After EU stimulus delay, euro units sights on flash PMIs as rally falters – Foreign exchange Information Preview

After EU stimulus delay, euro units sights on flash PMIs as rally falters – Foreign exchange Information Preview

Posted on June 19, 2020 at 12:43 pm GMTRaffi Boyadjian, XM Funding Analysis Desk

Eurozone PMIs bounced again strongly in Could, fuelling hopes of financial restoration on this planet’s largest buying and selling block. However with EU solidarity as soon as once more being examined as leaders are cut up on a virus rescue plan, all eyes shall be on the preliminary PMI indicators for June due on Tuesday (08:00 GMT) for indicators that the restoration stays on observe. The information may set the euro’s subsequent course because the forex consolidates after coming shut to totally retracing its March fall.

EU restoration fund runs into bother

There could be little doubt that the COVID-19 pandemic brought about financial devastation throughout Europe because the speedy unfold of the virus pressured a lot of the continent to enter lockdown. Nationwide governments have accomplished their half in offering fiscal help and the European Central Financial institution, whereas not as aggressive because the US Federal Reserve, has pumped trillions of euros both immediately or not directly into the Eurozone economic system. The place there’s been a shortcoming is having a fiscal response on a European Union stage.

Hopes had been operating excessive since late Could {that a} Franco-German proposal for a €500 billion fund (to be disbursed in grants) is gaining momentum. However an anticipated settlement in June is now out of the query as frugal Northern European nations refuse to drop their objection to the majority of the fund being comprised of handouts as a substitute of loans. Senior EU figures at the moment are taking a look at July as a extra lifelike timetable.

A big aid bundle consisting primarily of grants is seen as a vital element of a restoration plan given how closely indebted Eurozone economies are, notably within the periphery. The ECB is struggling to maintain periphery yield spreads from widening too considerably and a not-so-generous EU support bundle may exacerbate the issue if buyers had been to downgrade their outlook on the Eurozone economic system. A bounce in periphery bond yields from diminished investor confidence may trigger nice ache for nations like Italy and Spain as it could come at a time when they should borrow extra to pay for his or her fiscal stimulus.

Lockdown easings possible boosted progress in June

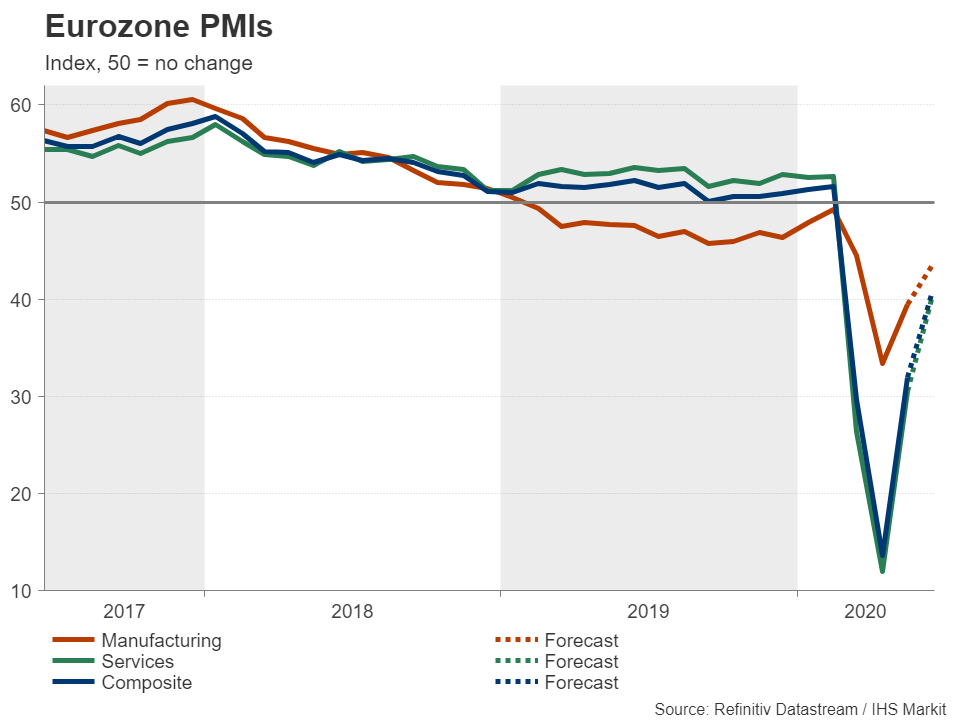

Within the absence of an EU rescue fund, all hopes relaxation on the gradual lifting of the lockdowns to spice up progress in virus-stricken member states. The additional rest of lockdown restrictions is predicted to have led to a different bounce in financial exercise in June. After rebounding to 31.9 in Could, the Eurozone composite PMI by IHS Markit is anticipated to have picked as much as 40.5 in June.

Trying on the sector breakdown, the flash manufacturing print is predicted at 43.4, whereas the providers PMI is forecast at 40.0. Though each would symbolize a good improve from Could, they continue to be beneath the 50 stage that separates growth from contraction. Therefore, markets shall be desperate to see optimistic surprises on the size noticed in the US from current knowledge on jobs and retail gross sales for indicators that the European restoration is getting onto a stronger footing.

Can upside shock in PMIs revive euro’s rally?

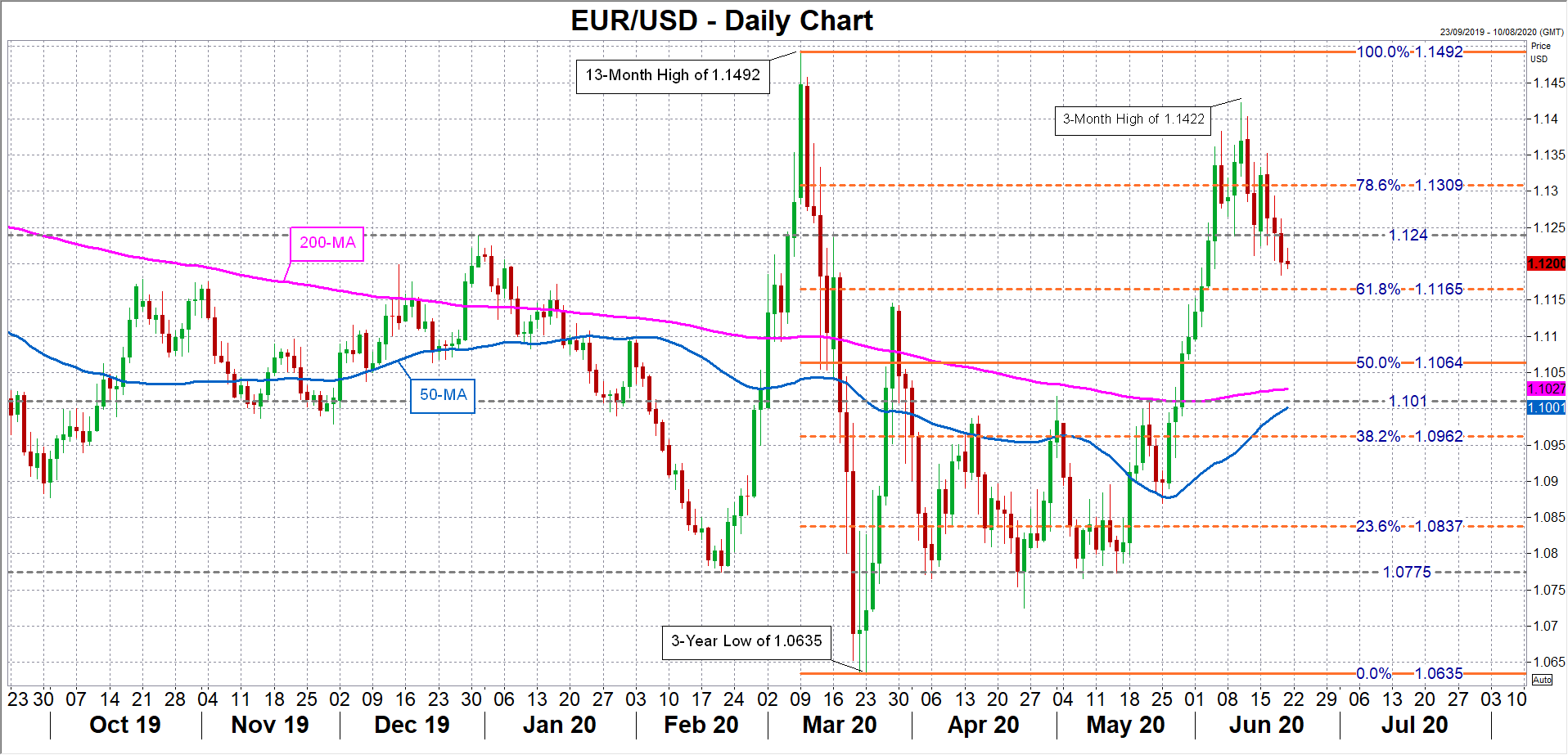

Ought to the PMI numbers fail to reassure buyers in regards to the energy of the Eurozone restoration, the euro may keep skewed to the draw back. Extra declines may push euro/greenback in direction of the 61.8% Fibonacci retracement of the March slide at 1.1165. A breach of this assist would put sellers inside vary of the 50% Fibonacci at 1.1064.

Nonetheless, if the info outstrip the forecasts, the euro may obtain a shot within the arm, placing the $1.13 stage again inside attain. The only forex has been consolidating after the newest upward wave peaked at $1.1422 earlier in June. Barring any greenback weak point, a deal on an EU stimulus and bettering financial indicators are what is going to decide whether or not the euro is ready stretch its rally previous the $1.1422 high.

EURUSD