, shouldn’t promoting the USD/CAD be a no brainer? Not fairly. Right here’s why:

- COVID-19: At this level within the COVID-19 pandemic, it seems to be just like the U.S. is main Canada in restoration. Job losses north of the border are nonetheless excessive, as proven by in the present day’s Canadian ADP Employment figures for August (-205.4K). This quantity missed the projected 901.8K badly, hurting sentiment towards the Loonie.

- Crude Oil Seasonality: Though WTI has rallied this week, fall/winter seasonality is true across the nook. If WTI turns into snug between $35.00 and $30.00 for the following six months, the Canadian vitality trade will contract additional.

Tomorrow, we’ll study a bit extra about Canada’s financial image. Retail Gross sales (July) are due out in the course of the pre-U.S. market hours. Not a lot is anticipated, solely about 1.0% progress, down from 23.7% in June. If this quantity misses the mark, the USD/CAD could also be poised to increase its two-week successful streak.

USD/CAD Challenges Fibonacci Resistance

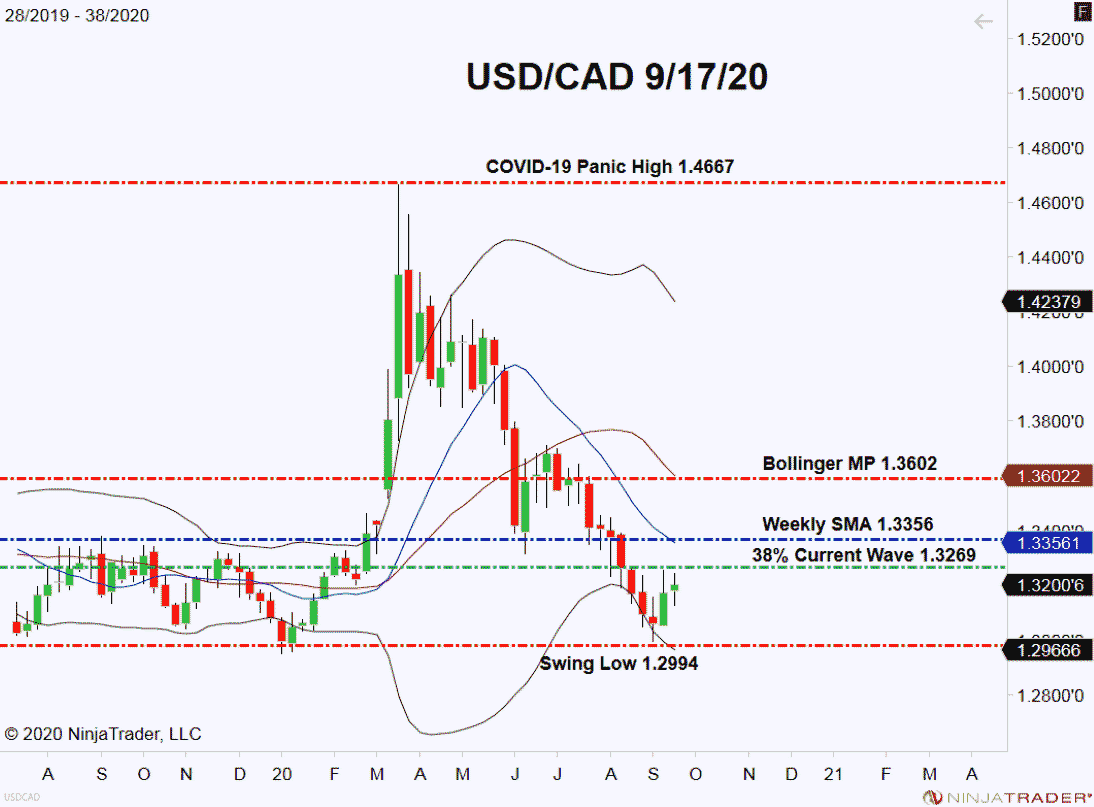

In a Stay Market Replace from final week, I broke down the significance of the 38% Fibonacci retracement on the USD/CAD weekly chart. This degree has already held up as soon as ― will it stand tall once more?

+2020_38+(11_29_08+AM).png)

Listed below are the important thing areas to look at on this marketplace for the close to future:

- Resistance(1): 38% Present Wave Retracement, 1.3269

- Help(1): Swing Low, 1.2994

Overview: If we see the USD/CAD shut the week above 1.3269, then this summer season’s downtrend could also be in jeopardy. Ought to this happen, a shorting alternative from the Weekly SMA could also be within the playing cards for coming classes.

Additionally, when you’re buying and selling the Loonie, remember to regulate WTI crude oil pricing. The October/November contracts are scheduled to roll over tomorrow. Excessive motion in WTI is feasible as institutional gamers carry within the month-to-month unfold.